Disaster capitalism - How financial markets benefit from the climate problem | DW Documentary

Summary

TLDRThe transcript discusses the emerging market for catastrophe bonds which allow investors to bet on potential disasters. It explores how former Wall Street bankers like John Seo create complex financial products to cover damages from events like hurricanes, using advanced statistical models. However, these products are inaccessible to most disaster-prone communities. The transcript criticizes how global capital exploits catastrophe risk for profit rather than focusing on prevention and community resilience. It highlights the limitations of algorithms in capturing unpredictable human behavior during crises when lives are at stake.

Takeaways

- 💰 Excess capital is a global issue, with an estimated 10 to 20 trillion dollars seeking profitable investments.

- 🌎 'Planet Finance' symbolizes a complex and fast-paced world where financial opportunities, especially risky ones, are pursued aggressively.

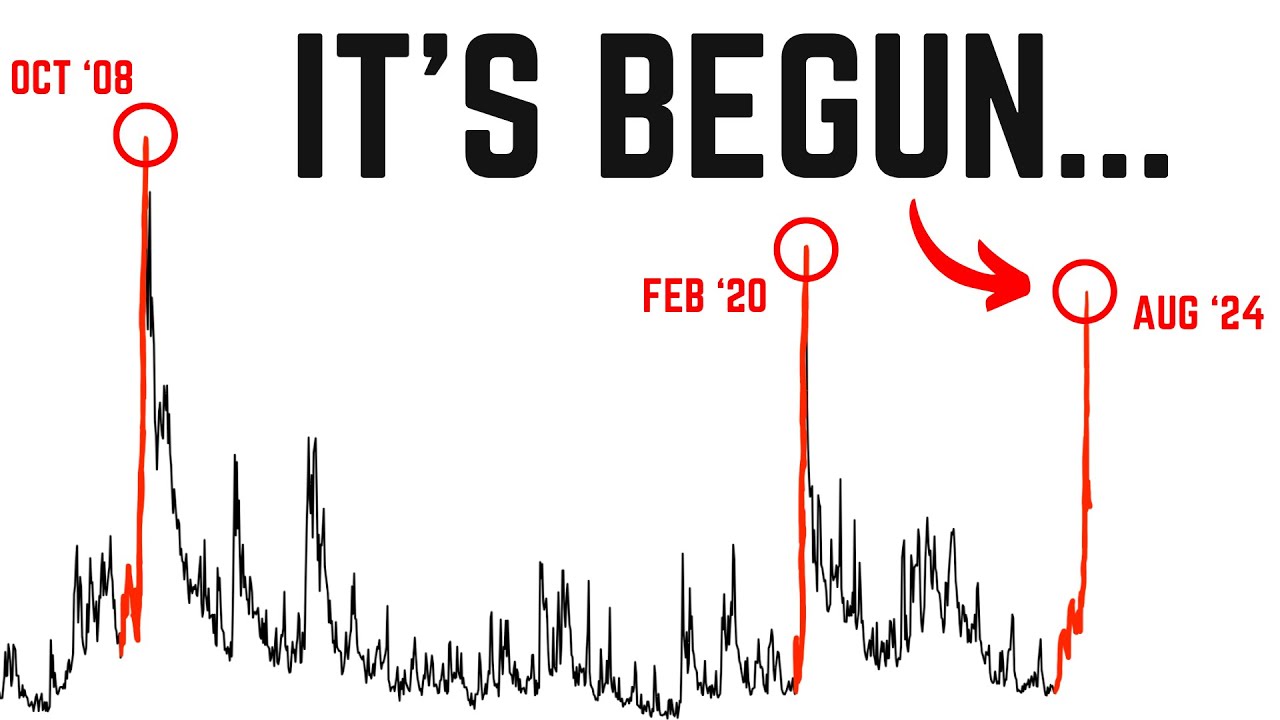

- 🔥 Catastrophe bonds (cat bonds) are financial instruments that speculate on the occurrence of disasters, transferring risk from insurance companies to investors.

- 🚨 The shift from traditional insurance to cat bonds reflects increasing costs and risks associated with natural disasters, leading entities like New York's Transportation Authority to seek alternative coverage methods.

- 🌧️ Cat bonds provide a unique investment opportunity, offering high returns but with the risk of total loss if the specified catastrophe occurs.

- 📈 The demand for cat bonds is growing, driven by their non-correlation with traditional financial markets and the increasing frequency and severity of natural disasters.

- 🔍 Cat bond pricing and risk assessment heavily rely on data modeling and predictions about future disasters' likelihood and impact.

- 🏘️ The personal stories from Bonny Dune illustrate the harsh realities and limitations of relying on public services during natural disasters, highlighting the importance of individual preparedness and community action.

- 💡 There is a clear divide between those who can afford to protect their assets through instruments like cat bonds and those who must fend for themselves.

- 🌐 The global nature of 'Planet Finance' shows that while financial markets can provide mechanisms for risk management, they also reflect broader disparities in access and vulnerability.

Q & A

What is the main issue caused by excess capital roaming the world?

-Excess capital has no useful place to be invested, so it creates its own opportunities and allows crazy financial schemes to arise just to be put to work.

How did catastrophe bonds first come about?

-They arose after Hurricane Sandy when the New York City transportation system realized its insurance was not enough to cover damages, so it worked with Wall Street to create catastrophe bonds to raise additional funds.

Who buys catastrophe bonds and why?

-Big investors like pension funds, hedge funds and others buy them because they provide high returns uncorrelated to other markets and diversify risk across different disaster types and geographies.

How do the catastrophe bond triggers work?

-The bonds have precise triggers based on disaster model predictions of minimum damage thresholds. If those triggers are hit, investors lose their money, which then pays for damages.

How did the residents of Bonny Doon fight the wildfires?

-When the fires approached and firefighters would not come, the residents fought the fires themselves, using bulldozers to create a fire break to protect their homes.

How did John Seo's firm assist with the wildfires?

-They used satellite imagery and modeling to predict property damage and losses, helping investors understand if their catastrophe bonds were at risk of being triggered.

What criticisms were raised about traditional disaster risk models?

-That they rely too much on historical data when risks are changing with climate change, so AI and machine learning approaches do more simulations to better predict future risk.

Why are catastrophe bonds appealing to investors?

-They provide returns uncorrelated to financial markets, so even if markets crash, the bonds continue paying high interest unrelated to market conditions.

How did residents of places like Bonny Doon feel they were viewed by officials?

-They felt labeled as insignificant and disposable, realizing for the first time that the fire department and wider society did not value them or their homes.

What preparations did the Bonny Doon elder make for future fires?

-He created a protective bunker stocked with air, water, and firefighting gear to shelter in and have the means to defend his property during future fires.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)