I Found A Secret To Fair Value Gaps

Summary

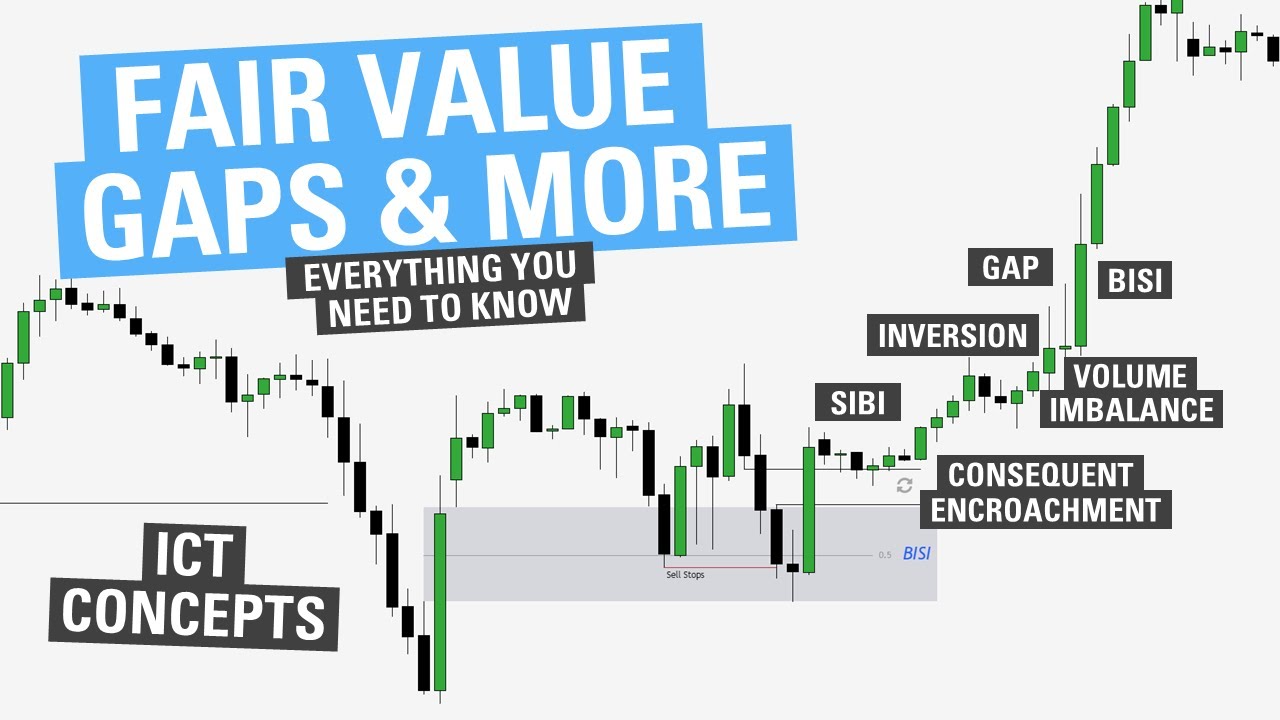

TLDRThe video script delves into the concept of fair value gaps in trading, highlighting their effectiveness yet variability. It introduces a 'secret technique' to determine the validity of these gaps, crucial for market prediction. The presenter outlines six key factors for a fair value gap to be considered valid, including being unmitigated, showing the right candle reaction, having confluence with support/resistance, and occurring after a structural break. The script promises that applying these criteria will enhance trading accuracy, offering viewers a strategic edge in the market.

Takeaways

- 📈 Fair value gaps are significant in trading due to their effectiveness in the market.

- 🔍 Not all fair value gaps are equal; some fail while others succeed, indicating the need for discernment.

- 🔑 There's a secret technique to identify valid fair value gaps, which, when learned, enhances their predictive accuracy.

- 📊 A fair value gap is identified by a significant price movement, creating a large candle without giving the opposite side a chance to react.

- ❌ An invalid fair value gap is one that has been tested or mitigated, reducing its potential for profit.

- 🕹️ The reaction of the candle within the gap is crucial; it should close within the gap or in the direction of the gap for it to be valid.

- 📉 Confluence with support and resistance levels can strengthen a fair value gap, increasing the likelihood of a profitable trade.

- 📊 Prioritizing fair value gaps based on their position on the chart is essential; lower gaps are stronger and higher priority.

- 🛠️ Utilizing the Gann box tool on TradingView can help identify and prioritize fair value gaps based on their relative strength.

- 🏁 A break of structure before the gap occurs, where price breaks previous highs or lows, is a key indicator of a valid fair value gap.

Q & A

What is a fair value gap in trading?

-A fair value gap is a situation in the market when the price moves up or down rapidly, creating a large candle without giving the opposite side enough time to react, leading to an imbalance in the market.

How can you identify a bullish or bearish fair value gap?

-A bullish fair value gap occurs when the price moves up quickly, while a bearish fair value gap happens when the price drops rapidly. These gaps are identified by marking the candles' top wick before the big move to the candles' lower wick after the move.

Why do some fair value gaps fail to work as expected?

-Some fair value gaps fail because they are invalid. A fair value gap becomes invalid if the price comes back down to the gap after its creation, indicating the gap has been tested and sellers have had a chance to react.

What are the six key factors that determine the validity of a fair value gap?

-The six key factors are: 1) The gap must be unmitigated and not tested before. 2) The reaction of the candle should close inside the gap or in the direction of the gap. 3) The presence of confluences like support and resistance. 4) The priority of the gap based on its position on the chart. 5) Using the Gann box tool to mark and prioritize gaps. 6) Ensuring there is a break of structure before the gap is made.

Why is it important for a fair value gap to be unmitigated?

-An unmitigated fair value gap is crucial because it signifies that the price surge did not give the opposite side a chance to react, maintaining the market imbalance which can lead to a retracement and potential profit.

How does the reaction of the candle within a fair value gap affect its validity?

-The reaction of the candle is important because if it closes inside the gap or in the direction of the gap, it indicates the market respects the gap, making it more likely to be a valid and profitable trade.

What role do support and resistance levels play in validating a fair value gap?

-Support and resistance levels serve as confluences that can strengthen a fair value gap. If a gap coincides with a support or resistance level, it increases the likelihood of the gap being valid and the price retracing to fill the imbalance.

How does the position of a fair value gap on the chart affect its priority?

-The position of a fair value gap on the chart determines its priority. The lowest gaps are considered the strongest and have the highest priority, while the highest gaps are the weakest and have the lowest priority.

What is the purpose of using the Gann box tool when analyzing fair value gaps?

-The Gann box tool is used to visually mark and prioritize fair value gaps based on their position relative to the tool's levels. It helps traders focus on the highest priority gaps, which are more likely to be valid and profitable.

Why is a break of structure important before a fair value gap is considered valid?

-A break of structure, where the price breaks a previous high or low, is important because it signifies a strong momentum shift. This momentum, along with the creation of a fair value gap, increases the chances of the gap being respected and leading to a profitable trade.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)