FIFO Periodic Inventory Method

Summary

TLDRThis video tutorial demonstrates the use of the FIFO method to calculate the ending inventory and cost of goods sold for a company using a periodic inventory system. It walks through a month's worth of purchases and sales of board games, explaining how to apply FIFO to determine the cost of goods sold and ending inventory. The video also addresses the scenario where physical inventory count reveals discrepancies, necessitating adjustments to the cost of goods sold and inventory valuation.

Takeaways

- 🔢 FIFO stands for 'First-In, First-Out', a method used to calculate ending inventory and cost of goods sold in a periodic inventory system.

- 📅 A periodic inventory system does not make journal entries for inventory changes or cost of goods sold throughout the accounting period; adjustments are made at the end.

- 🛒 The company in the example is a retailer of board games, purchasing from a manufacturer and then reselling to customers.

- 📦 On January 1st, the company purchased 20 board games at $35 each, marking the first inventory acquisition.

- 📈 On January 6th, a second purchase was made, this time for 30 board games at an increased cost of $40 each, indicating a price change.

- 📅 January 8th had no purchases, but 40 board games were sold, raising the question of how to calculate cost of goods sold using FIFO.

- 🛍️ On January 13th, another 25 board games were purchased at $50 each, further complicating the FIFO calculation.

- 🧮 To calculate cost of goods sold using FIFO, the first 20 units sold come from the January 1st purchase at $35 each, and the next 20 from the January 6th purchase at $40 each.

- 📊 The calculated cost of goods sold before adjustments is $1,500, derived from the FIFO method of matching sales to the earliest purchases.

- 🏷️ Ending inventory is calculated by taking the remaining units from the most recent purchases, which are 10 from January 6th and all 25 from January 13th.

- 📝 The ending inventory before adjustments is $1,650, based on the cost of the remaining units in stock.

- 🔍 A physical count at the end of the period may reveal discrepancies, such as having $1,600 of inventory instead of the calculated $1,650.

- ⚠️ If the physical count is lower than the calculated inventory value, the cost of goods sold is increased, and the ending inventory is adjusted to match the actual count.

Q & A

What does FIFO stand for in the context of inventory management?

-FIFO stands for 'First-In, First-Out,' which is a method used to calculate the cost of goods sold and ending inventory by assuming that the earliest purchased items are sold first.

What is a periodic inventory system?

-A periodic inventory system is an inventory management method where no journal entries are made throughout the accounting period to recognize changes in inventory or cost of goods sold. Instead, these are recognized at the end of the period.

Why does the cost of goods sold calculation change in a periodic inventory system when a physical count is taken?

-The cost of goods sold may change because the physical count could reveal discrepancies between the calculated inventory and the actual inventory on hand, necessitating adjustments to reflect the actual loss or gain of inventory items.

How many board games did the company purchase on January 1st, and at what cost per unit?

-The company purchased 20 board games on January 1st at a cost of $35 per unit.

What was the purchase cost per unit for the board games bought on January 6th?

-The purchase cost per unit for the board games bought on January 6th was $40.

How many board games were sold by the company on January 8th?

-The company sold 40 board games on January 8th.

What was the cost per unit for the board games purchased on January 13th?

-The cost per unit for the board games purchased on January 13th was $50.

How is the cost of goods sold calculated using FIFO in this scenario?

-The cost of goods sold is calculated by taking the first 20 units sold from the January 1st purchase at $35 each, and the next 20 units from the January 6th purchase at $40 each, and summing these amounts.

What is the calculated ending inventory value before considering the physical count?

-The calculated ending inventory value before considering the physical count is $1650, which includes 25 units at $50 each from the January 13th purchase and 10 units at $40 each from the January 6th purchase.

What happens if the physical inventory count reveals a lower value than the calculated ending inventory?

-If the physical count reveals a lower value, the cost of goods sold is increased by the difference, and the ending inventory is adjusted to match the physical count value.

What is the adjusted cost of goods sold if the physical count shows an ending inventory of $1600?

-If the physical count shows an ending inventory of $1600, the adjusted cost of goods sold would be $1550, which is $50 higher than the initial calculation to account for the discrepancy.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

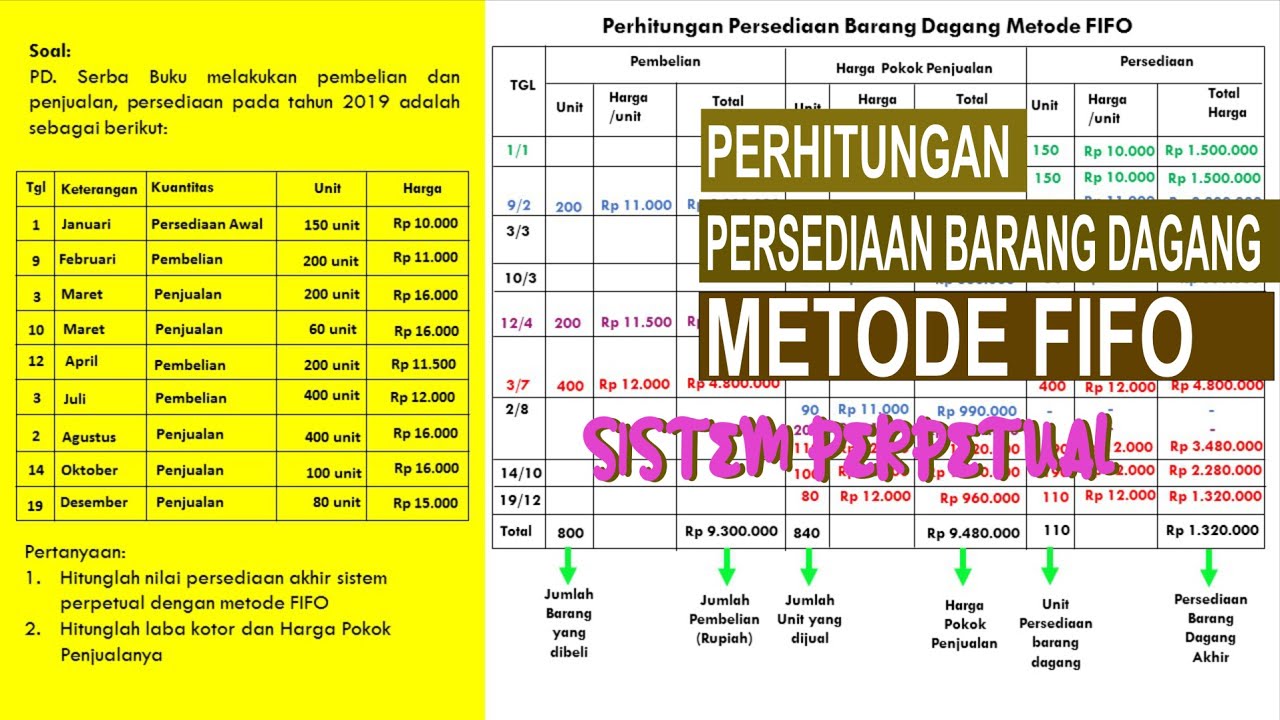

FIFO, LIFO, AVERAGE, METODE PERPETUAL | UD. SAYANG KAMU #fifoperpetual

Perhitungan Persedian Barang Dagang | Metode FIFO | Sistem Perpetual

Cara Menghitung Nilai Persediaan Akhir Metode FIFO Periodik

First In First Out (FIFO) | Inventory Cost Flows

FIFO Periodic & Perpetual I Pengantar Akuntansi

Inventory Cost Flow Assumptions | Principles of Accounting

5.0 / 5 (0 votes)