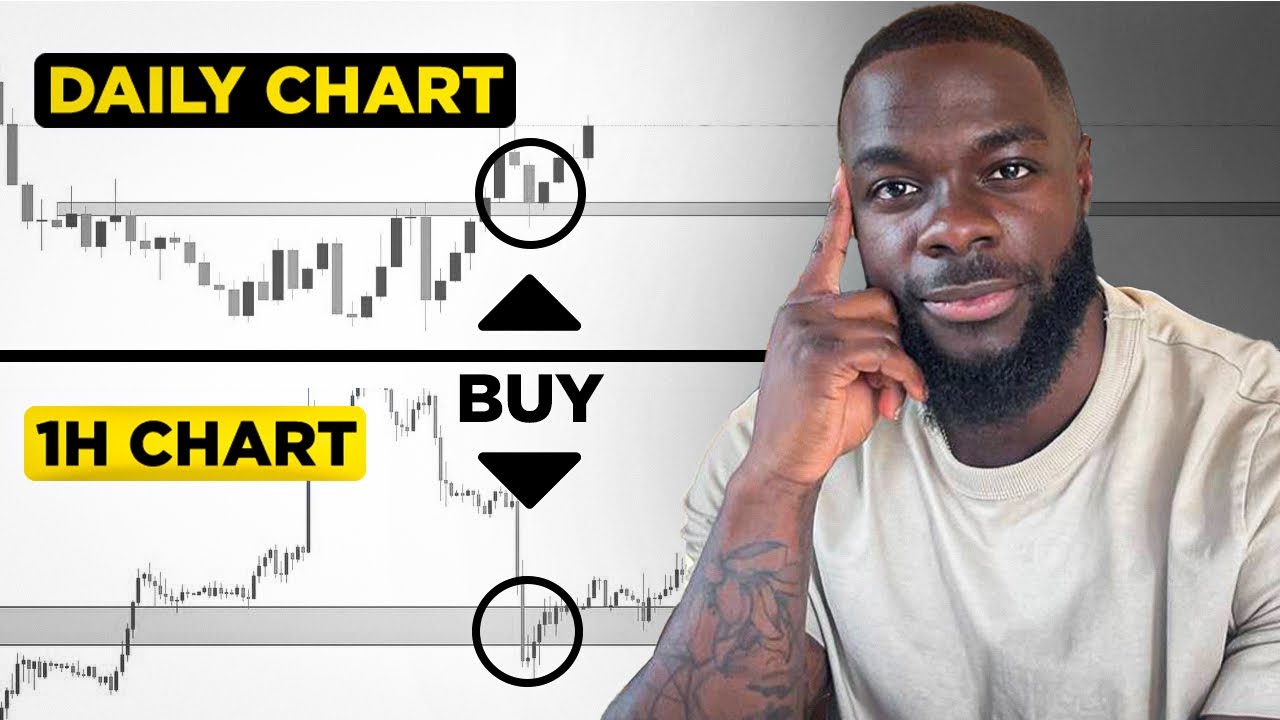

The Easiest SMC/ICT Strategy Ever: One Time Frame, One FVG, One Pair!

Summary

TLDRこのビデオスクリプトでは、トレーダーが市場構造に混乱し、エントリーポイントや価格動向をつかみづらくなる問題に焦点を当てています。そこで、新しいアプローチである「フェアバリューギャップ」を紹介し、新規週の始まりに注目する戦略を提案します。30分チャートでの価格アクションを分析し、特定のキルゾーンに基づいてエントリーとターゲットを設定します。さらに、初心者向けのシンプルなエントリー方法や、経験豊富なトレーダー向けの高度な分析もカバーしています。

Takeaways

- 😀 スクリプトは、トレーダーが市場構造に混乱し、どこでエントリーして価格がどこへ行くかわからない問題に対処する方法を説明しています。

- 📈 紹介されたアプローチは、新規週の始まりに注目し、30分足の価格アクションを分析することで、週全体にわたる固定されたゾーンを設定します。

- 🔍 トレーディングスタイルは、主に2つのキルゾーン(2-5と7-10のレンジャー)に基づいて取引をエントリーしますが、これは初心者でも理解しやすい方法です。

- 👤 スクリプトでは、Twitter上でこのアプローチを考案した人物にクレジットを与えています。その人物のアカウント名が提供されています。

- 📊 トレーディングの基本的なアプローチは、フェアバリューギャップ(Fair Valley Gap)からのリジェクションを待ち、それを基にエントリー信号を探します。

- 🌐 初心者向けのアプローチでは、市場の理解がなくても、シンプルなエントリールールに従って取引することができます。

- 🤖 スクリプトでは、自動テストされた結果を示しており、その結果に基づいて、このアプローチの有効性が述べられています。

- 💰 トレーディングの勝率についても触れており、40〜50%の勝率で3:1のリスクリワード比でトレードすると、長期的に利益を上げる可能性があるとされています。

- 📉 フェアバリューギャップは週の初めに最も影響力があり、その後徐々に弱まっていくため、週の初めに注目することが重要です。

- 🔄 トレーディングのエントリー方法には、価格のリトラスペクションやリジェクションを待つ方法が含まれています。また、異なるアプローチを組み合わせることで、より多くのエントリーポイントを見つけることができます。

- 📝 スクリプトでは、トレーディングのリスク管理と心理学の重要性にも触れており、100%の勝率を持つトレーディング戦略は存在しないと強調しています。

Q & A

セミナーで紹介されたトレーディング手法の基本的な考え方はどのようなものですか?

-セミナーで紹介されたトレーディング手法は、市場の構造を理解しにくく、どこでエントリーし、価格がどこへ行くかわからない人々に向けて、新しい週の始まりに30分チャートの価格アクションを分析し、特定のゾーンに基づいてトレードを実行するというものです。

セミナーで紹介されたトレーディングスタイルの名前は何ですか?また、その開発者の情報はどこで確認できますか?

-セミナーで紹介されたトレーディングスタイルの正確な名前は明示されていませんが、Twitterでのハンドルネームで開発者をクレジットしています。Twitter上でその人物の名前を検索することで、詳細を確認できます。

初心者向けのアプローチで提案されたエントリーポイントの方法は何ですか?

-初心者向けのアプローチでは、価格がフェアバリューギャップ(Fair Valley Gap)に接触し、そのギャップからリジェクション(反発)を示すキャンドルが閉じた時にエントリーポイントを設定することが提案されています。

セミナーで説明された「キルゾーン」とは何を意味していますか?

-「キルゾーン」とは、価格が特定の範囲に入ると、その範囲に基づいて売買のエントリーポイントを決定するゾーンです。セミナーでは、2-5と7-10のレンジがキルゾーンとして挙げられています。

セミナーで紹介されたトレーディング手法の勝率はどの程度ですか?

-セミナーでは、このトレーディング手法の勝率は40〜50%とされており、これは非常に良い勝率であると説明されています。また、3:1のリスクリワード比を提供していることも強調されています。

セミナーで説明された「フェアバリューギャップ」とはどのようなものですか?

-「フェアバリューギャップ」とは、新しい週の始まりに形成される最初のギャップであり、価格が週の初めにテストされていないため、最も尊重されることが期待されるギャップです。

セミナーで提案されたエントリータイプにはどのようなものがありますか?

-セミナーでは、単純なキャンドルのリジェクションや、流動性レベル内の価格アクションに基づくエントリータイプが提案されています。また、フェアバリューギャップからのリジェクションを利用したエントリーも紹介されています。

セミナーで紹介されたトレーディング手法のリスク管理には何が含まれていますか?

-セミナーで紹介されたトレーディング手法では、10ピップの固定されたストップロスと、3:1のターゲット利得が提案されています。これはリスクを管理し、トレーダーが損失を3倍の利益で上回る機会を持つことを意味します。

セミナーで説明されたトレーディング手法を適用する際、どの時間フレームを主に使用する予定ですか?

-セミナーでは、30分チャートを週の始まりに使用し、その上でフェアバリューギャップを特定することでトレーディング手法を適用する予定です。

セミナーで紹介されたトレーディング手法を改善するために、どのようなアプローチを取ることができますか?

-セミナーでは、トレーディング手法を改善するために、より低い時間フレームでエントリーポイントを見つけるなどのアプローチや、リスクリワード比を調整するなどの柔軟性を持ったアプローチを取ることが提案されています。

セミナーで紹介されたトレーディング手法を実装する際、トレーダーはどのように自己のスタイルに適応させるべきですか?

-トレーダーは、セミナーで紹介された基本的なトレーディング手法を理解した上で、自分のトレーディングスタイルやリスク管理ルールに合わせてアプローチを調整し、改善することができます。

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

ICT Market Maker Models SIMPLIFIED

Basic Market Structure Course For Beginners

Trading Was Hard Until I Understood This ONE Concept

Without This Concept ICT Doesn't Work

LEARN THIS SIMPLE FOREX DAY TRADING STRATEGY 2023 | How to MASTER Multiple Time Frame Analysis 💰

SHRINKFLATION EXPOSED: How Companies Secretly Increase Profits

5.0 / 5 (0 votes)