Why Everyone Wants You To Believe AI is a Bubble

Summary

TLDRThis video explores the economic dynamics driving the AI sector, highlighting the role of major players like Nvidia, OpenAI, and private equity in creating a self-reinforcing system that might not be a typical bubble but a 'black hole.' The script discusses how circular funding, massive investments in infrastructure, and interdependencies between tech companies, banks, and government contribute to an unsustainable AI boom. It also warns about the hidden risks, such as overbuilt data centers, inflated asset values, and the long-term consequences of AI's widespread adoption, likening it to a potential economic disaster akin to past financial crises.

Takeaways

- 😀 The AI industry is in a complex cycle, not just a bubble, driven by interdependent companies and financial strategies that prop up the entire system.

- 😀 The AI sector is being heavily funded by private equity and Wall Street, mimicking the same financial practices that led to the 2008 housing crash, but on a much larger and riskier scale.

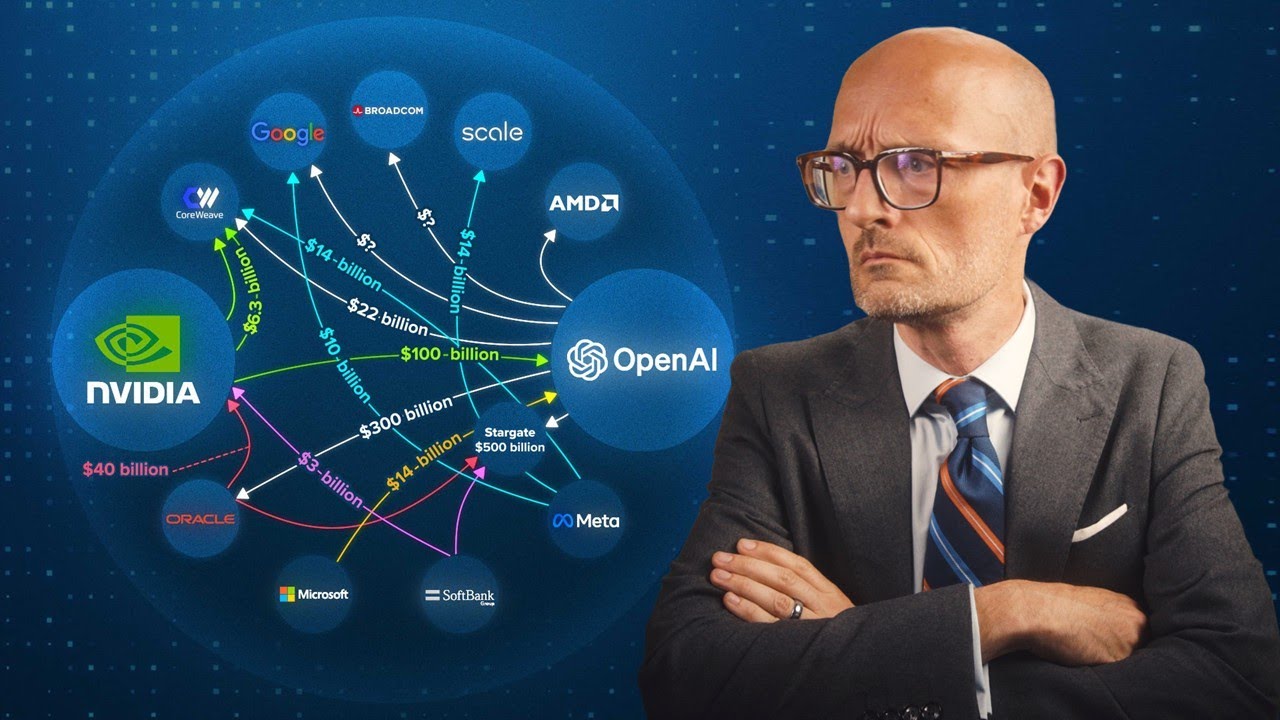

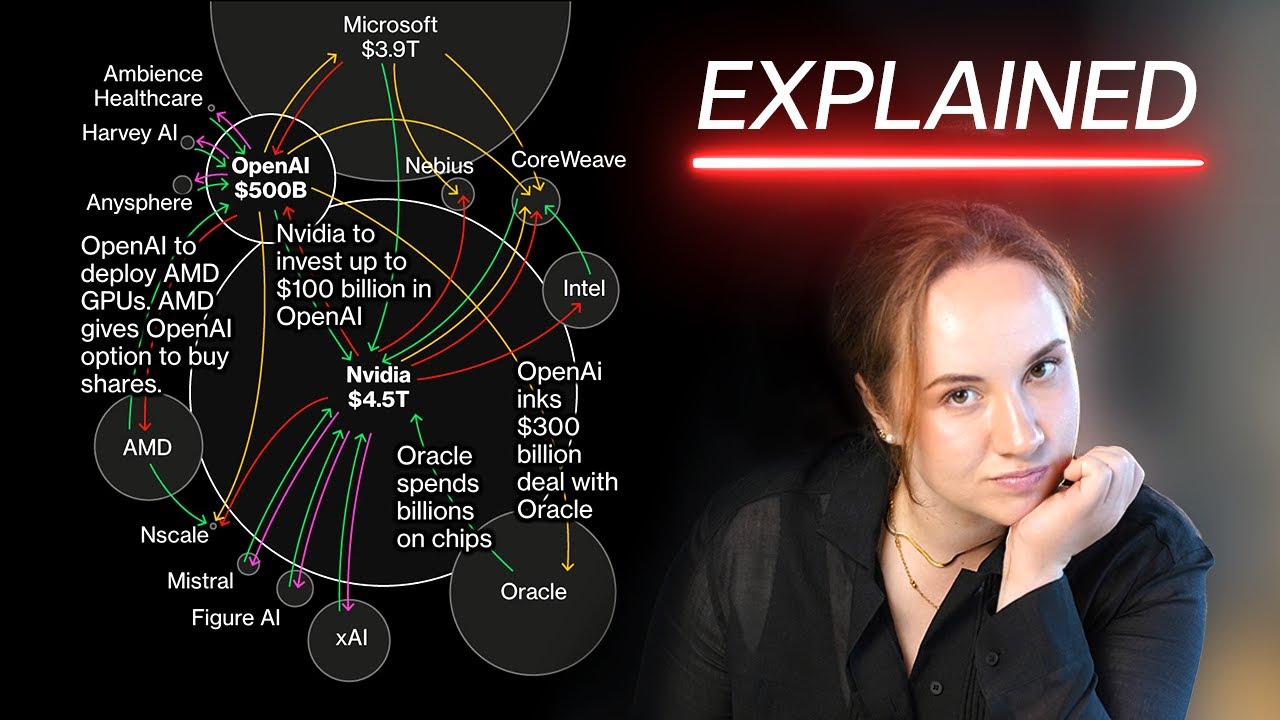

- 😀 Nvidia is at the heart of the AI ecosystem, where it funds AI labs like OpenAI with money that must be used to purchase Nvidia products, creating a circular investment loop that benefits Nvidia's stock.

- 😀 The AI infrastructure boom includes chipmakers (like Nvidia and AMD), data center providers (like Oracle and Cororeweave), and Big Tech companies (Amazon, Google, Microsoft), all feeding into each other in a web of financial transactions.

- 😀 AI labs such as OpenAI and Anthropic are locked into deals with cloud providers and chip manufacturers, reducing competition and fostering a network of dependencies between major tech players.

- 😀 Companies like Nvidia, AMD, and Oracle are artificially inflating stock prices by funneling money back into their own investments, creating a self-perpetuating financial cycle.

- 😀 Data centers, essential for AI processing, are being funded by private equity firms, which are acquiring land, power infrastructure, and real estate to build massive data centers that may eventually be underutilized.

- 😀 The rapid expansion of data centers is straining local infrastructure, including power grids, and is causing environmental concerns as companies rely on gas turbines to meet power demands while bypassing green initiatives.

- 😀 The true cost of AI infrastructure is often hidden in private equity deals, and the public may not realize the scale of the financial risk until it’s too late.

- 😀 Despite the large investments and ongoing hype, AI infrastructure may be overbuilt, with some data centers possibly turning into stranded assets if AI demand doesn't meet expectations.

- 😀 The US government has entered the race for AI dominance with the Genesis Mission, a federally funded push to develop AGI (artificial general intelligence), adding another layer of complexity to the growing AI infrastructure boom.

- 😀 The AI sector's financial structure is compared to a black hole, where capital and resources get swallowed up with no clear exit strategy, and any downturn will be slow and subtle, unlike the sudden collapse of a typical bubble.

Q & A

What is the main argument presented in the video regarding the AI industry?

-The main argument suggests that the AI industry is not a typical 'bubble' but a 'black hole'—a financial system where money is continually invested without an exit strategy, leading to a potential long-term financial trap rather than a short-term crash.

How do Nvidia and OpenAI contribute to the circular financial loop in the AI sector?

-Nvidia invests in OpenAI by providing chips, while OpenAI buys Nvidia products with the funds Nvidia gives them. This creates a feedback loop where Nvidia’s revenue increases, boosting their stock price, and allowing them to reinvest in OpenAI, creating a cycle that appears like growth but is financially self-sustaining.

Why is the AI infrastructure described as a 'black hole' rather than a 'bubble'?

-Unlike a traditional bubble, where assets can be sold or flipped, AI infrastructure—such as data centers and chips—requires constant investment and cannot easily be re-sold. As more money pours into it, it gets absorbed into ongoing debt payments, depreciation, and operational costs, with no clear way out.

What role does private equity play in the AI industry, according to the video?

-Private equity firms have been buying up data centers and leasing them to big tech companies like Amazon, Microsoft, and Google. These firms are financing the infrastructure needed for AI but are at risk if AI demand does not meet expectations, as it could lead to underutilized, costly assets.

How does the environmental impact of AI infrastructure factor into the discussion?

-The massive energy consumption required to power data centers is a key concern. AI's infrastructure build-out could lead to increased pollution, with data centers consuming vast amounts of energy, water, and land. In some cases, companies are resorting to gas turbines to bypass power grid limitations, which contradicts their environmental pledges.

What are the risks associated with AI infrastructure, such as data centers, becoming underutilized?

-If AI demand does not meet projections, private equity-backed data centers could become unprofitable, leading to financial distress. Just as with the overbuilt railroads of the 19th century, underutilized data centers could become stranded assets, leading to massive losses for investors and lenders.

How are big tech companies managing depreciation costs on AI infrastructure?

-Big tech companies like Google, Microsoft, and Amazon are extending the useful life of their servers and network gear from four to six years. This accounting maneuver reduces their depreciation costs, which artificially boosts their reported profits, even though the hardware might actually become obsolete sooner.

What is the significance of the US government's involvement in AI development?

-The US government is investing in AI through initiatives like the Genesis Mission, which is designed to accelerate the development of Artificial General Intelligence (AGI). This government-backed effort adds another layer of financial support and competition to the AI arms race, increasing both the stakes and the potential risks.

How does the video suggest the AI 'black hole' might unfold in the future?

-The video predicts that the AI 'black hole' will not burst suddenly like a traditional bubble. Instead, it will gradually deflate, with micro failures happening slowly behind closed doors. AI infrastructure construction will slow down, and companies will quietly shut down or scale back operations, all while the public remains unaware of the growing financial distress.

Why does the speaker believe that understanding the AI financial system is important for individuals?

-Understanding the AI financial system is crucial because even if people can't change the system, they can protect themselves or profit from it. By recognizing how money and power move in this space, individuals can make informed decisions and avoid falling victim to the risks associated with this 'black hole'.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

If the AI bubble pops, will the whole U.S. economy go with it? | About That

Are we in an AI Bubble? (These 5 Warning Signs Will Tell You)

Is AI’s Circular Financing Inflating a Bubble?

What Everyone Gets Wrong about AI

Your Hospital bills are about to get EXPENSIVE!!!

Inside AI’s Circular Economy: Geopolitical Loopholes, Hidden Debt, and Financial Engineering

5.0 / 5 (0 votes)