Are we in an AI Bubble? (These 5 Warning Signs Will Tell You)

Summary

TLDRThe script delves into the potential risks behind the booming AI market, highlighting an $800 billion funding gap that threatens to derail the AI infrastructure boom. It reveals how vendor financing between companies like Oracle, Nvidia, and OpenAI is creating a dangerous financial circle, all fueled by massive debt. The collapse of private credit firms and rising defaults add further instability. Drawing comparisons to the dot-com bubble, the speaker warns investors to be cautious and emphasizes the importance of knowing when to sell to protect profits from a potential market correction.

Takeaways

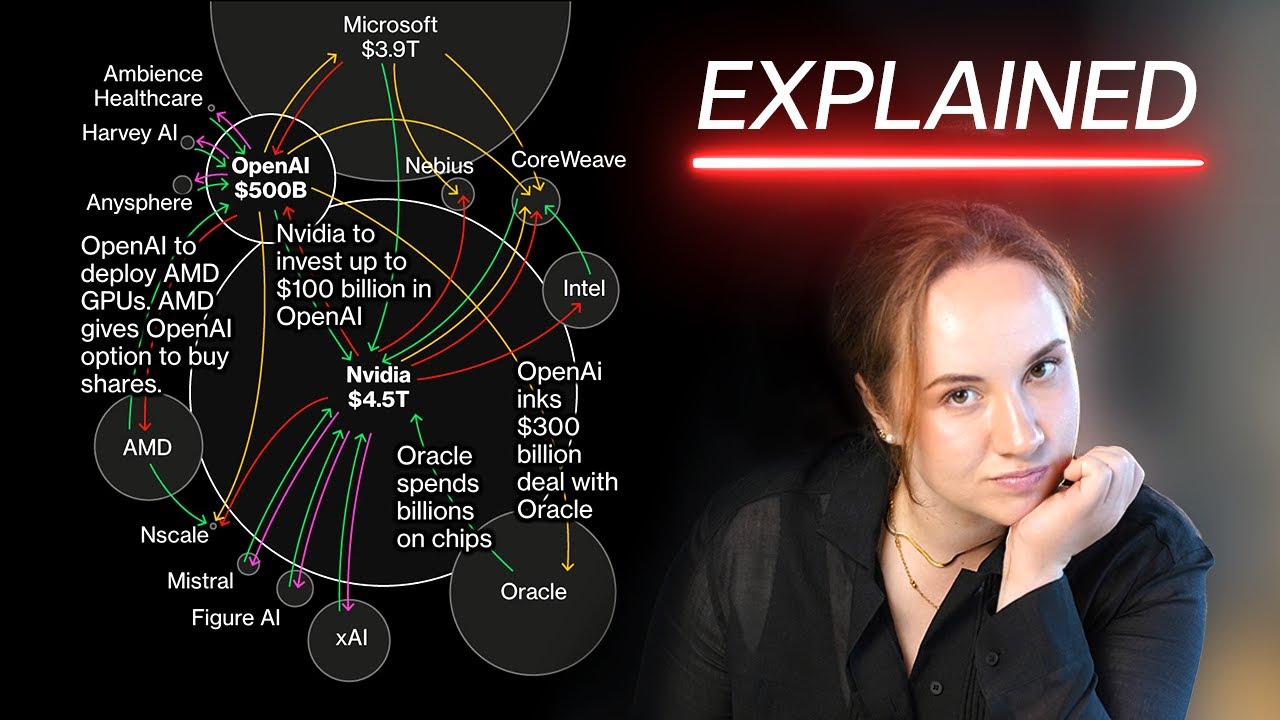

- 😀 The AI infrastructure boom is being fueled by massive debt, with companies like Oracle and Nvidia involved in a complex financing circle that could collapse.

- 😀 Oracle announced a $300 billion deal with OpenAI but lacks the cash to support it, relying on excessive debt (500% debt-to-equity ratio).

- 😀 Nvidia is playing a central role in the financing circle by providing vendor financing to companies like OpenAI, creating a risky cycle of money flowing between companies.

- 😀 The private credit industry, which was supposed to bridge the $800 billion gap in AI infrastructure funding, is struggling with massive underperformance and rising defaults.

- 😀 Global tech companies, including Microsoft, Amazon, and Meta, can self-fund part of the AI boom, but a significant funding gap of $800 billion remains.

- 😀 If private credit can't fill the funding gap, one of three things could happen: drastic AI spending cuts, massive debt leverage by tech companies, or government intervention with subsidies.

- 😀 The historical comparison to the dot-com bubble of the late 1990s reveals striking similarities, with AI valuations, infrastructure spending, and vendor financing mirroring that period.

- 😀 AI companies like OpenAI are signing massive contracts, but their revenue (e.g., $10 billion/year) is insufficient to sustain such high expenditures, potentially leading to a financial collapse.

- 😀 The $800 billion gap in funding for AI infrastructure could lead to a major slowdown in AI development, tech stock crashes, or unsustainable levels of debt in the tech industry.

- 😀 To protect investments, it’s important for investors to learn when to sell during a bull market, as tech stocks could be at risk of collapsing in the near future, similar to the dot-com bubble.

Q & A

What is the $800 billion debt bomb referenced in the video?

-The $800 billion debt bomb refers to the massive financing gap that exists in funding the AI infrastructure boom. Despite the massive market cap growth of companies like Nvidia, the private credit market that was supposed to fill this gap is underperforming, and there are concerns that this gap may lead to a collapse in the AI sector.

How does vendor financing work in the AI industry?

-Vendor financing is when a company like Oracle, which signs large deals with AI companies, doesn't have the funds to cover the deal upfront. Oracle turns to Nvidia, which provides chips and infrastructure, and Nvidia, in turn, funds OpenAI and other AI companies. This creates a circular debt system, where money moves around between these companies without any actual cash flow, increasing the risk of collapse.

Why is Oracle’s debt-to-equity ratio a concern in this context?

-Oracle has a debt-to-equity ratio of 500%, meaning it owes five times as much in debt as its equity. This is concerning because it shows Oracle is relying heavily on borrowing to fund its AI infrastructure projects. If it can't generate enough cash flow or if the projects don't deliver, Oracle may struggle to meet its obligations, creating systemic risk for the AI sector.

What is the risk of private credit firms collapsing?

-Private credit firms like Blackstone and Blue Owl Capital are facing significant financial stress due to rising defaults in consumer credit and difficulties in refinancing loans. These firms were supposed to help bridge the $800 billion gap in AI infrastructure funding, but their underperformance signals trouble for the funding needed to sustain the AI boom.

What is the connection between the AI boom and the 2000 dotcom bubble?

-The AI boom and the dotcom bubble share many similarities. Both are driven by new, transformative technologies that promise high returns, attracting massive investments. However, just like the dotcom bubble, this rapid investment in AI infrastructure could lead to overcapacity, debt defaults, and a market collapse once the promised returns fail to materialize.

What are the three main options for resolving the $800 billion funding gap?

-The three main options are: 1) AI companies dramatically cut their spending on infrastructure, slowing down the AI boom. 2) Hyperscalers like Amazon and Microsoft take on massive debt themselves, which increases their financial risk. 3) The government steps in with subsidies and guarantees, though this creates a moral hazard and could lead to taxpayer risk.

What does the comparison between AI's current situation and Global Crossing in 2002 mean?

-The comparison highlights the danger of overinvesting in infrastructure without the revenue to support it. Just like Global Crossing, which went bankrupt despite building real fiber-optic infrastructure, AI companies might build the necessary infrastructure but struggle to repay the debt if their revenue can't keep up, leading to a market collapse.

Why are some tech investors concerned about AI's unsustainable growth?

-Investors are concerned that the rapid and unsustainable growth of the AI sector could lead to an overextension of resources. As companies like Oracle and Nvidia rely heavily on debt and vendor financing to fund AI projects, the risk of defaults and a market crash increases, leaving investors vulnerable to significant losses.

How can investors protect themselves from the potential AI bubble collapse?

-Investors can protect themselves by staying informed about market conditions, learning when to take profits, and not getting caught up in the excitement of a bull market. It's crucial to know when to sell and lock in profits before the bubble bursts, a strategy Felix Preen teaches through his live training.

What role does government intervention play in preventing an AI market collapse?

-Government intervention could play a significant role in preventing an AI market collapse by providing subsidies and guarantees to ensure the continued growth of AI infrastructure. However, this creates a moral hazard for taxpayers and could increase systemic risk, especially if AI companies are unable to generate sufficient revenue to cover their debt.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Inside AI’s Circular Economy: Geopolitical Loopholes, Hidden Debt, and Financial Engineering

Why Everyone Wants You To Believe AI is a Bubble

Real Estate Bubble vs Boom | Identifying Real Estate Market Cycle

How ChatGPT Changed Society Forever

It's Happening Again and Nobody’s Talking About It

The Rise of AI Robots (This is the Future)

5.0 / 5 (0 votes)