Supercharge Your Trading with ICT's Daily/Weekly Range Secrets

Summary

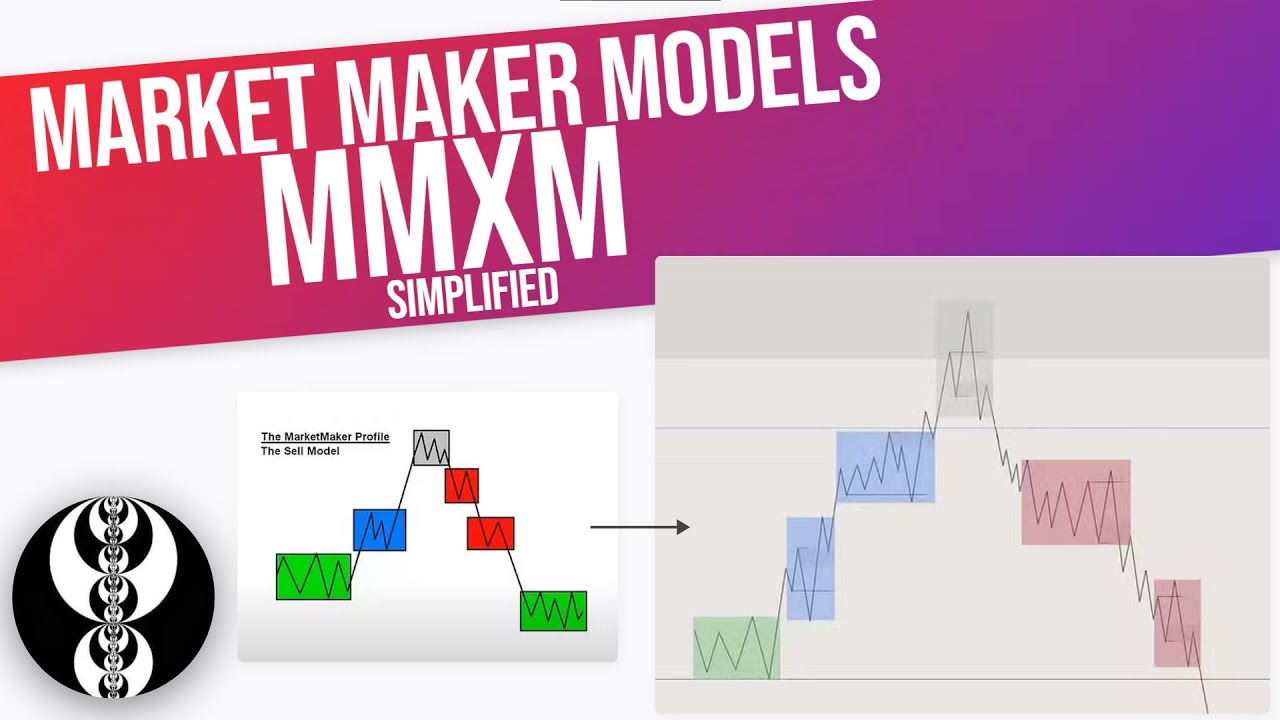

TLDRIn this video, the presenter dives into the practical applications of the daily and weekly range concepts within the Power Three framework, focusing on accumulation, manipulation, and distribution patterns. The video covers how to identify key price levels, such as the open price for Sunday and the high/low of the week, to forecast market movements. Viewers are taught to recognize specific daily session behaviors (Asia, London, New York) and their roles in price manipulation and continuation. The presenter emphasizes the importance of higher timeframe analysis and the significance of liquidity targeting in developing a consistent, repeatable trading strategy.

Takeaways

- 😀 Understanding the daily and weekly ranges is crucial for effective trading within the Power Three framework, helping to define price movements and biases.

- 😀 Each day of the week has its own specific characteristics: Sunday and Monday typically involve consolidation and manipulation, while Tuesday and Wednesday often form the high or low of the week.

- 😀 The weekly range can be broken down into specific sessions (Asia, London, New York), each of which plays a role in price action and liquidity targeting.

- 😀 Price tends to move from a discount (below Sunday's open price) for buys and from a premium (above Sunday's open price) for sells, following the general Power Three logic of accumulation, manipulation, and distribution.

- 😀 Key price levels such as weekly fair value gaps and previous week's highs are important in identifying liquidity and can serve as points of interest for higher probability trades.

- 😀 A good rule of thumb is that Tuesday and Wednesday have a 70% chance of presenting the high or low of the week, and Thursday or Friday may present retracements or reversals.

- 😀 When studying price action, it's important to use tools like day separators and session indicators to keep track of the day's open prices and key levels.

- 😀 Successful trading requires repetition and experience. Understanding market patterns and concepts like premium and discount arrays, and utilizing them in real-time, helps build confidence and improve trade accuracy.

- 😀 Always manage risk and understand that trading is not about being perfect; rather, it's about using repeatable processes and understanding market structure to increase your odds of success.

- 😀 The provided liquidity targeting PDF offers practical steps for traders to focus on liquidity levels and amplify their targeting skills as they study and apply ICT concepts.

Q & A

What are the core concepts discussed in the video?

-The video focuses on the application of the 'Daily Weekly Range' and the 'Power Three' framework (Accumulation, Manipulation, Distribution) in trading. It covers how to understand market movements through weekly and daily ranges and specific session behaviors to guide trading decisions.

What is the significance of understanding Accumulation, Manipulation, and Distribution in trading?

-These three phases represent key market behaviors. 'Accumulation' refers to the process where smart money accumulates positions, 'Manipulation' is when the market is driven to take out stops and trigger liquidity, and 'Distribution' is when the market moves towards its target after liquidity has been taken. Understanding these helps traders identify repeatable patterns in the market.

How does the Weekly Range affect trading decisions?

-The Weekly Range helps traders determine key price levels and behaviors for each day of the week. Specific days like Tuesday and Wednesday have a 70% chance of setting the high or low for the week. This knowledge allows traders to frame their trades with higher probability setups.

What role does the 'Sunday Open Price' play in the analysis?

-The Sunday Open Price is key in identifying potential price action patterns. It often serves as a reference point for determining whether price will reverse or continue a trend. Traders look for price to move below the Sunday Open for buying opportunities and above it for selling opportunities, depending on the market bias.

Why is the concept of Premium and Discount Arrays important in trading?

-Premium Arrays refer to higher price levels where traders might sell, and Discount Arrays refer to lower price levels where traders might buy. These concepts help in determining entry points and key levels for trading based on the direction of the market, supporting the overall strategy of buying low and selling high.

What specific characteristics do each of the days in a weekly range have?

-Each day has unique characteristics in the context of the weekly range: Sunday and Monday typically involve consolidation, while Tuesday and Wednesday are often the days when the high or low of the week is set. Thursday and Friday generally involve retracement or continuation patterns, depending on where the market is relative to key liquidity levels.

How can a trader use the 1-hour chart to study the daily and weekly ranges?

-The 1-hour chart is useful for clearly visualizing the market’s behavior within the daily and weekly ranges. It helps identify key price points like the Sunday open, daily session highs and lows, and important fair value gaps. By marking these, traders can spot patterns of accumulation, manipulation, and distribution.

What is the relationship between the Daily Ranges and different trading sessions like Asia, London, and New York?

-Each trading session has distinct characteristics. Asia typically involves consolidation, London often leads to manipulation and starts price movement, and New York can continue the trend. The manipulation and breakout strategies can vary based on the session, and traders can use these to predict price movements within the daily range.

Why is it important to understand the roles of Asia, London, and New York sessions in daily range analysis?

-Understanding these sessions helps traders predict price action and determine entry points. For example, during the London session, the market may create the low or high of the day, and in the New York session, that move may continue or retrace. This insight improves the accuracy of trade setups and risk management.

What tools or indicators can be helpful for studying daily and weekly ranges?

-Tools such as session indicators, day separators, and custom indicators showing the daily open price are crucial for visualizing the weekly and daily ranges. These indicators help traders mark key levels and times, making it easier to identify price movements and assess market behavior across different sessions.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)