Chapter 6: Measurement

Summary

TLDRThis chapter delves into the concepts of measurement bases in financial reporting, highlighting two primary types: historical cost and current value. Current value encompasses fair value, value in use, fulfillment value, and current cost. The chapter explores the application of these measurement bases in the context of assets, liabilities, and equity. Factors such as relevance, faithful representation, and qualitative characteristics guide the choice of measurement basis. The video concludes by discussing cash flow-based measurement techniques, emphasizing that they are used within current value measurements but are not standalone measurement bases.

Takeaways

- 😀 There are two primary measurement bases: historical cost and current value.

- 😀 Historical cost refers to the transaction price, with changes in value typically not recognized unless they involve impairment, depreciation, or accruals.

- 😀 Current value measurements provide updated information that reflects conditions at the measurement date and include fair value, value in use, fulfillment value, and current cost.

- 😀 Fair value is the price received to sell an asset or transfer a liability in an orderly transaction between market participants, unaffected by transaction costs.

- 😀 Value in use and fulfillment value are entity-specific measurements that consider future cash flows and expected transaction costs for disposal.

- 😀 Current cost refers to the cost of acquiring an equivalent asset at the measurement date, including transaction costs, and is considered an entry value.

- 😀 Historical cost and current cost are entry values, while fair value, value in use, and fulfillment value are exit values.

- 😀 The choice of measurement basis depends on the nature of the asset or liability and how it contributes to future cash flows, such as when an asset is sensitive to market price changes.

- 😀 The relevance of the information provided by a measurement basis is essential in choosing between historical cost and current value.

- 😀 Measurement of equity is indirect, with total equity being residual, though some components like the par value of shares are measured directly.

- 😀 Cash flow-based measurement techniques can be used to estimate certain values but are not considered independent measurement bases, as they are applied within historical cost or current value measurements.

Q & A

What are the two main measurement bases discussed in the script?

-The two main measurement bases discussed are historical cost and current value.

How is historical cost defined in the context of financial statements?

-Historical cost refers to the transaction price, which typically remains unchanged unless affected by impairment, depreciation, or interest accrual.

What does current value reflect in financial statements?

-Current value reflects updated monetary information that takes into account the conditions at the measurement date.

What are the different measurement bases under current value?

-The measurement bases under current value include fair value, value in use, fulfillment value, and current cost.

What is the definition of fair value?

-Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

How does value in use differ from fair value?

-Value in use refers to the present value of future cash flows that an asset will generate for a specific entity, while fair value is determined by market participants and does not consider entity-specific factors.

What is current cost, and how does it compare to historical cost?

-Current cost is the cost of acquiring an equivalent asset at the measurement date, including transaction costs. Unlike historical cost, it reflects the current conditions and is an entry value, similar to historical cost.

What factors should be considered when choosing a measurement basis?

-Factors to consider include the nature of the asset or liability, how it contributes to future cash flows, and the qualitative characteristics of relevance and faithful representation.

What is the role of measurement uncertainty in selecting a measurement basis?

-Measurement uncertainty involves the uncertainty about the amount or timing of future cash flows. This is important when selecting between historical cost and current value measurements.

How is equity measured, and why is total equity not measured directly?

-Total equity is not measured directly because it is residual. However, components of equity, such as the total par value of shares, are measured directly.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

SBR Topic Explainer: Solving questions using the conceptual framework

Accounting for IGCSE - Video 29 - Inventory Valuation

Accounting Principles | Class 11 | Accountancy | Chapter 3 | Part 2

Kerangka Dasar Laporan Keuangan

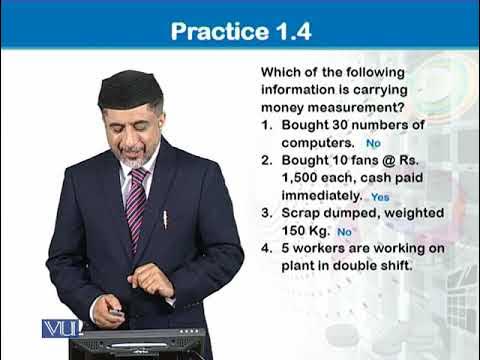

MGT101_Topic003

Perhitungan Biaya Produk Sampingan (By Product) | Akuntansi Biaya

5.0 / 5 (0 votes)