1,000,000 backtest simulations in 20 seconds with vectorbt

Summary

TLDRIn this video, Jason, the founder of PWAT, delves into the topic of backtesting, particularly focusing on how to avoid common pitfalls like overfitting. He emphasizes the importance of statistical significance in strategy testing, explaining that blindly optimizing for the best results often leads to failure. Using the Vector BT library, he demonstrates a simple moving average strategy, showcases the process of walk-forward analysis, and tests whether the optimized strategy performs well on out-of-sample data. Jason concludes by stressing the need for robust statistical analysis to validate the effectiveness of any trading strategy.

Takeaways

- 😀 Backtesting is a valuable tool but can lead to losses if not done correctly, especially when strategies are over-optimized for past data.

- 😀 Overfitting in backtesting occurs when strategies are optimized for past data and then applied to new, unseen data, leading to poor real-world performance.

- 😀 A proper backtest should include statistical significance tests to validate the strategy's effectiveness and ensure it's not just fitting noise.

- 😀 Vector BT is a powerful backtesting library that allows millions of simulations to be run in seconds, making it highly efficient for testing strategies.

- 😀 Walk forward analysis is used in backtesting, where a portion of the data is used for training (blue section), and another portion is used for testing the strategy (orange section).

- 😀 The walk forward analysis helps in simulating real-world conditions where past data is used for training, and future data is used for testing strategy performance.

- 😀 In data science, techniques like cross-validation are similar to walk forward analysis, helping ensure the model's robustness and minimizing overfitting.

- 😀 A simple moving average strategy involves buying when the fast moving average crosses above the slow moving average and selling when the opposite happens.

- 😀 Optimizing strategy parameters can lead to finding the highest Sharpe ratio, but it’s crucial to validate the results using out-of-sample data to avoid overfitting.

- 😀 Statistical tests, such as the one-sided T-test, help assess whether the Sharpe ratio from out-of-sample data is significantly higher than in-sample data, which helps in evaluating the strategy's real-world potential.

- 😀 A high P-value (e.g., 0.858) suggests that the strategy may have been overfit to the data, and it cannot be claimed to perform significantly better on unseen data.

- 😀 Vector BT is not only useful for running fast simulations but also for teaching the importance of proper backtesting methods and understanding statistical significance in strategy validation.

Q & A

What is the main topic of the video?

-The video primarily discusses backtesting strategies in finance, specifically focusing on how to avoid overfitting during backtesting, and using tools like Vector BT to conduct proper statistical analysis of strategies.

Why is it important to avoid overfitting in backtesting?

-Overfitting occurs when a strategy is tailored too specifically to past data, making it less likely to perform well in the future. This leads to unrealistic expectations and losses when applied to new, unseen data.

What is the risk of brute-forcing optimization in backtesting?

-Brute-forcing optimization by tuning parameters until the highest Sharpe ratio or P&L is found may result in a model that works well with past data but fails with new data due to overfitting.

What is a walk-forward analysis?

-A walk-forward analysis involves splitting data into two sections: one for training the model and the other for testing it. This allows you to simulate how the model would perform with new, unseen data and avoid overfitting.

How does Vector BT simplify backtesting?

-Vector BT allows for efficient backtesting by running millions of simulations quickly. It also provides built-in features to help download data and implement strategies like moving averages with minimal effort.

What is the significance of the Sharpe ratio in backtesting?

-The Sharpe ratio is a measure of risk-adjusted return. A higher Sharpe ratio indicates a better return for the risk taken, making it an important metric when evaluating the effectiveness of a trading strategy.

How does Vector BT help with finding the optimal strategy parameters?

-Vector BT allows users to test different combinations of parameters, such as fast and slow moving averages, to find the best Sharpe ratio, helping to identify an optimal strategy.

What does a T-test do in the context of backtesting?

-A T-test is used to compare the population means of two sets of data (e.g., in-sample and out-of-sample Sharpe ratios) to determine if the difference between them is statistically significant.

What does a P-value of 0.858 indicate in the T-test?

-A P-value of 0.858 suggests that there is no statistically significant difference between the in-sample and out-of-sample Sharpe ratios, meaning the strategy may have been overfitted to the in-sample data.

What is the goal of backtesting according to the video?

-The goal of backtesting is to determine whether a strategy is statistically significant and whether it generalizes well to unseen data, rather than just optimizing for past performance.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

【日本株爆益戦略④】超勝率が上がる大暴落回避パターン!!これを知れば損失回避&利益に繋がるぞ!!これで皆損失を回避してるで。米国株、FX、仮想通貨何でも使える‼️

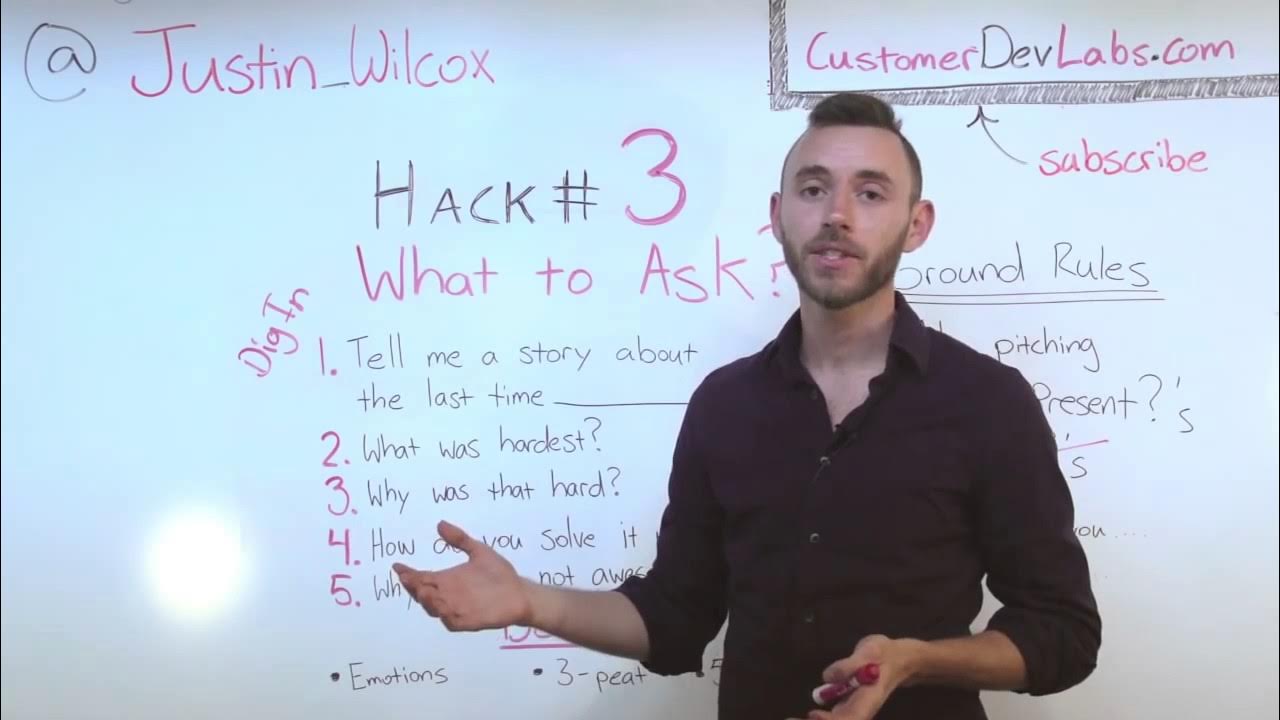

Customer Discovery: What Do You Ask, with Justin Wilcox

Ultimate Guide To BACKTESTING - How & Why You Should Do It!

C++ Weekly - Ep 482 - Safely Wrapping C APIs

Filter columns, not tables, in DAX

10 Algorithmic Trading Mistakes to Avoid!

5.0 / 5 (0 votes)