10 Algorithmic Trading Mistakes to Avoid!

Summary

TLDRThis video script delves into common pitfalls in algorithmic trading, emphasizing the importance of avoiding overfitting, using only available data, and the significance of walk-forward testing. It advises on the accurate accounting of trade costs, starting small with real money, trusting algorithms after thorough testing, and the perils of copying code without understanding. The script also stresses the necessity of commenting code for clarity and considering risk alongside total returns. It concludes by underscoring the need for a solid trading strategy before coding an algorithm, offering insights into improving trading performance.

Takeaways

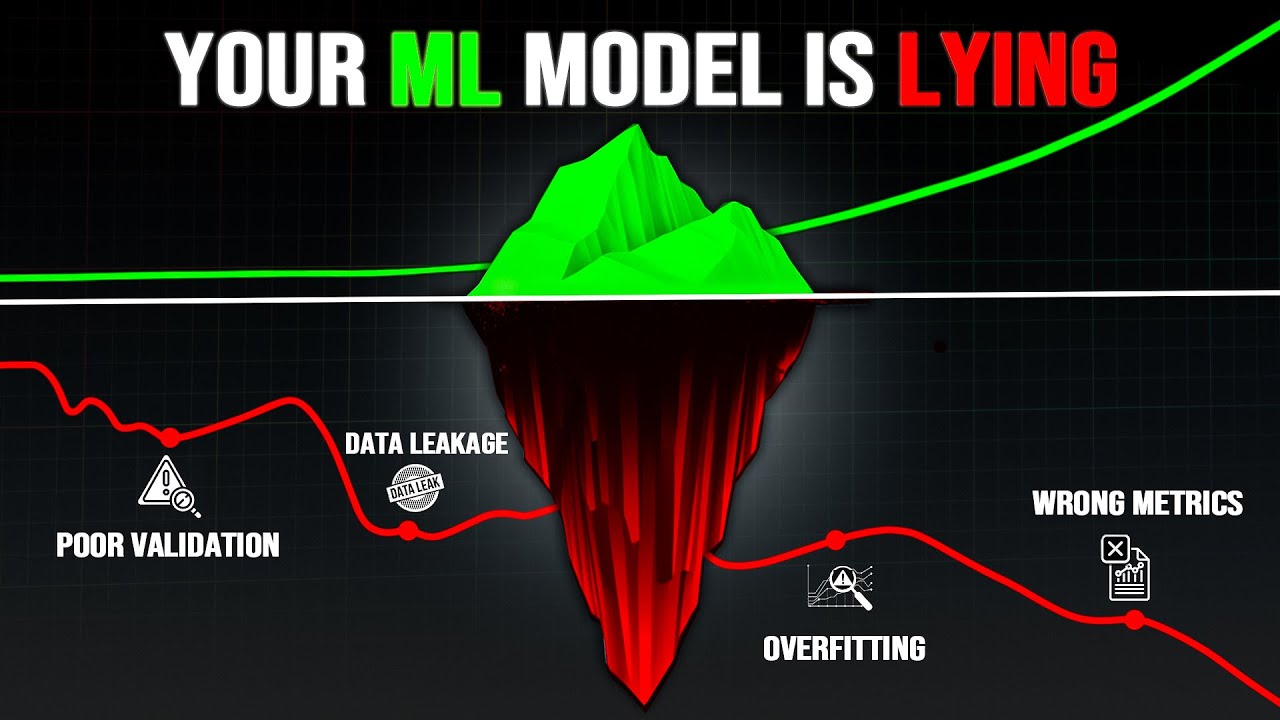

- 🔍 Back-testing is crucial for algorithmic trading but can be misleading if not done correctly, especially due to the risk of overfitting.

- 📉 Avoid overfitting by not excessively optimizing your algorithm to historical data; use a portion of data for validation.

- ⏳ Ensure that your algorithm uses only data that was available at the time of the decision to avoid using future information.

- 🔧 Utilize walk-forward testing to simulate real-time trading conditions and to avoid common back-testing pitfalls.

- 💸 Account for all trade costs, including the bid-ask spread and slippage, to get a realistic view of your algorithm's performance.

- 🚀 Start with small investments when transitioning from back-testing to live trading to minimize risk and identify any unforeseen issues.

- 🔗 Trust your algorithm once it has proven itself through rigorous testing, but remain vigilant and ready to intervene if necessary.

- 🛠 Understand and customize your algorithm thoroughly; avoid blindly copying others' code without fully grasping its logic.

- ✏️ Comment your code extensively to maintain clarity and ease of understanding, especially for complex algorithmic trading strategies.

- 📈 Consider not only the total return but also risk metrics like volatility, max drawdown, and the Sharpe ratio when evaluating algorithm performance.

- 💡 Develop a clear trading strategy before implementing it as an algorithm to ensure a solid foundation for your trading decisions.

Q & A

What is the primary focus of the video?

-The video focuses on educating viewers about common mistakes to avoid in algorithmic trading and how to improve trading performance by recognizing and correcting these errors.

Why can backtesting be dangerous if done incorrectly?

-Backtesting can be dangerous because it may lead to overfitting, where the algorithm is overly optimized to the test data, resulting in poor performance on new, unseen data.

What is overfitting in the context of algorithmic trading?

-Overfitting occurs when an algorithm is excessively tailored to historical data, making it perform well on that specific data but poorly on new data due to its lack of generalizability.

How can traders avoid overfitting their algorithms?

-Traders can avoid overfitting by reserving a portion of historical data for validation, ensuring the algorithm performs well on both training and untouched data.

Why is using future data in an algorithm a mistake?

-Using future data in an algorithm leads to unrealistic and overly optimistic performance predictions because in live trading, future data is not accessible.

What is walk-forward testing and why is it important?

-Walk-forward testing is a method where an algorithm is tested on a rolling basis with new data, simulating live trading conditions. It's important because it helps identify overfitting and provides a more realistic assessment of algorithm performance.

Why should traders account for trade costs when testing an algorithm?

-Trade costs, including commissions, bid-ask spread, and slippage, can significantly impact the bottom line. Ignoring these costs can lead to overestimating an algorithm's profitability.

What is the significance of starting small when transitioning from backtesting to live trading?

-Starting small with real money allows traders to identify and address potential issues without significant financial risk, ensuring the algorithm performs as expected in live markets.

Why is it crucial to trust your algorithm once it has been thoroughly tested?

-Trusting the algorithm is important to assess its true performance. Constant interference can skew the results, making it difficult to evaluate the algorithm's effectiveness.

How can copying someone else's code be detrimental to algorithmic trading success?

-Copying code without understanding it can lead to misuse and poor performance, as the trader may not grasp the logic or nuances necessary for adapting the algorithm to different market conditions.

Why is commenting code important in algorithmic trading?

-Commenting code is crucial for maintaining clarity and understanding, especially when revisiting the code after a period. It aids in debugging and future modifications.

What role does developing a trading strategy play before creating an algorithm?

-Developing a trading strategy is foundational as it provides the conceptual framework that the algorithm will execute. It ensures the algorithm is based on a sound investment thesis.

Why should traders consider other performance metrics besides total return when evaluating algorithms?

-Metrics like risk, volatility, max drawdown, and the Sharpe ratio provide a more comprehensive view of an algorithm's performance, accounting for both returns and the risks taken to achieve them.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

1,000,000 backtest simulations in 20 seconds with vectorbt

All Machine Learning Beginner Mistakes explained in 17 Min

5 Price Action Rules EVERY Trader NEEDS To Know

L17 Integration Testing

Eczema Dr Vanita Rattan | What causes eczema on hands/ face | Eczema treatment | atopic dermatitis

5 Ways Data Science Changed Finance

5.0 / 5 (0 votes)