Materi Laba Rugi Keuangan Bisnis

Summary

TLDRThis video script covers a lecture on business financial report analysis, focusing on profit and loss statements. The speaker explains the key components of the report, including sales turnover, various types of costs (general, administrative, operational), and how to calculate profit. Depreciation, other income, and taxes are also discussed as critical elements in determining the company's net profit. The session emphasizes the importance of understanding these financial reports for business decision-making, tax reporting, and performance evaluation. Practical examples and formulas are shared to help viewers grasp key concepts and apply them to real-world scenarios.

Takeaways

- 😀 The Profit and Loss statement is a critical part of financial reports, complementing the Balance Sheet.

- 😀 The financial report should include the company name, profit and loss details, and the period it covers (e.g., monthly or yearly).

- 😀 Sales turnover for the year is calculated by multiplying monthly sales by 12, providing a yearly revenue estimate.

- 😀 If a company has only been operating for part of the year, the turnover should be adjusted based on the number of months operated.

- 😀 General costs include labor, administrative costs, and operational expenses such as utilities and office supplies.

- 😀 All costs—general, administrative, and operational—are deducted from gross profit to calculate operational profit.

- 😀 Depreciation and amortization are considered as reductions in the value of assets, impacting the net income.

- 😀 Interest costs, related to bank loans or debts, need to be subtracted from the profit before calculating taxes.

- 😀 Taxes are divided into corporate and individual taxes and should be deducted from profit before tax to determine the final net profit.

- 😀 Net profit reflects the company’s profitability after accounting for all expenses, including operational costs, depreciation, interest, and taxes.

- 😀 Additional income from non-core business activities, such as other ventures, should be recorded separately in the profit and loss statement.

Q & A

What is the main topic discussed in this lecture?

-The main topic discussed is business financial report analysis, specifically focusing on the profit and loss statement after discussing the balance sheet.

What is the purpose of preparing a financial report for a company?

-The financial report serves to help with tax reporting, provide insights for company development, and fulfill mandatory requirements for public companies.

Why is it important to specify the date and period in financial reports?

-It is crucial to specify the date and period to accurately reflect the company's financial performance for a defined period, typically a year, such as 12 months.

How do companies handle financial reporting if they only started operating partway through the year?

-If a company starts partway through the year, it reports its financial performance starting from its operational month, with calculations adjusted based on the number of months the company has been active.

What is the significance of the gross profit figure in a profit and loss statement?

-Gross profit is a key figure showing the company’s earnings after deducting the cost of goods sold, but before accounting for other operational, administrative, and financial costs.

What types of costs are typically included under general and operational costs?

-General and operational costs include labor, administrative costs like paper or supplies, and operational expenses such as utilities, transportation, and accommodation.

What is the difference between gross profit and operational profit?

-Gross profit is the revenue left after subtracting the cost of goods sold, while operational profit accounts for further deductions including general and operational costs.

How does depreciation affect a company's financial report?

-Depreciation is deducted from the total value of assets, representing the gradual loss in value over time. It reduces the total value of assets on the balance sheet and impacts net profit.

What is the role of taxes in the profit and loss statement?

-Taxes are deducted from the pre-tax profits to calculate the net profit, with corporate taxes being an essential element in the financial report, affecting the company’s overall profitability.

What are the key components involved in calculating profit before interest and taxes (EBIT)?

-EBIT is calculated by subtracting depreciation and other operational costs from the gross profit, and adding any other income, with interest expenses subtracted to arrive at the operating profit.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Materi Pertemuan ke-13 Manajamen Keuangan dan Pembiayaan Usaha

Gestão Contábil - Retomada de conceitos: Principais Conceitos e Ferramentas em 15 Tópicos

Aktivitas Belajar 7.4

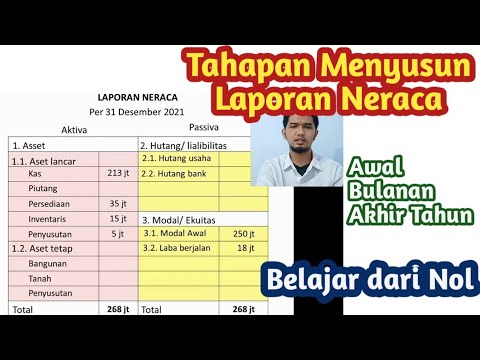

Cara Membuat Laporan Neraca dan laporan akhir tahun

Financial reporting basics & examples | Start your business

What is Financial Modelling? - Introduction #financialmodeling course

5.0 / 5 (0 votes)