Learn My Best Gold Trading Strategy in 8 Minutes (Perfect for Beginners)

Summary

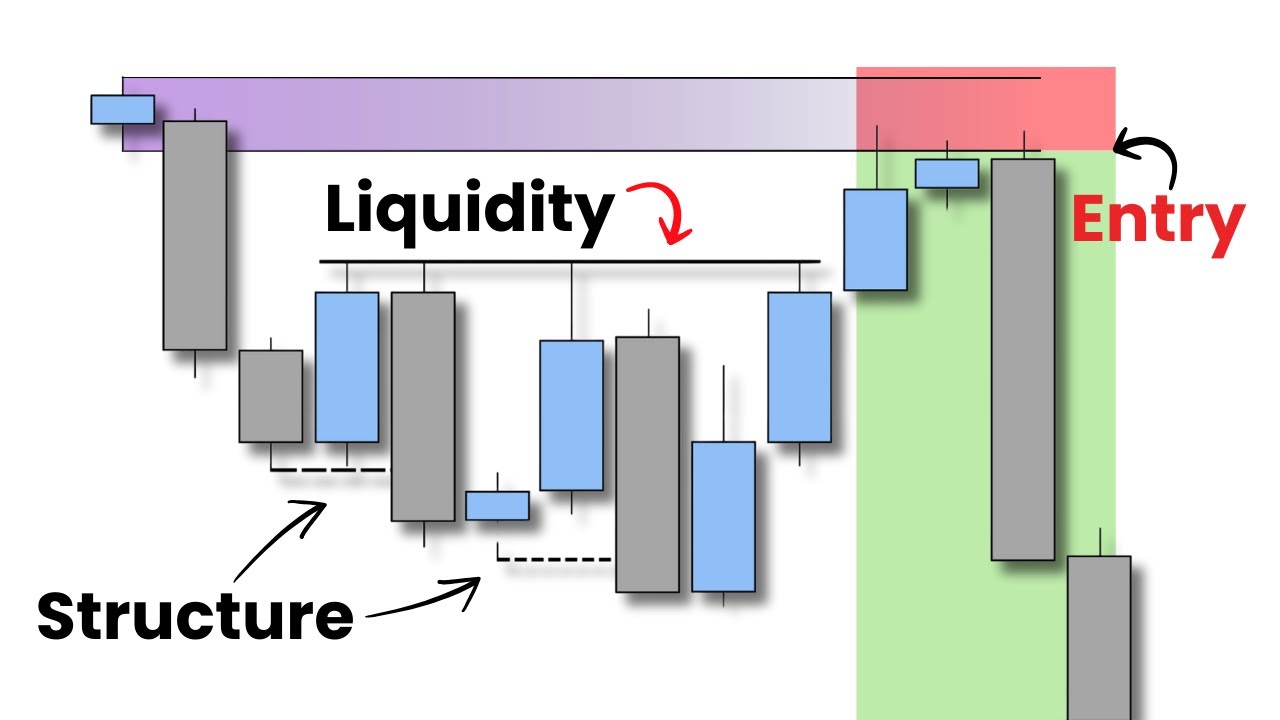

TLDRIn this video, the presenter introduces a simple yet effective gold trading strategy based on liquidity concepts, specifically targeting the London session. The strategy emphasizes the importance of analyzing the Asia session, focusing on liquidity sweeps of the Asia high or low before entering trades. By identifying breaks in structure after the London open, traders can capitalize on price movements. The strategy boasts a high win rate of 70-80% if strictly followed, and the presenter stresses the importance of backtesting, discipline, and psychological readiness to become a profitable trader. Additional tips on risk management and entry models are also provided.

Takeaways

- 😀 Understand liquidity: The strategy focuses on the concept of liquidity, particularly observing the Asia session's highs and lows.

- 😀 Importance of Asia session: The Asia session’s high and low need to be swept before entering a trade in the London session.

- 😀 Timing is crucial: The strategy works specifically in the first hour of the London session, where significant moves are often made.

- 😀 Use of custom indicator: A custom indicator is used to highlight the Asia session, Pre-London session, and key liquidity zones.

- 😀 Liquidity sweep rule: A liquidity sweep (either Asia High or Low) in Pre-London is a mandatory condition for the strategy to work.

- 😀 Break of structure (BoS): After the liquidity sweep, a break of structure (higher high or lower low) is used for entry on a 5-minute chart.

- 😀 Risk management: Stop loss is set below the previous swing low/high, with a target set at a 1:2 risk-to-reward ratio.

- 😀 No sweep, no setup: If the Asia session high or low is not swept, there’s no trade setup in the London session.

- 😀 Low probability setups: If the Asia or Pre-London session trends significantly, the likelihood of a profitable move in the London session decreases.

- 😀 Discipline and backtesting: Emphasize the importance of backtesting, journaling, and testing the strategy to build confidence and improve performance.

Q & A

What is the primary concept behind the strategy shared in the video?

-The primary concept behind the strategy is the use of liquidity, specifically focusing on liquidity sweeps at the Asia session high or low, and executing trades during the London session. This strategy aims to capitalize on price movements triggered by liquidity shifts.

Why is it important to watch the Asia session and Pre London session for this strategy?

-The Asia session and Pre London session are important because they provide insights into market behavior and liquidity levels. A liquidity sweep of the Asia high or low during the Pre London period is essential for confirming that a significant price move may occur in the London session.

How does the strategy determine when to enter a trade?

-The strategy enters a trade based on a liquidity sweep of the Asia low or high. If this occurs during the Pre London session, and the first hour of the London session shows a break in market structure (such as a higher high or lower low), the trader can enter a position.

What role does the break of structure play in the entry decision?

-The break of structure, such as a higher high or lower low, indicates that the market is shifting direction. This is a key entry signal for traders, confirming that the liquidity sweep has led to a significant price movement, which is expected to continue during the London session.

What is the suggested stop loss and target for trades in this strategy?

-The stop loss should be placed below the previous swing low, while the target is set at a simple 1:2 risk-to-reward ratio. This ensures a manageable risk level while aiming for a reasonable profit based on market movement.

Why is liquidity important for this strategy to work?

-Liquidity is crucial because it drives price movement. Without a sweep of the Asia high or low, the market lacks the necessary liquidity to trigger a significant move, making it unlikely for the London session to generate substantial price action.

What is the London Continuation strategy mentioned in the video?

-The London Continuation strategy occurs when the Asia session and Pre London session have already experienced a significant trend. In such cases, the London session may not provide a strong move, and the trader must focus on continuation setups rather than new trend development.

How does the strategy address low-probability setups?

-Low-probability setups occur when there is no liquidity sweep or when the Asia and Pre London sessions are trending heavily. In these cases, while an entry might still be taken, the potential for a significant price move is reduced, and these trades are considered less reliable.

What can traders do if they are not seeing favorable results on certain days, like Mondays?

-Traders are encouraged to analyze their results and eliminate low-performing days, such as Mondays, from their trading schedule. By doing this, they can improve their win rate by focusing on days when the strategy performs better.

What is the recommended action for traders after learning this strategy?

-Traders should write down the rules of the strategy, backtest it using historical data, and practice on a demo account to build confidence. Testing and discipline are key to mastering the strategy and ensuring it works consistently in real market conditions.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

ICT - Mastering High Probability Scalping Vol. 1 of 3

Supercharge Your Trading with ICT's Daily/Weekly Range Secrets

Liquidity + Structure = Profit

Adım Adım ICT Stratejisi ve Trading Planı

i backtested my Enhanced ICT 2022 Model for a week! Insane Results

Trading Strategy had 100% Win Rate in 2024 - What’s the Secret?

5.0 / 5 (0 votes)