ICT Daily Bias Simplified [Full Guide]

Summary

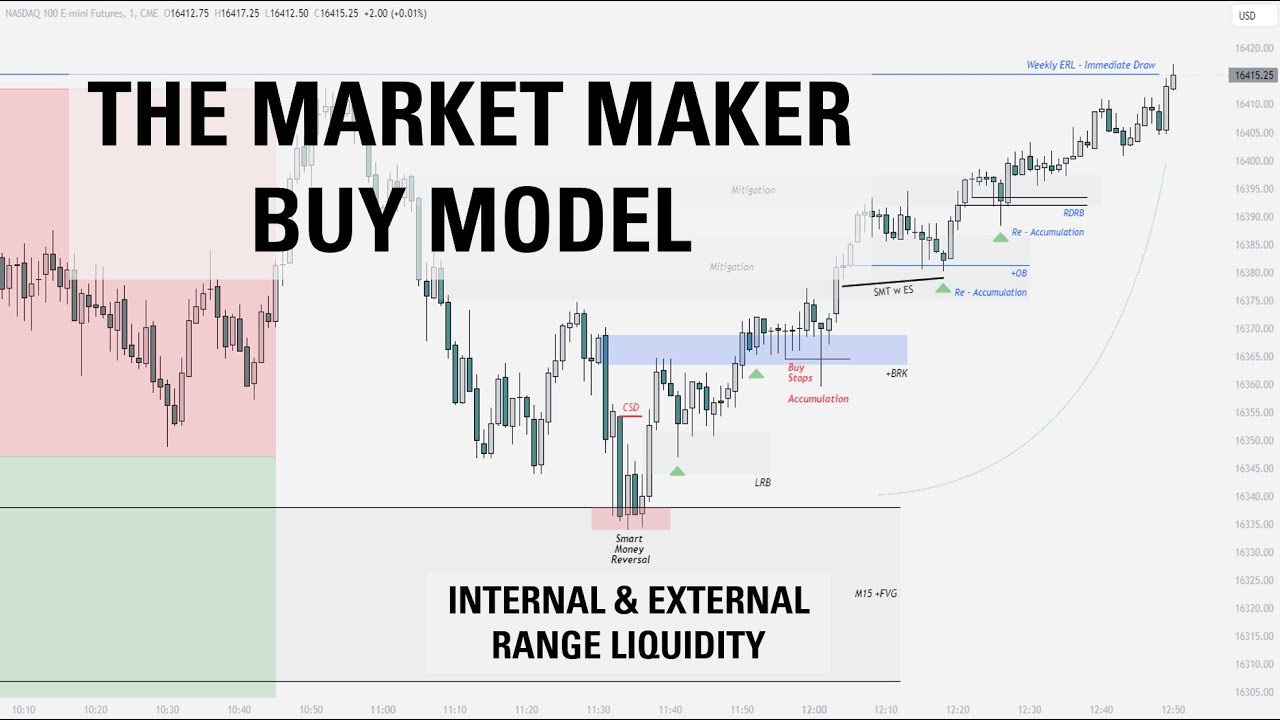

TLDRIn this video, the trader demonstrates an effective method for identifying trade opportunities using market structure, fair value gaps, and liquidity zones. Key concepts include trading based on structural shifts, analyzing price reactions at key levels, and managing risk through partial profits. The trader emphasizes the importance of top-down analysis and liquidity concepts to enhance decision-making. Despite a losing trade, the method remains efficient for consistently identifying trading zones and refining entry strategies. Viewers are encouraged to apply the simple yet powerful approach for better trading results.

Takeaways

- 😀 Market structure shifts help identify potential entry points, signaling changes in price trends.

- 😀 Liquidity zones are areas in the market where price can be drawn toward, indicating high concentration of orders.

- 😀 Fair value gaps represent price levels that may have been underexplored, with trades often targeting the 50% level of these gaps.

- 😀 Breakers, or previous price levels that caused a market shift, act as key entry points or reversal signals.

- 😀 Stop losses should be placed just above certain levels, such as above a key candlestick, to limit losses during price fluctuations.

- 😀 Setting clear profit targets is important; liquidity zones, daily highs/lows are often used for setting these targets.

- 😀 Risk management through partial profit-taking is crucial for mitigating losses and securing gains.

- 😀 The method discussed is easy to apply and doesn't require excessive time or complex tools to implement.

- 😀 Applying drone liquidity concepts and top-down analysis can enhance the accuracy of trade predictions and decisions.

- 😀 The approach shared in the tutorial focuses on simplicity, enabling traders to act quickly when market conditions align.

- 😀 The speaker encourages viewers to join a community (Discord) for additional learning, Q&A, and seminars to enhance trading knowledge.

Q & A

What is the Trading Zone mentioned in the video?

-The Trading Zone refers to a price level or area on the chart where the trader expects price to react. This zone is identified using fair value gaps and liquidity zones, which are critical for determining where price is likely to change direction.

What is a fair value gap and how is it used in trading?

-A fair value gap is a price gap where the market has not yet fully corrected. Traders often look for price to return to this gap and trade from it, expecting the market to fill the gap or react in a certain way.

What does the term 'market structure shift' mean?

-A market structure shift occurs when price changes direction or breaks a pattern, signaling a potential change in market sentiment. In this video, it is used to identify when price might start moving in a new trend or direction.

How does liquidity play a role in the trader’s decision-making process?

-Liquidity is critical because it represents the amount of market orders available to fill trades. A trader will look for areas with high liquidity, as these are likely to produce significant price movement. Price often reacts to these liquidity zones before continuing in the anticipated direction.

What is the significance of the 'breaker block' mentioned in the video?

-A breaker block is a price level where the market has previously reversed. It is an area of support or resistance that, once broken, can signal a continuation or reversal of the trend. In this case, the speaker discusses waiting for price to react to the breaker block before entering a trade.

Why does the trader mention entering the trade at the 50% of the fair value gap?

-Entering the trade at the 50% level of the fair value gap is a common strategy for traders who believe that price will return to the middle of the gap before continuing in the intended direction. This level is often seen as a good entry point for a trade.

What is the role of stop loss and how does the trader manage it in this strategy?

-The stop loss is placed above key price levels (e.g., above a candle or structure) to limit potential losses if the market goes against the trade. The trader aims to manage risk by setting a stop loss at an appropriate level to protect against significant losses.

How does the trader decide on the profit targets?

-Profit targets are determined based on key support and resistance levels, such as the Asian low, previous daily high, or low. These levels are used to gauge where price may reverse or pause, providing a logical place to take profits or adjust stop losses.

What is the 'New York Killzone' mentioned in the script?

-The 'New York Killzone' refers to a specific time period during the New York trading session when the market tends to be more volatile. This is often when significant price movements occur, and traders may enter or exit trades based on this increased activity.

What is the purpose of applying top-down analysis in trading?

-Top-down analysis involves looking at multiple time frames to understand the broader market trend before making a decision on a lower time frame. This method helps traders align their entries with the overall market direction, improving their chances of success in trades.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

ICT Market Maker Model - Live Trade Explanation

How To Spot the Bottom of ICT's Market Maker Model

My Secret High Probability Liquidity Sweep Strategy [Full In-Depth Guide]

The Market Maker Buy Model | Full Trade Breakdown $NQ

Easiest ICT 2022 Mentorship Checklist - ICT Concepts

How To Predict The ICT Market Maker Model LIVE

5.0 / 5 (0 votes)