The ONLY Market Structure Trading Video You’ll Ever Need

Summary

TLDRThis video provides an in-depth explanation of market structure and its crucial role in trading. It covers the fundamentals of swing points, trends, and price action to help traders identify the right times to buy and sell. The video introduces key concepts like break of structure and change of character, emphasizing their importance in determining market direction. It also suggests using tools like Lux Algo's smart money concepts indicator for visualizing these patterns. Through visual examples, the video explains how to spot trends, reversals, and key entry points, empowering traders to make informed decisions.

Takeaways

- 😀 Understanding market structure is crucial for successful trading, as it helps in identifying the right times to buy and sell.

- 📉 The market can be in three stages: uptrend, downtrend, or sideways, and recognizing these trends is key to making profitable trades.

- 🔑 Swing points (structure points) are essential in identifying market trends by marking key highs and lows in price movements.

- ⬆️ In an uptrend, price makes higher highs and higher lows, which signals a favorable time for long positions.

- ⬇️ In a downtrend, price makes lower highs and lower lows, which signals a favorable time for short positions.

- 🔄 Sideways market action indicates indecision, and it is essential to wait for a breakout to determine the next move.

- 📊 Smart Money Concepts by Lux Algo can visually display market structure elements like Break of Structure (BOS) and Change of Character (CH) for easier decision-making.

- ⚖️ A Break of Structure (BOS) occurs when two or more swing points are broken, signaling a strong shift in market direction.

- 🔄 A Change of Character (CH) is shown when the most recent swing high or low is broken, indicating a potential change in market sentiment.

- 💡 Risk management is essential: Set stop losses above swing points or fair value gaps and target liquidity zones for better trade setups.

- 📉 Fair value gaps can be used as entry points for reversals, where you can enter a trade after the trend shifts, aiming for a higher risk-to-reward ratio.

Q & A

What is market structure in trading?

-Market structure refers to the pattern of price movements that helps traders identify trends in the market, such as uptrends, downtrends, or sideways price action. It involves analyzing swing points (highs and lows) to understand market sentiment and predict future price movement.

Why is understanding market structure important for traders?

-Understanding market structure helps traders identify the right times to buy or sell, preventing them from getting trapped in bad positions. It allows them to recognize trends and make informed decisions based on the direction of the market.

What are swing points and why are they important?

-Swing points are the high and low points in the price movement. Identifying these points helps traders see the developing trends in the market and make decisions on whether to enter a trade or not.

What are the three stages of market structure?

-The three stages of market structure are: 1) Uptrend, where prices make higher highs and higher lows. 2) Downtrend, where prices make lower highs and lower lows. 3) Sideways, where no new highs or lows are made, and the market is indecisive.

How does an uptrend differ from a downtrend?

-In an uptrend, prices make higher highs and higher lows, signaling a favorable environment for buying (long positions). In a downtrend, prices make lower highs and lower lows, signaling a favorable environment for selling (short positions).

What happens during sideways price action?

-Sideways price action occurs when no new higher highs or lower lows are formed, indicating indecision in the market. A breakout from this range can occur, but trend continuation is more likely if a significant higher time frame level is reached.

What is the role of indicators in understanding market structure?

-Indicators like 'Smart Money Concepts by Lux Algo' visually display key market structure concepts, such as Break of Structure (BOS) and Change of Character (CH), making it easier for traders to identify significant price movements and trends without manually analyzing the market.

What is the difference between Break of Structure (BOS) and Change of Character (CH)?

-Break of Structure (BOS) occurs when a second swing high or low is broken, signaling a stronger shift in market direction. Change of Character (CH) occurs when the most recent swing high or low is broken by a single candle close, indicating a potential change in trend direction.

How can a trader use fair value gaps in their trading strategy?

-Fair value gaps, which are created when a price breaks a significant level and leaves behind a gap, can be used as entry points for trades. For example, if a trend reversal occurs and a fair value gap is formed, traders can enter the market at the midpoint of that gap and set their stop loss accordingly.

How can understanding market structure help in risk management?

-Understanding market structure helps traders identify trends and set appropriate stop losses, which is crucial for managing risk. By entering trades in the right direction and using tools like fair value gaps and trend confirmations, traders can improve their risk-to-reward ratio and protect their capital.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

ICT Market Maker Model - Explained In-depth!

Securities Exchange Act of 1934

Financial Derivatives Unit 2 Part 2 | Hedging Meaning | Market Index Application | Future Contract

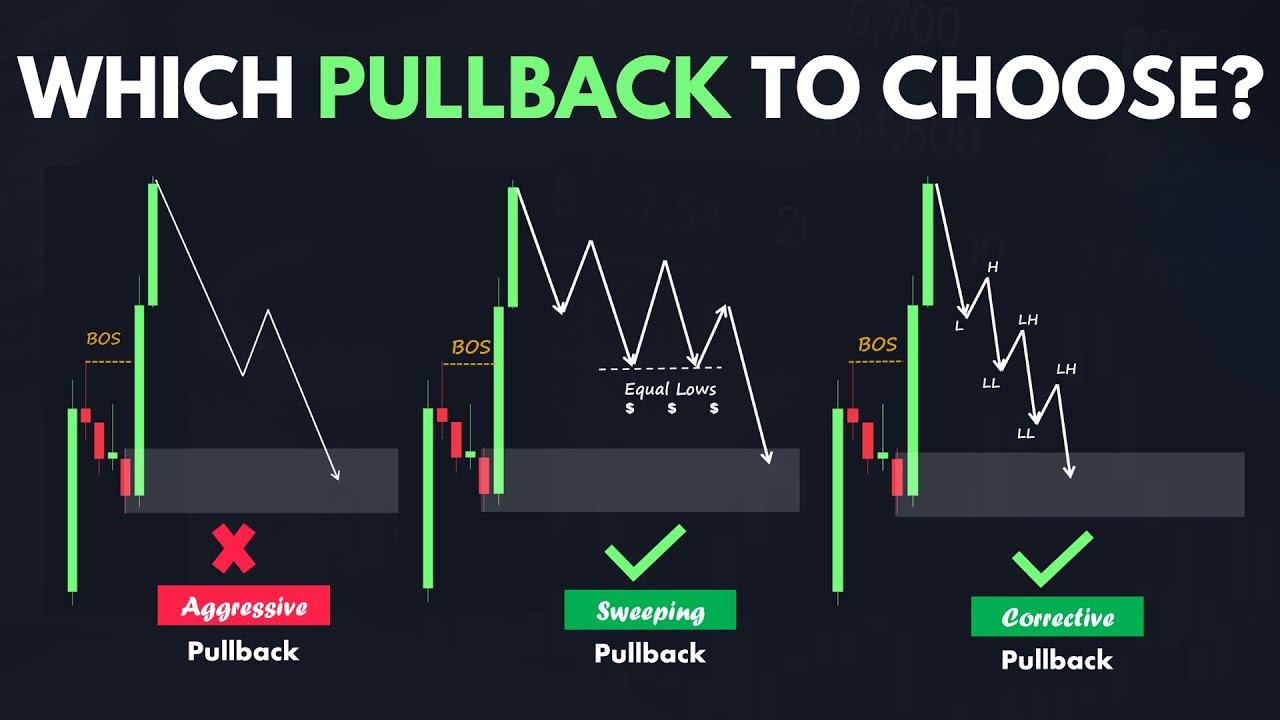

Best Pullback Trading Strategies In Forex - The Pullback Mastery Guide

Struktur Dan Fungsi Sistem Pernapasan Manusia : Organ Pernapasan Manusia

Identifying Fake MSS CHOCH and Retracements Updated

5.0 / 5 (0 votes)