$NVDA EARNING ANALYSIS IN 3min

Summary

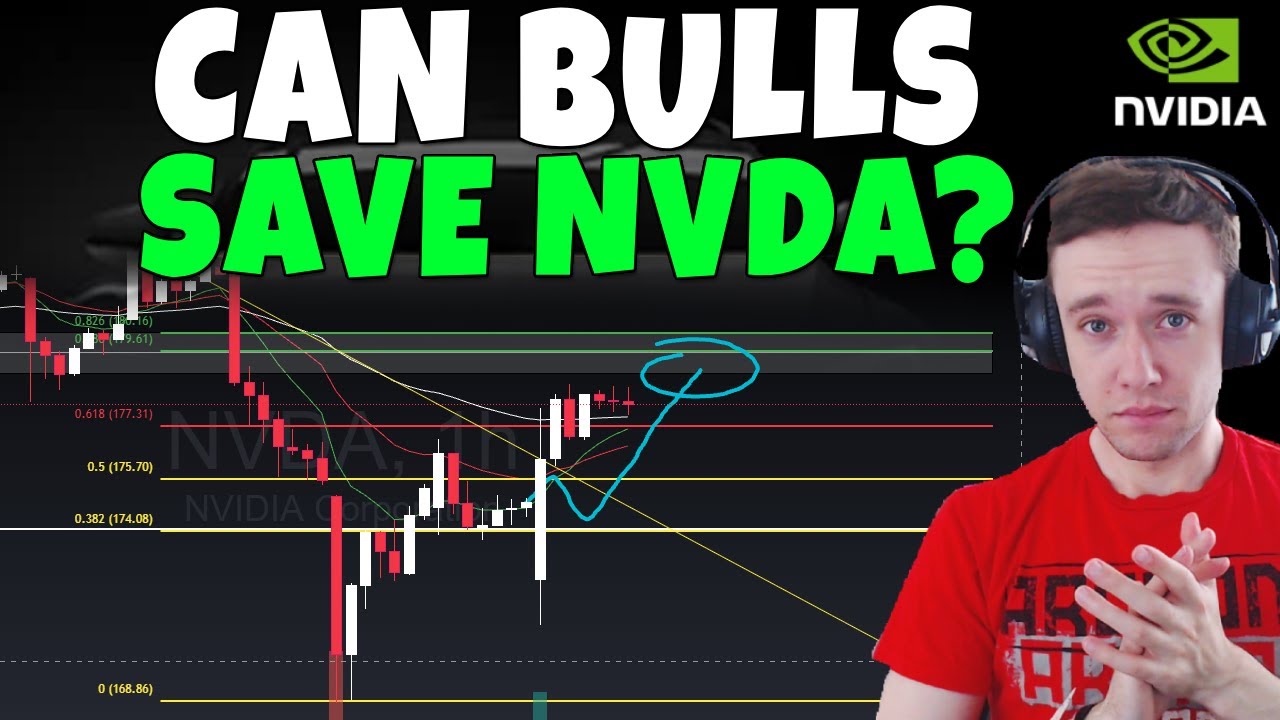

TLDRIn this technical analysis video, the presenter examines NVIDIA's stock performance ahead of its earnings release. They highlight the stock's downward trend since November 2021, noting multiple resistance levels and a significant drop in net income by 45% in Q1 2022. The video discusses the company's P/E ratio, comparing it to industry standards, and suggests that NVIDIA's current price might be overvalued at almost 90 times the expected earnings. The presenter also points out technical indicators like the MACD, which is bearish, and key support levels to watch, concluding with a cautious outlook on the stock's potential post-earnings performance.

Takeaways

- 📉 Nvidia's stock has been on a downward trend since November 2021, with falling tops indicating a bearish movement.

- 📊 The stock has faced multiple rejections at the sloping resistance line, the 100-day moving average, and the top resistance level.

- 💼 The 50-day moving average is providing support at around $169-168, which is a key level to watch for potential price action.

- 🔍 There is an internal support level identified at a gap around $157, which could be a significant area of interest if the price drops further.

- 🔢 In the first quarter of 2022, Nvidia reported a net income of $1.6 billion, which is a 45% decrease from the previous quarter's $3 billion.

- 📉 This significant drop in net income raises concerns about the company's financial health and could impact investor sentiment.

- 📈 The company's expected earnings per share (EPS) for the current quarter is $0.49, which, if achieved, would still place the stock at a high valuation compared to other tech giants.

- 📊 A valuation comparison shows Nvidia's price-to-earnings (P/E) ratio at approximately 90 times, which is higher than the 25-35 times range of other major tech companies like Apple, Google, and Microsoft.

- 📉 The Moving Average Convergence Divergence (MACD) indicator is pointing south, suggesting a potential bearish continuation for the stock.

- 🚨 If the upcoming earnings report results in a rejection, the stock price could test the lower support levels, potentially revisiting the bottom established in the recent downtrend.

- 🗓️ The speaker emphasizes the importance of watching the earnings release and the subsequent market reaction, as it could dictate the stock's direction in the short term.

Q & A

What is the current focus of the video script discussion?

-The video script focuses on the technical analysis of NVIDIA's stock performance, particularly in anticipation of its earnings report.

How has NVIDIA's stock trend been since November 2021 according to the script?

-The script indicates that NVIDIA's stock has been slowly grinding down since November 2021, with falling tops and a downward channel being formed.

What is the significance of the 'rejection' mentioned in the script?

-In the context of the script, 'rejection' refers to the stock price failing to break through a resistance level, such as the sloping resistance guard and the 100-day moving average.

What are the support levels mentioned for NVIDIA's stock in the script?

-The script mentions two support levels for NVIDIA's stock: the 50-day moving average support at around $168, and an internal support at around $157.

What was the net income reported by NVIDIA in the first quarter of 2022 compared to the previous year?

-The script reports that NVIDIA's net income for the first quarter of 2022 was $1.6 billion, which is a 45% decrease compared to the $3 billion reported in December 2021.

How does the script analyze NVIDIA's earnings per share (EPS) in comparison to its market price?

-The script calculates the price-to-earnings (P/E) ratio based on NVIDIA's expected EPS of 49 cents, resulting in a P/E of 90 times, which is almost double the market average for major tech companies.

What is the MACD indicator suggesting about NVIDIA's stock trend according to the script?

-The script mentions that the MACD indicator is pointing south, which typically indicates a bearish trend or potential downward movement in the stock price.

What is the potential outcome for NVIDIA's stock if the earnings report is rejected according to the script?

-If the earnings report is rejected, the script suggests that NVIDIA's stock might test the bottom support level, potentially leading to a further decline in price.

What is the comparison of NVIDIA's P/E ratio with other major tech companies mentioned in the script?

-The script compares NVIDIA's P/E ratio of 90 times with other tech companies such as Apple at 35 times, Google at 25 times, and Microsoft at around 30-32 times.

What is the script's final recommendation for viewers regarding NVIDIA's stock?

-The script advises viewers to watch the support levels closely and to be cautious, as the stock appears to be facing significant resistance and potential downward pressure.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)