Chapter 14- Working Capital Policy

Summary

TLDRIn this video, Mike learns about key financial concepts essential for managing his pizza company. He explores the Cash Conversion Cycle (CCC), which involves calculating the Inventory Conversion Period, Average Collection Period, and Payables Deferral Period to measure how quickly the business turns resources into cash. Additionally, Mike discovers working capital management, including the choice between relaxed, restrictive, and moderate policies for managing current assets. Lastly, he evaluates three financing approaches—moderate, aggressive, and conservative—to determine the best way to fund his company's assets and operations. These insights will help Mike optimize his cash flow and business efficiency.

Takeaways

- 😀 The cash conversion cycle tracks the time it takes for a business to purchase, produce, sell, and collect cash from its sales.

- 😀 The first part of the cycle is the inventory conversion period, which measures the average time to convert materials into finished goods and then sell them.

- 😀 The formula for inventory conversion period is inventory divided by cost of goods sold per day.

- 😀 The second part is the average collection period, which calculates how long it takes to collect cash after a sale.

- 😀 The formula for average collection period is receivables divided by daily sales.

- 😀 The third part is the payables deferral period, which shows how long the company takes to pay for materials and labor after purchasing them.

- 😀 The cash conversion cycle is determined by adding the inventory conversion period and average collection period, then subtracting the payables deferral period.

- 😀 Working capital management involves deciding how many current assets to hold, with three possible policies: relaxed, restrictive, and moderate.

- 😀 A relaxed policy holds more current assets relative to sales, while a restrictive policy minimizes these holdings.

- 😀 A moderate policy strikes a balance between holding assets and minimizing them, based on business needs.

- 😀 To finance current assets, Mike can choose between a moderate, aggressive, or conservative approach, depending on how much short-term or long-term debt to use.

Q & A

What is the cash conversion cycle?

-The cash conversion cycle is the time it takes for a company to purchase or produce inventory, sell it, and then collect the cash from the sale. It helps businesses understand how efficiently they are managing their inventory, sales, and cash flow.

How is the inventory conversion period calculated?

-The inventory conversion period is calculated by dividing the inventory by the cost of goods sold per day. This gives the average time required to convert materials into finished goods and sell them.

What does the average collection period tell Mike?

-The average collection period, calculated by dividing receivables by daily sales, tells Mike how long it takes for his company to collect cash after a sale has been made.

What is the payables deferral period and why is it important?

-The payables deferral period indicates how long it takes for a company to pay for materials and labor after purchasing them. This is important for understanding the company's cash flow and payment schedule.

How is the cash conversion cycle calculated?

-The cash conversion cycle is calculated by adding the inventory conversion period to the average collection period and then subtracting the payables deferral period from that sum.

What is the working capital management concept?

-Working capital management involves managing a company’s current assets and current liabilities to ensure it has sufficient liquidity to run its operations efficiently.

What is networking capital?

-Networking capital is the difference between a company’s current assets and its current liabilities. It shows the liquidity available to fund the company’s day-to-day operations.

What are the three policies for managing current assets?

-The three policies for managing current assets are: the relaxed policy (holding more current assets), the restrictive policy (holding fewer current assets), and the moderate policy (a balance between the two).

What is the moderate approach to short-term financing?

-The moderate approach to short-term financing involves matching the maturities of assets and liabilities so that temporary operating current assets are financed with short-term debt, while permanent operating current assets and fixed assets are financed with long-term debt or equity.

What are the benefits of a conservative approach to financing?

-A conservative approach to financing involves using long-term sources to finance permanent operating capital and some temporary operating current assets. This approach reduces the risk of liquidity issues by relying less on short-term debt.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Literasi Keuangan untuk Remaja: Lima Tips untuk Pengelolaan Uang yang Bijak

Pass the Bank of America Interview 2024 | Bank of America Video Interview

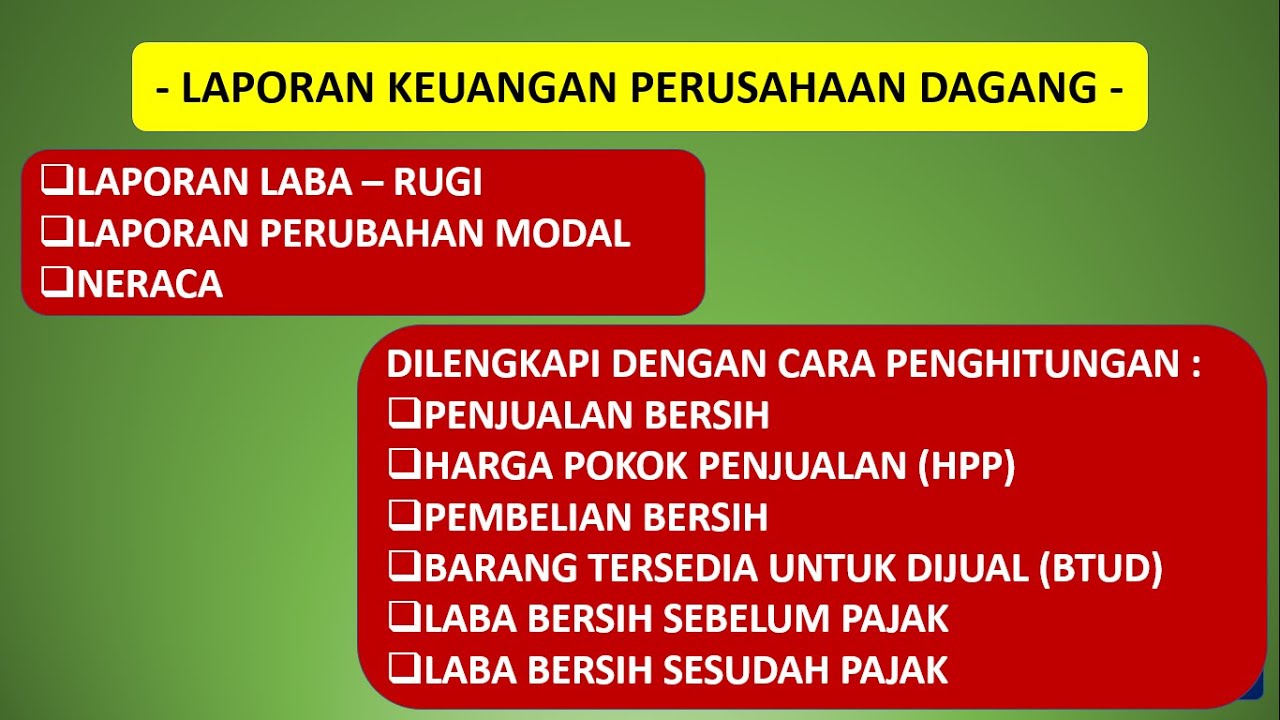

LAPORAN KEUANGAN PERUSAHAAN DAGANG

Literasi Finansial

Watch this to save money on your wedding | Money Psychology

BELAJAR ACCURATE ONLINE 1 - MENYIAPKAN DATA USAHA PERUSAHAAN DENGAN ACCURATE ONLINE

5.0 / 5 (0 votes)