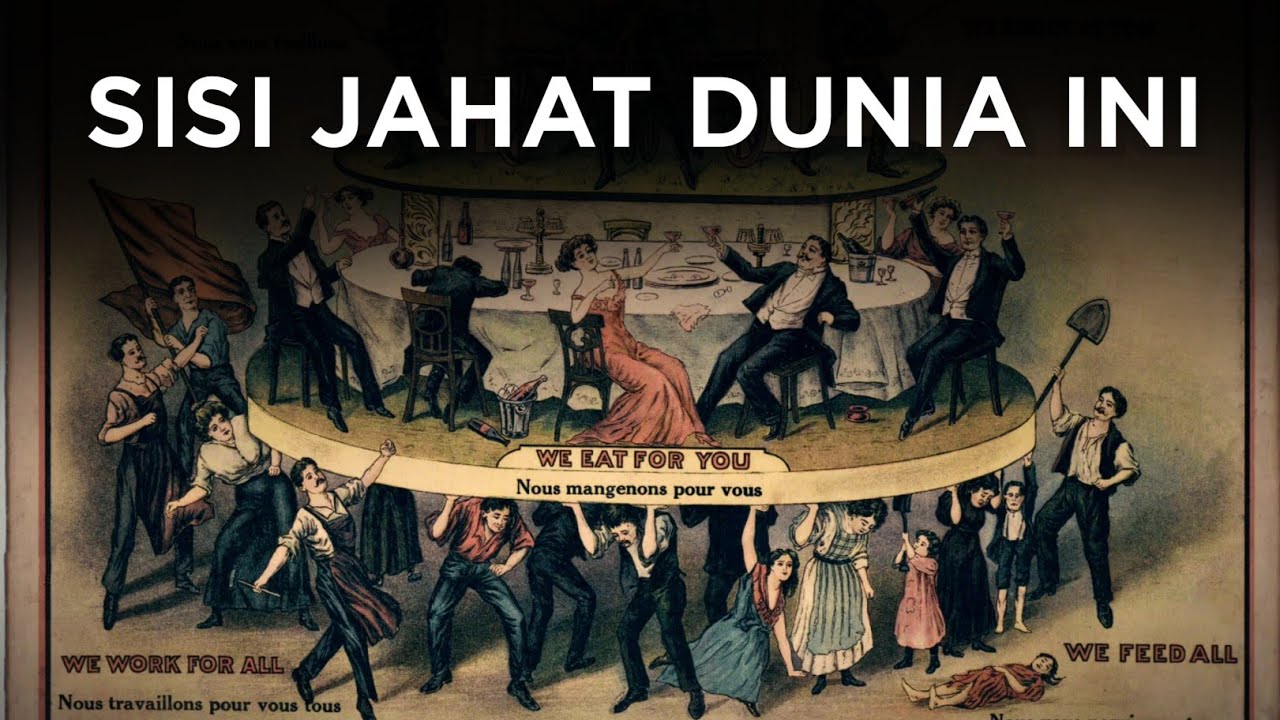

"Lifestyle Inflation" Isn't A Real Thing.

Summary

TLDRIn this video, the creator challenges the concept of lifestyle inflation, questioning whether it's truly a subconscious issue or just poor spending habits. They reflect on their personal journey of gradually increasing income and deliberate spending choices that align with their values. The creator emphasizes the importance of intentional spending, such as investing in quality items, repairing broken things, and enhancing life experiences. They argue that as long as you're responsible, using additional income to improve your life isn't inherently bad—it's simply a matter of aligning your financial choices with your goals and values.

Takeaways

- 😀 Lifestyle inflation is often seen as the result of higher income leading to increased spending, but it may also be a result of poor financial choices or irresponsible spending.

- 😀 The speaker challenges the concept of lifestyle inflation, suggesting that it can be an excuse for not taking responsibility for financial decisions.

- 😀 Making intentional lifestyle upgrades, like investing in things that improve your well-being, can be a valid way to spend increased income.

- 😀 The purpose of money is to better your life. Once basic needs are met, money becomes a tool for improving quality of life and aligning with personal goals.

- 😀 Avoiding lifestyle inflation doesn’t mean completely avoiding spending; rather, it’s about making deliberate choices that align with one’s values.

- 😀 Lifestyle upgrades, like fixing long-term issues or investing in high-quality products, can contribute to a more fulfilling life without jeopardizing financial health.

- 😀 Instead of accumulating debt or overspending on wants, the speaker emphasizes the importance of making choices that align with long-term financial goals.

- 😀 Experiences, such as saying yes to social events or being generous with friends, can enrich life without the negative impacts of reckless spending.

- 😀 It's important to differentiate between 'good enough' and 'good' when it comes to purchases, particularly in terms of quality and durability, to avoid wasting money in the long run.

- 😀 Spending money on convenience or outsourcing tasks, like grocery shopping or household maintenance, can buy back time and improve life satisfaction.

- 😀 Ultimately, lifestyle inflation is not about the money you make or spend, but the choices you make in spending it responsibly and intentionally.

Q & A

What is the concept of lifestyle inflation, and why is it often discussed in personal finance?

-Lifestyle inflation refers to the phenomenon where an individual increases their spending as their income grows, often without realizing it. This can lead to a situation where the increased income does not actually improve financial stability because the additional money is spent on upgrades or non-essential items. It is commonly discussed in personal finance as a cautionary principle, advising people to avoid increasing their expenses when they earn more money.

Does the script suggest that lifestyle inflation is always bad?

-No, the script argues that lifestyle inflation isn't inherently bad. The key point is that if the spending increase aligns with one's values and goals, and is affordable, it can be a positive thing. The issue arises when individuals use increased income irresponsibly, without considering their long-term financial well-being.

What is the difference between lifestyle inflation and irresponsible spending according to the script?

-The script suggests that lifestyle inflation is often used as a label for irresponsible spending, but in reality, it is more about personal choices. Irresponsible spending occurs when people use their increased income to indulge in unnecessary items, like a nicer car or frequent dining out, while neglecting to address financial responsibilities like debt repayment or building savings.

How does the speaker personally handle the idea of lifestyle inflation?

-The speaker admits that they don't actively avoid lifestyle inflation but instead stay in tune with their values. As their income increased, they intentionally allocated more money to improve their life in ways that align with their goals, such as upgrading essential items and addressing long-standing annoyances, rather than engaging in mindless consumption.

What example does the speaker provide to explain how they intentionally inflated their lifestyle?

-The speaker shares the example of getting Invisalign to fix their teeth, a long-standing issue that bothered them. While the procedure was expensive, they felt it was worth the investment as it addressed a personal concern that had been on their mind for years. This was an intentional way to improve their lifestyle.

How does the speaker justify upgrading to higher quality items?

-The speaker follows the principle of 'buy once, cry once,' meaning they now invest in higher quality items that will last longer and avoid wasting money on cheaper alternatives that need to be replaced frequently. They provide examples like purchasing better furniture and a new mattress, which have made a significant positive impact on their life.

Why does the speaker emphasize replacing and repairing things in their life?

-The speaker highlights the importance of replacing and repairing things that are worn out or broken. Growing up with limited resources, they had a habit of settling for 'good enough,' but as their financial situation improved, they chose to replace or repair items that no longer served them well, such as old towels, clothing, and even a damaged screen door.

What role does saying 'yes' more often play in the speaker's approach to lifestyle inflation?

-Saying 'yes' more often is part of the speaker's mindset to live more fully and enjoy experiences without overly restricting their spending. This could include attending events, going out to dinner, or other social activities where they don't impose strict spending limits, allowing themselves to fully enjoy the moment.

How does the speaker's approach to convenience fit into their lifestyle inflation?

-The speaker chooses to spend money on convenience when it improves their quality of life. They mention spending a little more at grocery stores to save time, outsourcing tasks like snow shoveling, and avoiding the hassle of doing everything on the cheap when it's not worth the time or effort. This decision allows them to focus on other priorities.

What does the speaker say about spending money on others and generosity?

-The speaker values generosity and treats friends to small things like coffee or drinks when they can afford it, without worrying about splitting the bill. They also mention that if a social activity is outside a friend's budget, they might offer to treat them so they can still participate. This highlights the speaker's focus on equitable and reciprocal relationships.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)