Standar Akuntansi Keuangan di Indonesia | SAK IFRS | SAK ETAP | SAK EMKM

Summary

TLDRThe video discusses the five main accounting standards in Indonesia, including PSAK (IFRS-based), PSAK for entities without significant public accountability (KFAP), and others like the Syariah accounting standard and government accounting standards. It highlights the differences between these standards, such as the simpler KFAP for small and medium enterprises, and the adoption of IFRS standards by larger entities. The speaker also outlines the revisions and amendments to PSAK, providing examples like PSAK 66 and PSAK 1. The presentation concludes with an overview of the regulations governing micro, small, and medium enterprises (MKM) and the simplifications in accounting standards applicable to them.

Takeaways

- 😀 PSAK-IFRS is applied to entities with significant public accountability, including listed companies and financial institutions.

- 😀 KFAP (Simplified Accounting Standards for Small Entities) is designed for smaller businesses that do not have significant public accountability, providing simpler financial reporting.

- 😀 Syariah Accounting Standards (S.AK Syariah) are specifically for entities operating under Islamic finance principles.

- 😀 PSAK is revised periodically to adapt to changes in financial reporting needs, with updates like PSAK 108 related to syariah accounting.

- 😀 Amended PSAKs involve minor changes that do not significantly alter the original standards, while revised PSAKs involve substantial changes.

- 😀 KFAP standards provide a more accessible framework for small businesses, allowing them to generate financial reports that are easier to audit.

- 😀 New standards for private entities are being developed to replace the etap model, offering a simpler yet more comprehensive accounting framework.

- 😀 Exposure drafts are issued before the final release of new or revised PSAK standards, allowing public input on potential changes.

- 😀 Different accounting treatments for assets, liabilities, and income are applied based on the type of PSAK standard used, with IFRS standards favoring fair value accounting over historical cost models.

- 😀 Small and medium enterprises (SMEs) can use simplified accounting frameworks like KFAP, with clear criteria based on assets and turnover as defined in Indonesian law (Undang-Undang No. 20/2008).

Q & A

What are the five accounting standards applicable in Indonesia?

-The five accounting standards in Indonesia are: PSAK (IFRS-based), KFAK (for entities without public accountability), SAK for Micro, Small, and Medium Enterprises (MKM), SAK Syariah (Islamic accounting standard), and Government Accounting Standards (PSAP) based on Government Regulation No. 71 of 2010.

Which entities are required to use PSAK-IFRS in Indonesia?

-Entities that have significant public accountability, such as companies listed on the Indonesian Stock Exchange (IDX), and those managing assets as a fiduciary for the public, such as banks, insurance companies, pension funds, and investment banks, are required to use PSAK-IFRS.

What is the difference between PSAK-IFRS and KFAK?

-PSAK-IFRS is a full accounting standard for entities with significant public accountability, while KFAK is a simplified version for entities without such accountability. KFAK is designed to be more accessible for smaller entities, offering less complex reporting and fewer disclosure requirements.

What are the key components of financial reporting under PSAK?

-Key components under PSAK include the presentation of financial statements, the recognition and measurement of transactions, financial statement components like property investments and inventories, and specific standards such as PSAK 73 related to leases.

What is the distinction between a new PSAK and a PSAK revision?

-A new PSAK is a completely new standard introduced, such as PSAK 66 and PSAK 12, which significantly change the previous regulations. A PSAK revision, on the other hand, is an update to existing standards, making significant changes to measurements, presentations, or disclosures (e.g., PSAK 24).

What is the purpose of the simplified KFAK standard?

-The KFAK standard aims to provide a simpler accounting framework for small and medium-sized entities (SMEs), enabling them to prepare financial statements that are auditable and provide reliable financial information without the complexity of full IFRS standards.

How does PSAK-IFRS differ from KFAK in terms of income reporting?

-Under PSAK-IFRS, there is a detailed income reporting system that includes comprehensive income, whereas in KFAK, the income statement is simpler, only reflecting profit and loss with fewer categories, such as the absence of comprehensive income items.

What does PSAK 73 pertain to?

-PSAK 73 addresses lease accounting, providing guidelines on how leases should be recognized, measured, and presented in the financial statements. This standard affects both lessees and lessors.

What is the role of the Dewan Standar Akuntansi Keuangan (DSAK) in Indonesia?

-DSAK is responsible for developing and issuing the accounting standards in Indonesia, including PSAK, SAK Syariah, and other related standards. They also issue technical bulletins and interpretive standards, as well as frameworks like the conceptual framework for financial reporting.

What are the criteria for classifying a business as micro, small, or medium in Indonesia?

-According to Indonesian law, a micro enterprise has net assets of up to 50 million IDR (excluding land and buildings) and annual sales of up to 300 million IDR. Small enterprises have sales between 300 million and 2.5 billion IDR, while medium enterprises have net assets ranging from 500 million to 10 billion IDR and annual sales between 2.5 billion and 50 billion IDR.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

MEMAHAMI 4 STANDAR AKUNTANSI KEUANGAN YANG BERLAKU DI INDONESIA | LAPORAN KEUANGAN | DCONSULTING

Standar Akuntansi Keuangan di Indonesia

PENGANTAR AKUNTANSI 1, PERTEMUAN KE 2: PENGANTAR AKUNTANSI DAN BISNIS (BAGIAN 2)

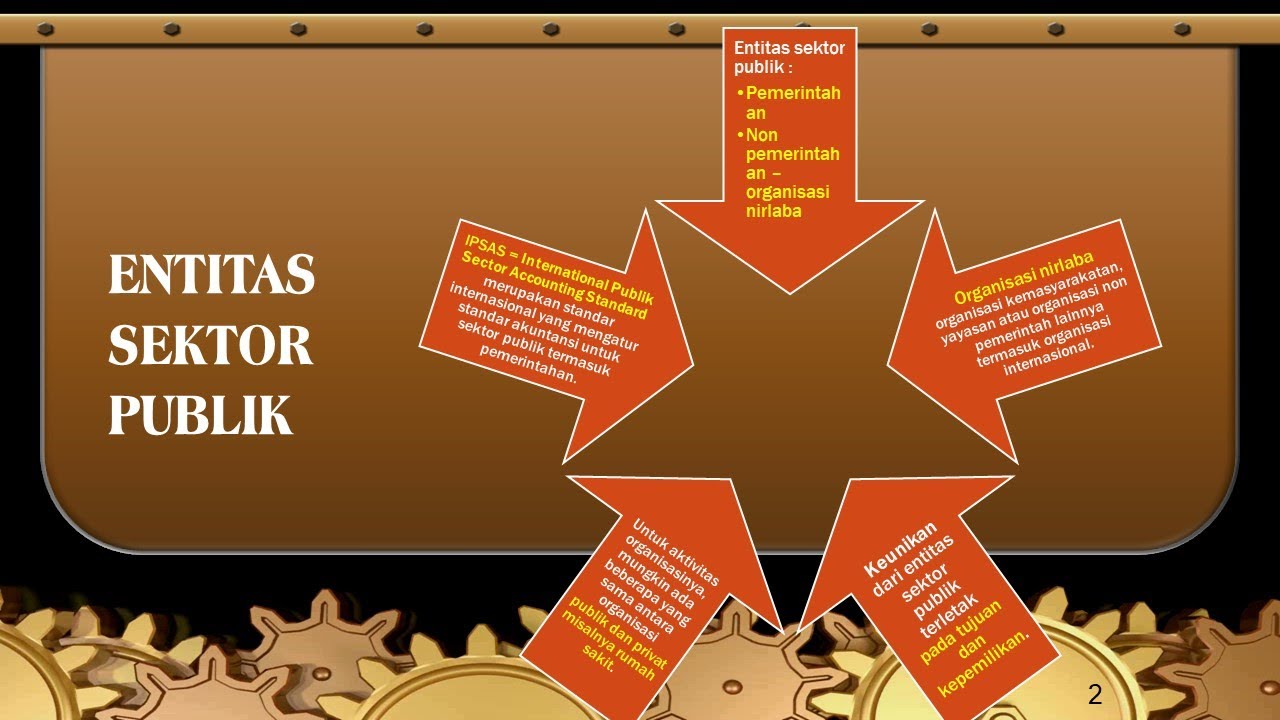

PENGANTAR AKUNTANSI SEKTOR PUBLIK

Pemenang Lomba Video Akuntansi APA Fest 2021 - Sejarah Akuntansi Dunia dan Indonesia

TUGAS AKUNTANSI SEKTOR PUBLIK-KELOMPOK 2

5.0 / 5 (0 votes)