TUGAS AKUNTANSI SEKTOR PUBLIK-KELOMPOK 2

Summary

TLDRThis presentation from Group 2 focuses on Public Sector Accounting and the application of PSAK 45. It covers the importance of public sector accounting in ensuring transparency, accountability, and effective management of public resources. PSAK 45, released by the Indonesian Institute of Accountants, provides a framework for non-profit entities to present financial reports. The benefits of applying PSAK 45 include improved financial transparency, accountability, and trust, while helping organizations comply with regulations and improve financial analysis. The presentation concludes with a sincere apology for any errors and gratitude to the audience.

Takeaways

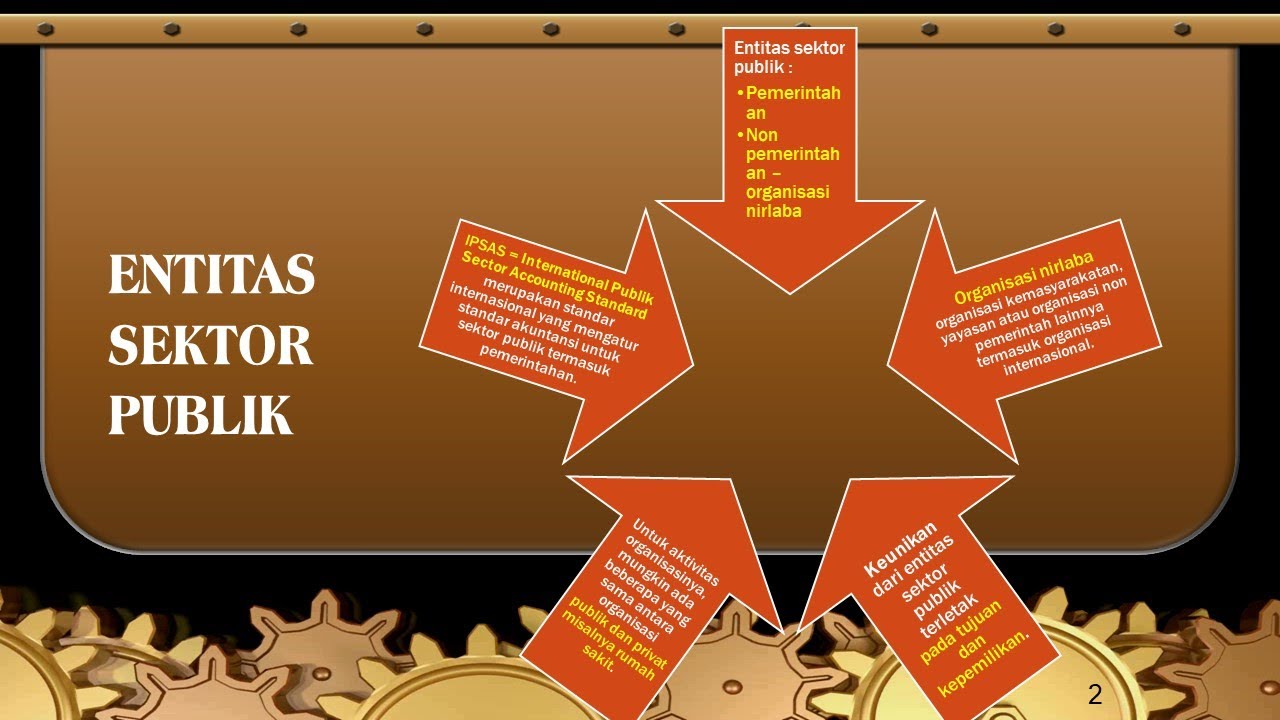

- 😀 Public sector accounting involves the recording, classification, and reporting of financial transactions by public entities to ensure transparency and accountability.

- 😀 PSAK 45 is a standard governing the financial reporting of non-profit entities, released by the Indonesian Institute of Accountants to guide relevant and reliable financial statement presentation.

- 😀 The main goals of PSAK 45 are to enhance transparency and accountability, provide useful information for decision-making, and facilitate comparisons between non-profit entities.

- 😀 The relationship between public sector accounting and PSAK 45 is closely tied, as PSAK 45 provides the framework for financial reporting for non-profit entities.

- 😀 PSAK 45 requires non-profit entities in the public sector to ensure their financial statements reflect their true financial position and provide clear information about managed resources.

- 😀 The implementation of PSAK 45 can improve financial transparency in public sector organizations by providing guidelines on presenting clear and active financial statements.

- 😀 PSAK 45 helps to increase accountability in public sector organizations by offering guidelines for presenting responsible financial reports.

- 😀 By following PSAK 45, public sector organizations can improve the quality of their financial reports by adhering to generally accepted accounting principles.

- 😀 The application of PSAK 45 increases trust in financial reports by making them transparent and accountable, enhancing stakeholder confidence.

- 😀 PSAK 45 helps public sector organizations increase efficiency and effectiveness in financial management by offering guidance on managing finances according to applicable accounting principles.

- 😀 The standard also supports public sector organizations in improving their financial analysis capabilities, ensuring compliance with regulations, and providing guidance on accurate financial reporting.

Q & A

What is the primary purpose of public sector accounting?

-The primary purpose of public sector accounting is to ensure transparency and accountability in managing public resources by recording, classifying, and reporting financial transactions.

What is PSAK 45, and why is it important in public sector accounting?

-PSAK 45 is a financial reporting standard issued by the Indonesian Institute of Accountants that governs the financial statements of non-profit entities. It is important as it provides guidelines for presenting reliable and relevant financial information.

What are the three main objectives of PSAK 45?

-The three main objectives of PSAK 45 are: 1) Improving transparency and accountability, 2) Providing useful information for decision-making, and 3) Facilitating comparisons among non-profit entities.

How does PSAK 45 impact public sector entities?

-PSAK 45 helps public sector entities by ensuring their financial reports reflect the actual financial condition and provide clear information about the resources they manage.

What are the key benefits of implementing PSAK 45 in public sector accounting?

-The key benefits of implementing PSAK 45 include: 1) Increased transparency, 2) Enhanced accountability, 3) Improved financial quality, 4) Increased trust from stakeholders, 5) Improved efficiency in financial management, 6) Better financial analysis capabilities, and 7) Improved compliance with regulations.

What is the relationship between public sector accounting and PSAK 45?

-The relationship between public sector accounting and PSAK 45 is very close, as PSAK 45 provides a framework for non-profit entities in preparing financial statements, including the statement of financial position, activities report, cash flow statement, and notes to the financial statements.

What types of financial statements are included under PSAK 45?

-Under PSAK 45, the required financial statements include: 1) Statement of financial position, 2) Statement of activities, 3) Cash flow statement, and 4) Notes to the financial statements.

How does PSAK 45 improve transparency in public sector financial reporting?

-PSAK 45 improves transparency by providing clear guidelines on how to present financial information, making it easier for stakeholders to understand the financial status and resource management of public sector organizations.

How does PSAK 45 contribute to enhancing accountability in public sector organizations?

-PSAK 45 enhances accountability by setting standards for presenting financial reports in a way that can be audited and verified, ensuring that public sector organizations are responsible for their financial management.

Why is stakeholder trust important in the context of PSAK 45 implementation?

-Stakeholder trust is important because transparent and accountable financial reporting, as promoted by PSAK 45, helps build confidence in the public sector organization’s ability to manage resources effectively and ethically.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)