Document Summary Table 13 of GSTR 1 is mandatory to report from May 2025

Summary

TLDRThis video provides a detailed guide on managing GST reporting for online sales through platforms like Meesho, Flipkart, and Amazon. It covers the process of calculating the total number of invoices issued, handling cancellations, and understanding the correct GST reporting structure. The speaker explains how to adjust for sales returns, credit notes, and cancellations across different platforms, ensuring compliance with the GST portal’s requirements. Key steps include filtering invoice data, calculating net issued invoices, and ensuring accurate reporting, making the process more efficient for online sellers.

Takeaways

- 😀 Correctly calculate the total number of invoices by including both 'From' and 'To' invoices and adding +1 to account for both.

- 😀 For cancellations in Meesho, use the 'Sales Return' document and report the total number of cancellations to adjust the 'Net Issued' invoices.

- 😀 Meesho cancellation handling follows the same reporting structure as the GST portal, meaning cancellations are included under the same document count in GSTR-1.

- 😀 Flipkart provides both sales and GST reports, making it easier to copy the data into your system for further analysis and reporting.

- 😀 In Flipkart's GST report, simply copy the 'From', 'To', and 'Net Issued' invoice details for easy tracking of issued invoices.

- 😀 Amazon separates its B2B and B2C reports, with specific focus on B2C reports for cancellations and refunds.

- 😀 For Amazon, sort invoice numbers alphabetically, then calculate the total by subtracting cancellations from the total issued invoices.

- 😀 Be mindful that Amazon might not generate invoices if the order is canceled immediately, which should be excluded from the total count of cancellations.

- 😀 When working with GST reporting, always align with the GSTR-1 format, ensuring correct reporting of both B2B and B2C transactions, and credit notes.

- 😀 Ensure accurate cancellation tracking by filtering cancellations and adjusting the 'Net Issued' invoices accordingly in the reporting system.

Q & A

Why do we need to add +1 when calculating the total number of invoices?

-You add +1 to include both the starting and ending invoice numbers. This ensures that both invoices are counted within the range, providing an accurate total.

How do you handle cancelled invoices in Meesho?

-In Meesho, cancellations are reported under 'Sales Return.' You don't need any formula for this; just ensure that you note the total number of cancelled invoices and calculate the net invoices accordingly.

What is the reporting structure for GST in B2C transactions on the GST portal?

-In B2C transactions, credit notes for small businesses (also called 'Others') are adjusted in Table 7 of the GST portal. There is no need for separate reporting for these credit notes.

What is the difference between B2B and B2C reporting in GST?

-B2B invoices require separate reporting for credit notes, while B2C invoices (large and small) adjust credit notes directly in Table 7 of the GST report, with no separate reporting needed.

How do you handle Flipkart’s GST invoice data?

-Flipkart provides a GST report with all the necessary details like from/to invoice numbers, total invoices, cancellations, and net issued invoices. You simply need to copy the data from this report into your GST sheet.

What should you do when dealing with Amazon B2C invoice data?

-For Amazon B2C data, first filter the invoice numbers in ascending order. Then, filter out any shipped transactions. After identifying the cancelled invoices, subtract them from the total to calculate the net invoices issued.

What is the issue with some invoices not being generated in Amazon?

-Amazon may not generate invoices if the customer cancels the order immediately. These invoices aren't considered as they weren't generated, and hence aren't counted in the reporting.

Why should you be cautious when handling online sales data in GST reporting?

-Online sales may involve discrepancies due to mismatches in generated invoices, especially when orders are canceled or not processed correctly. It is crucial to double-check the data to ensure accuracy in reporting.

What is the advantage of using Flipkart's GST report?

-Flipkart's GST report is very useful because it provides a detailed breakdown of invoice data, including cancellations and net issued invoices, making the process of transferring data to the GST portal easier and more accurate.

What is the final advice for handling cancellations and invoice data across platforms?

-Ensure to cross-check all invoice data, especially cancellations. Follow the structured reporting format aligned with GST guidelines, and pay close attention to the specific adjustments required for B2C small transactions (Table 7), to avoid any reporting errors.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Best Phones From 5K To 25K 🔥 Flipkart Big Billion Days & Amazon Great Indian Sale

Explanation on how to fill Zomato/ swiggy/ ola/ booking.com/ urbanclap sale in GSTR 1 and GSTR 3B

CARA AKTIFKAN INSTAGRAM SHOP & FACEBOOK SHOP 2024 TERBARU ‼️

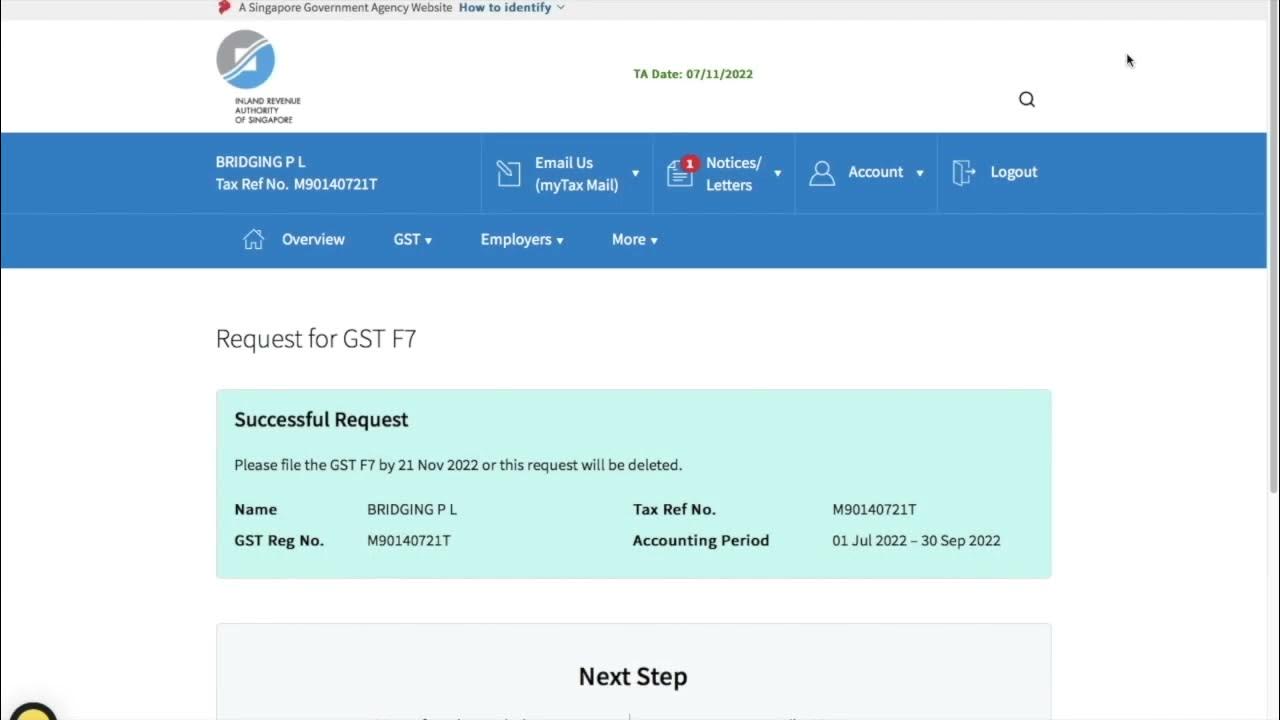

Filing of GST Return (Video Guide)

Ideality of Affiliate Marketing

Selling Beats Online: What I Did To Make $840,000

5.0 / 5 (0 votes)