Enterprise Risk Management | Thomas H. Stanton | TEDxJHUDC

Summary

TLDRThis speech addresses the importance of Enterprise Risk Management (ERM) in navigating complex organizational environments. It highlights how poor information flow and failure to recognize major risks can lead to disasters, citing examples like the BP oil spill and the GM ignition switch issue. The speaker emphasizes the need for top-down support in ERM to foster a culture that identifies and mitigates significant risks early, allowing organizations to operate effectively and avoid crises. The analogy of a car with brakes to illustrate the necessity of risk management in enabling progress is a key takeaway.

Takeaways

- 🌐 Complex world leads to unforeseen risks that can severely impact organizations.

- 🛑 Examples of risk surprises include the BP Gulf oil spill, GM ignition switch issue, and Takata airbags, which resulted in CEO firings and business failures.

- 🏥 Government organizations like the Veterans Administration and IRS also face risk management challenges, leading to dismissals and policy changes.

- 🔮 The common issue is a disconnect between top management's perception of success and the actual problems faced at lower levels of the organization.

- 🗣️ Effective communication of information from all levels is crucial for a company's success, as demonstrated by JP Morgan Chase and Goldman Sachs during the financial crisis.

- 🚫 Enterprise Risk Management (ERM) is essential to identify and address major risks that could hinder an organization's mission.

- 📋 ERM involves asking what the significant risks are and focusing on them rather than getting lost in minor details.

- 🔑 Support from top management is vital for the success of ERM, as it helps to foster a culture of open communication about risks.

- 🤝 Overcoming the 'no risks' mentality and encouraging departments to share their vulnerabilities is key to proactive risk management.

- 🛑 Early identification and addressing of risks can prevent small issues from escalating into major problems.

- 🚗 The purpose of ERM is not to create bureaucracy but to facilitate discussions on priorities and manage risks effectively for better organizational performance.

Q & A

What is the primary concern discussed in the script?

-The primary concern is the complexity of modern organizations and how emerging risks can lead to significant disasters if not properly managed.

Can you give examples of major disasters mentioned that were caused by organizational complexities?

-Examples include the BP Gulf oil spill, the GM ignition switch problem, and the Takata airbags issue.

What is a common response to these disasters in both private and public sectors?

-A common response is firing top executives and other personnel, and sometimes making legislative changes to address the issues.

What issue was highlighted within the Veterans Administration (VA) hospitals?

-The issue highlighted was long wait times for veterans, which were hidden due to pressure from the head of the VA to report that all were being dealt with within two weeks.

How does the script describe the flow of information in successful companies during the financial crisis?

-In successful companies, there was a strong flow of information from the bottom to the top and across silos, allowing them to respond quickly to emerging risks.

What role does Enterprise Risk Management (ERM) play according to the script?

-ERM helps organizations identify and manage major risks that could prevent them from achieving their mission, emphasizing the importance of addressing significant risks early.

How did JP Morgan Chase and Goldman Sachs handle the mortgage crisis differently from other companies?

-JP Morgan Chase and Goldman Sachs quickly identified and responded to delinquencies in their mortgage portfolios, taking preemptive actions like hedging their subprime portfolios.

What is the key lesson about information flow in organizations as mentioned in the script?

-The key lesson is that successful companies have a free flow of information from bottom to top and top to bottom, which helps in making informed decisions.

What example was given to illustrate the importance of good information flow?

-The example given was Goldman Sachs, where the head of the mortgage desk ensured that the top executives were informed about the losses, leading to timely risk mitigation actions.

What is the main objective of Enterprise Risk Management as described?

-The main objective of ERM is to help organizations identify and address major risks early, facilitating informed decision-making without creating additional bureaucracy.

What metaphor does John Reed use to describe the purpose of risk management?

-John Reed uses the metaphor of car brakes, stating that brakes are necessary so a car can go fast. Similarly, risk management helps an organization move forward confidently by understanding and addressing risks.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

SI GRC VHD M08 141021 V01 UP

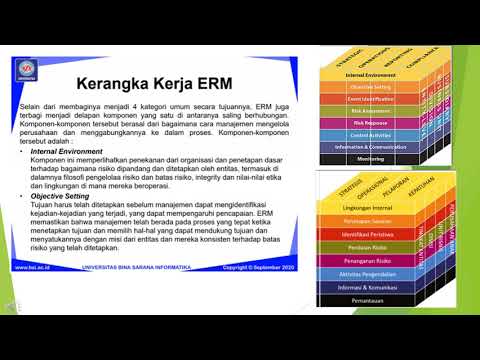

KERANGKA KERJA ENTERPRISE RISK MANAGEMENT ERM

67. Is Enterprise Risk Management (ERM) overrated? | A critical look at ERM methodologies

Apa itu Enterprise Risk Management?

A Content Level Comparison of COSO ERM and ISO 31000

Enterprise Risk Management (ERM) | What is Enterprise Risk Management Process / Strategies

5.0 / 5 (0 votes)