Enterprise Risk Management (ERM) | What is Enterprise Risk Management Process / Strategies

Summary

TLDRIn this video, Knowledge Topper delves into the concept of Enterprise Risk Management (ERM), explaining its importance in identifying and mitigating risks faced by businesses. The video covers different types of risks, such as hazard, financial, strategic, and operational risks, providing examples to illustrate each one. It also discusses various risk response strategies like avoidance, reduction, and sharing. The ERM process, including risk identification, assessment, response, and communication, is outlined, emphasizing the need for continuous monitoring. The video aims to enhance understanding of how enterprises can secure financial stability by effectively managing risks.

Takeaways

- 😀 Enterprise Risk Management (ERM) helps businesses identify and mitigate risks that could impact their goals or operations.

- 😀 Different enterprises are exposed to various types of risks depending on their business nature, such as financial, operational, strategic, and hazard risks.

- 😀 Hazard risks involve threats to human life, health, or property, like fires due to electrical short circuits.

- 😀 Financial risks relate to money and may involve fluctuations in exchange rates, affecting enterprises dealing internationally, as shown by the example of a Pakistani enterprise facing exchange rate risk.

- 😀 Strategic risks arise from business decisions, such as expanding into new markets without fully assessing potential risks, as demonstrated by a US enterprise's expansion into China.

- 😀 Operational risks are associated with the failure of internal processes, systems, or employees, leading to potential losses.

- 😀 ERM includes five risk response strategies: risk avoidance, risk reduction, alternative actions, risk sharing (insurance), and risk acceptance.

- 😀 Risk avoidance involves eliminating risky activities that could harm the business, like discontinuing production of a product with declining demand.

- 😀 Risk reduction focuses on minimizing the impact of potential losses, such as through frequent monitoring of manufacturing processes to avoid defects.

- 😀 Risk acceptance acknowledges that some risks are unavoidable, like natural disasters, and the business must accept potential losses.

- 😀 The ERM process includes strategy setting, risk identification, risk assessment, risk response, and continuous communication and monitoring to manage risks effectively.

Q & A

What is enterprise risk management (ERM)?

-Enterprise risk management (ERM) refers to the processes and strategies used by organizations to identify, assess, and mitigate risks that could threaten the achievement of their objectives, ensuring long-term financial stability.

Why is understanding the nature of a business important in enterprise risk management?

-Understanding the nature of a business is crucial in ERM because each enterprise operates in a different environment, with unique activities and strategies. This determines the specific risks they face, allowing for tailored risk management strategies.

What are the four main types of risk that enterprises typically face?

-The four main types of risk that enterprises typically face are hazard risk (e.g., fire or health-related incidents), financial risk (e.g., fluctuations in cost or revenue), strategic risk (e.g., poor business decisions), and operational risk (e.g., failure in internal processes or systems).

Can you explain the concept of 'exchange rate risk' with an example?

-Exchange rate risk occurs when fluctuations in currency value impact the financial outcome of international transactions. For example, a Pakistani enterprise orders raw materials from the USA, and the exchange rate between the Pakistani Rupee (PKR) and US Dollar (USD) fluctuates between the order date and payment date, causing the enterprise to incur additional costs.

How can enterprises manage exchange rate risk?

-Enterprises can manage exchange rate risk by using financial instruments like forward and futures contracts, which allow them to lock in currency values at the time of the order, thus avoiding the impact of fluctuations in exchange rates.

What are strategic risks, and can you provide an example?

-Strategic risks are risks that arise from business decisions that affect the long-term goals of an enterprise. For instance, a US-based company may decide to expand operations in China, but political tensions between the two countries might force the company to shut down operations there, leading to a loss.

What does operational risk entail?

-Operational risk involves losses resulting from failures or inefficiencies in internal processes, systems, employees, or policies. This can include issues like fraud, system failures, or employee errors, which can negatively impact an organization's performance.

What is risk avoidance, and can you give an example?

-Risk avoidance is a strategy where an enterprise eliminates activities that expose it to significant risk. For example, if a company sees a decline in demand for a product, it may decide to stop producing that product entirely to avoid future losses.

What are the five main risk response strategies?

-The five main risk response strategies are risk avoidance (eliminating the risk), risk reduction (mitigating the impact of the risk), alternative actions (finding alternative ways to reduce the risk), sharing or insuring the risk (transferring the risk to a third party), and risk acceptance (acknowledging the risk and accepting its potential consequences).

What is the most critical step in the enterprise risk management process?

-The most critical step in the enterprise risk management process is communication and monitoring. This involves gathering relevant data and information, continuously monitoring risks, and ensuring that the risk management process is communicated across all departments for timely response.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

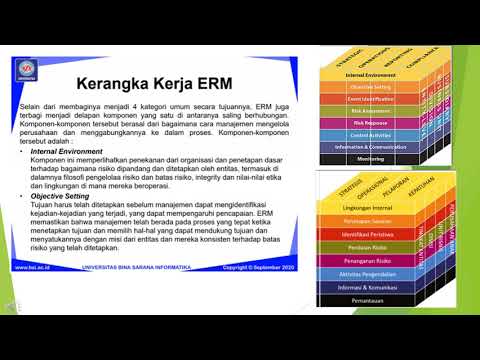

KERANGKA KERJA ENTERPRISE RISK MANAGEMENT ERM

SI GRC VHD M08 141021 V01 UP

Apa itu Enterprise Risk Management?

CH05. L06. Project and product risk

67. Is Enterprise Risk Management (ERM) overrated? | A critical look at ERM methodologies

Risk Management | Process of Risk management | How to manage Risk in Business

5.0 / 5 (0 votes)