Apa itu Enterprise Risk Management?

Summary

TLDRThis video explains the concept of Enterprise Risk Management (ERM) and its significance in business strategy. It highlights the importance of a comprehensive risk management framework, including internal environment, objective setting, event identification, and control activities. The video discusses challenges in ERM implementation, such as lack of interest from senior management and inadequate resources, and suggests solutions like professional development and gaining executive support. It also emphasizes the role of internal audits in ensuring effective risk management processes and evaluates strategies for integrating risk management into an organization’s culture and operations.

Takeaways

- 😀 ERM (Enterprise Risk Management) is a comprehensive framework for managing risks across an organization to help achieve business objectives.

- 😀 ERM has gained significant importance over time as a critical part of business strategy, enabling organizations to tackle risks holistically.

- 😀 ERM involves creating practical guidelines to apply a strong risk management framework that addresses risks across businesses of all sizes.

- 😀 According to ERM principles, risk management is the ability to identify and manage all business risks in pursuit of objectives.

- 😀 Effective ERM involves adopting strategies that help management address risks while ensuring the organization’s overall strategy and risk coverage are in place.

- 😀 ERM can only succeed if there is a strong organizational culture and leadership at the top levels, with risk management being part of the company culture.

- 😀 ERM's objectives can be broadly categorized into four main areas: strategy, operations, reporting, and compliance.

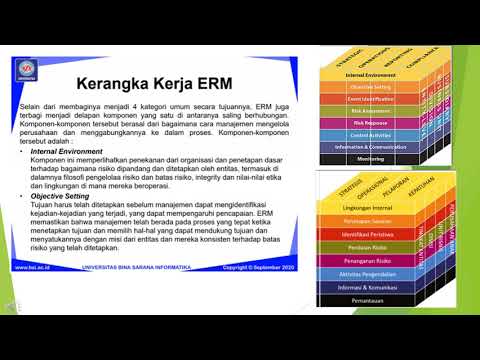

- 😀 The ERM framework consists of eight interconnected components: internal environment, objective setting, event identification, risk assessment, risk responses, control activities, information & communication, and monitoring.

- 😀 A key part of implementing ERM is preparing both soft and hard infrastructures to support risk management processes within an organization.

- 😀 Companies face several challenges when implementing ERM, such as lack of interest from senior management, insufficient resources, ineffective risk measurement, and high costs, but solutions include professional development and engaging senior leadership through quick wins.

Q & A

What is the concept of Enterprise Risk Management (ERM) as mentioned in the script?

-Enterprise Risk Management (ERM) is defined as the ability of management to handle all business risks in order to achieve or meet organizational goals. It is a comprehensive framework that assists organizations in managing risks holistically, integrating it into their overall business strategy.

How does ERM contribute to an organization's strategic planning?

-ERM provides a structured approach to identifying, assessing, and managing risks, which supports the strategic planning process by ensuring that risks are effectively mitigated in alignment with the organization's goals and objectives.

What are the four major categories of objectives outlined in the ERM framework?

-The four major categories of objectives are: Strategy, Operations, Reporting, and Compliance. These categories guide organizations in setting and achieving their goals while ensuring that risk is managed across different dimensions of the business.

What are the eight components of the ERM framework?

-The eight components are: 1) Internal Environment, 2) Objective Setting, 3) Event Identification, 4) Risk Assessment, 5) Risk Response, 6) Control Activities, 7) Information and Communication, and 8) Monitoring. These components work together to provide a holistic approach to risk management.

Why is company culture important in implementing ERM?

-A strong company culture is crucial because it fosters a risk-aware mindset among employees and leadership. Without the right culture and strong leadership, the ERM framework cannot be effectively implemented, and risk management efforts may fail.

What are some of the main challenges faced by companies in implementing ERM?

-The main challenges include a lack of interest from senior management, failure to achieve quick wins, insufficient skilled personnel, ineffective and inconsistent risk reporting, and cost constraints. These factors can hinder the successful adoption of ERM systems within organizations.

How can these challenges be addressed to improve ERM implementation?

-To overcome these challenges, companies can focus on building a professional and adequately staffed team, ensuring proper training, securing executive support by demonstrating quick wins, and maintaining motivation among teams throughout the long-term implementation process.

What role does internal audit play in the ERM process?

-Internal audit plays a key role in ERM by providing assurance on the effectiveness of the risk management process. This includes evaluating the design and effectiveness of risk management processes, ensuring that risks are properly assessed, and reviewing risk reporting and controls.

How can internal audit support the development of ERM strategies within an organization?

-Internal audit can support ERM by consulting on the formation of risk management strategies, assisting in their development and implementation, and ensuring that the board of directors approves and commits to the strategies. This helps create a solid foundation for long-term risk management.

What is the importance of risk response in the ERM framework?

-Risk response is crucial because it determines how an organization will address and mitigate identified risks. Effective risk response strategies help ensure that risks are managed in a way that aligns with organizational goals and minimizes potential negative impacts.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

SI GRC VHD M08 141021 V01 UP

67. Is Enterprise Risk Management (ERM) overrated? | A critical look at ERM methodologies

KERANGKA KERJA ENTERPRISE RISK MANAGEMENT ERM

Enterprise Risk Management (ERM) | What is Enterprise Risk Management Process / Strategies

A Content Level Comparison of COSO ERM and ISO 31000

CORPORATE RISK MANAGEMENT

5.0 / 5 (0 votes)