Sistem Informasi Akuntansi_Romney_Pengendalian&Sistem Informasi Akuntansi.

Summary

TLDRThis video lecture on Accounting Information Systems by Catur Sasongko focuses on the critical importance of internal control in business. It explores concepts like risk management, preventive and detective controls, and the role of governance in safeguarding assets. The speaker delves into various control frameworks, including COSO and COBIT, and their practical applications within organizations. Key topics include identifying and assessing risks, ensuring compliance, and using technology to improve operational efficiency. The session highlights the need for proactive, responsive, and corrective measures to protect businesses from threats and enhance decision-making processes.

Takeaways

- 😀 Understanding internal control is crucial for protecting a company's assets and ensuring the reliability of financial reporting.

- 😀 Effective internal control prevents fraud, secures assets, and ensures compliance with laws and regulations.

- 😀 Control frameworks such as COBIT, COSO, and ERM help businesses manage risk and align their internal control structures.

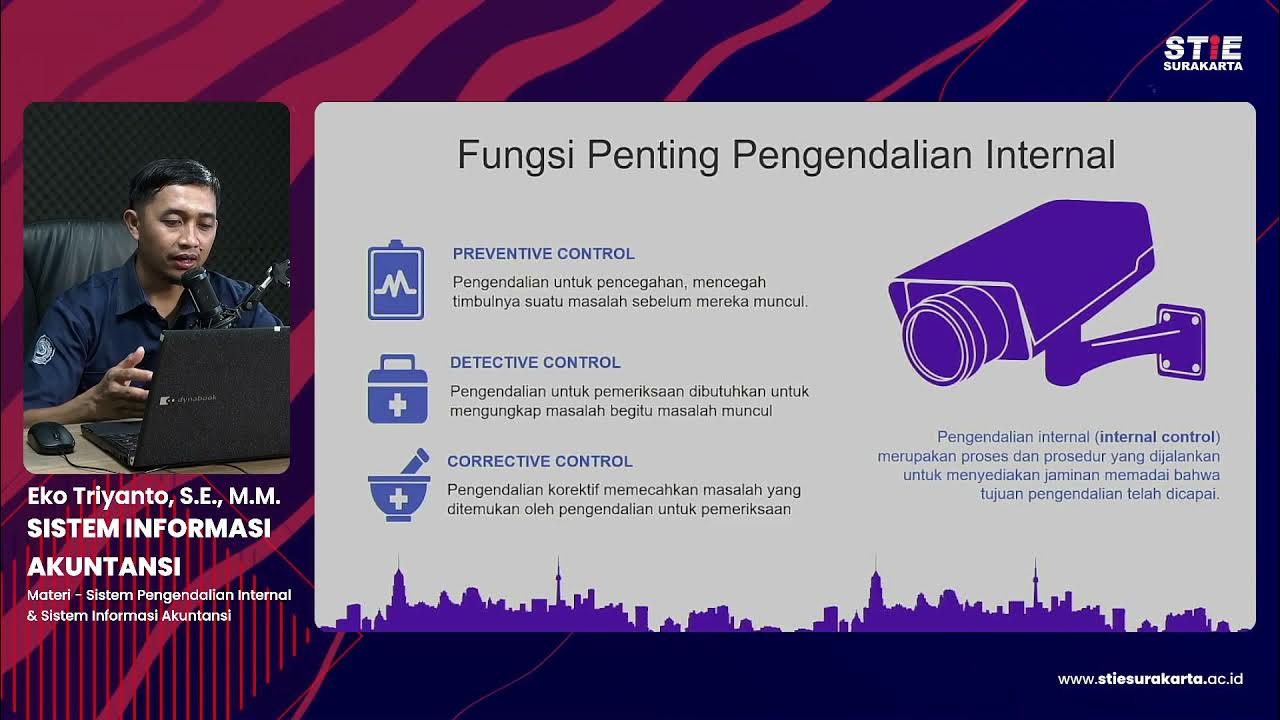

- 😀 Preventive controls are designed to stop problems before they occur, like restricted access to sensitive areas.

- 😀 Detective controls identify problems after they happen, like regular inventory checks to identify discrepancies.

- 😀 Corrective controls address issues after detection, such as replacing an employee or improving processes to prevent further losses.

- 😀 Risk management is essential to anticipate and mitigate both internal and external risks, including unpredictable events like pandemics.

- 😀 A strong control environment includes ethical leadership, clear organizational structures, and effective communication of responsibilities.

- 😀 Risk response strategies include reduction (implementing controls), acceptance (acknowledging potential impacts), sharing (through insurance), and avoidance (ceasing risky activities).

- 😀 Segregation of duties is vital in preventing fraud, as key functions like recording transactions and authorizing payments should be handled by separate individuals.

- 😀 Ongoing monitoring, including audits and the use of fraud detection software, ensures the continuous effectiveness of internal controls and helps identify new risks.

Q & A

What is the main objective of accounting information systems (AIS)?

-The main objective of AIS is to control the organization in order to achieve its goals, such as increasing shareholder value and ensuring the security of assets while maintaining accurate financial reporting.

Why is internal control important in an organization?

-Internal control is crucial because it helps protect the company from potential threats, such as theft or fraud, and ensures that financial records are accurate and reliable. It also aids in achieving operational efficiency and compliance with laws.

What are the four types of control objectives that companies should set?

-The four control objectives companies should set are securing assets, maintaining accurate financial records, providing reliable information for decision-making, and improving operational efficiency.

What is the difference between preventive and detective controls?

-Preventive controls are designed to prevent problems from occurring, such as using restricted access to sensitive areas. Detective controls, on the other hand, identify issues after they have occurred, such as regular stock audits to identify discrepancies in inventory.

What is the COBIT framework used for?

-The COBIT framework is used for managing and controlling technology-related risks, ensuring that information technology is properly governed and aligned with the overall business objectives of the organization.

What role does COSO play in internal control?

-COSO (Committee of Sponsoring Organizations of the Treadway Commission) provides a framework for internal control in organizations, focusing on areas such as risk management, control activities, and monitoring. It helps ensure the reliability of financial reporting and compliance with laws.

What does ERM stand for, and how does it relate to internal control?

-ERM stands for Enterprise Risk Management. It extends COSO's internal control framework by focusing more on identifying, assessing, and responding to risks that might affect an organization’s ability to achieve its objectives.

What are residual risks?

-Residual risks are the risks that remain after internal controls have been applied. They cannot be entirely eliminated, but companies can minimize them through strategies such as purchasing insurance or adjusting their internal control measures.

How does a company address risk through internal controls?

-A company addresses risk by implementing various internal controls such as access restrictions, separation of duties, audits, and contingency planning to prevent, detect, and correct problems that may arise.

What is the role of monitoring in internal control?

-Monitoring in internal control involves continuously evaluating the effectiveness of the internal control system through audits, tracking performance against set standards, and making necessary adjustments to improve control activities.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Sistem Informasi Akuntansi #8 Sistem pengendalian internal & Sistem Informasi Akuntansi-Eko Triyanto

2023 Meet 1 Akuntansi Manajemen : Introduction

Module 1 - Introduction to Management Accounting - Video 1

Accounting for Management - ACCA Management Accounting (MA)

2023 Meet 3 Akuntasi Manajemen : Konsep dan Prilaku Biaya

2023 Meet 2 Akuntansi Manajemen : Konsep Dasar Akuntansi Manajemen

5.0 / 5 (0 votes)