How to Post a Special Journal to a Trading Company Ledger

Summary

TLDRIn this video, the speaker explains the process of posting transactions from special journals to the general ledger in accounting. The focus is on simplifying the task, as balances are already present in special journals. The tutorial covers specific journals like sales, cash receipts, and disbursement journals, emphasizing the importance of posting details such as account names, numbers, and totals. Key topics include handling sundries, trade payables, rent expenses, and purchases, with step-by-step instructions on transferring totals and ensuring accuracy in ledger entries. The session ends with a reminder to post accurately and consistently.

Takeaways

- 😀 Posting from special journals to the general ledger is easier than from general journals due to pre-existing balances in the special journals.

- 😀 For each entry, it is essential to start with the correct name and format, including ledger columns for each account (e.g., sales journal, cash receipts journal).

- 😀 In the sales journal, the accounts to be posted include accounts receivable and sales, which should be transferred into the general ledger.

- 😀 Sundries should not be posted to the general ledger if they pertain to specific income accounts; income should be posted as a debit.

- 😀 Cash disbursement journals should record accounts payable, with the rent expense being posted as part of the cash disbursement process.

- 😀 For cash receipts, always ensure that the amounts are transferred from the debit column to the general ledger with correct referencing.

- 😀 Posting totals at the bottom of each journal entry helps maintain clarity and consistency when transferring to the general ledger.

- 😀 When posting equipment purchases or similar assets, ensure the specific accounts are correctly posted, not just the sundries.

- 😀 It is crucial to match debit and credit balances during posting to avoid discrepancies in the general ledger, particularly for sales and receipts.

- 😀 Regular practice with posting entries from journals to the general ledger helps improve the understanding and efficiency of the accounting process.

Q & A

What is the main focus of the meeting in the transcript?

-The main focus of the meeting is on posting from special journals to the general ledger in the context of an accounting cycle, with a specific emphasis on understanding the processes involved in ledger posting and the differences between special and general journals.

How does posting from a special journal to the general ledger differ from posting from a general journal?

-Posting from a special journal to the general ledger is easier because the balance is already available in the special journal, unlike a general journal where the accounts need to be manually calculated and posted.

What are the steps involved in posting from a special journal to the general ledger?

-The steps involve writing the title first, entering the relevant account name and number, and then transferring the balance from the special journal into the general ledger, including debit and credit details, with reference to the corresponding journal.

What is the significance of the sundries column in the special journal?

-The sundries column in the special journal is used to record miscellaneous items, such as equipment purchases or specific expenses, that do not fit into other predefined categories. These items must be correctly posted to the general ledger.

What should be done with sundries accounts when posting to the general ledger?

-Sundries accounts should not be posted as they are; instead, the specific nature of the item, such as equipment or income, should be properly identified and posted under the correct category in the general ledger.

What are the specific journal entries for a cash disbursement?

-In a cash disbursement journal, the entry typically includes crediting accounts payable and debiting the relevant expense account, such as rent expense. The value for the debit and credit should reflect the transaction amount.

How should a sales journal entry be posted to the general ledger?

-A sales journal entry should be posted by taking the total from the sales journal’s debit column and transferring the amount to the general ledger under the appropriate account, such as trade receivables or sales revenue.

What happens when there are discrepancies between the debit and credit columns?

-If there are discrepancies between the debit and credit columns, the difference should be noted as a balance, and it is important to investigate the cause of the imbalance, which might indicate an error in posting or missing information.

How are purchases treated in the special journal, particularly in relation to equipment and sundries?

-Purchases, especially for equipment, are recorded in the purchase journal, with the corresponding debit entry for the purchase amount and the appropriate credit entry to the accounts payable. Sundries related to purchases are handled similarly but are posted under their respective categories.

What should be the approach to posting rental payments and related expenses?

-When posting rental payments, the rental expense account should be debited, and the notes payable account should be credited. It is crucial not to take the total from the sundries column but to handle the rental fee separately to ensure accuracy in accounting.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

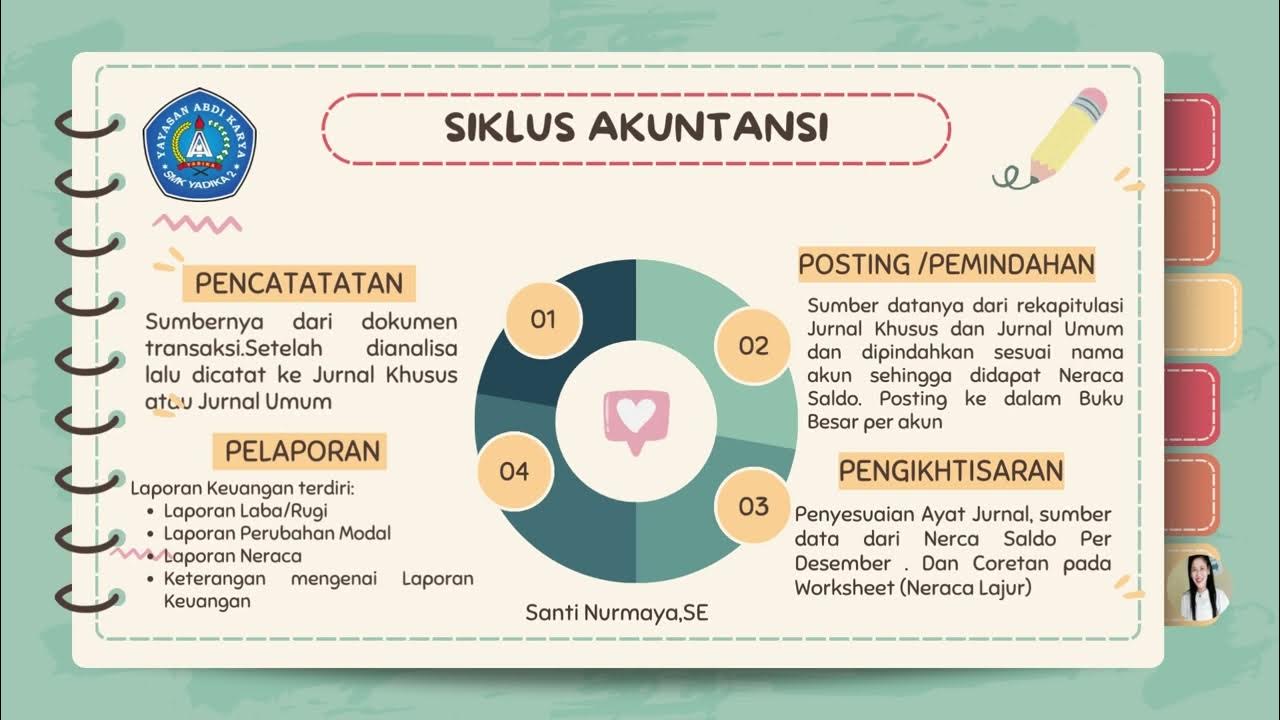

Mengelola Jurnal Khusus dan umum,Buku Besar, Laporan Keuangan Perusahaan Jasa,Dagang dan Manufaktur.

Posting to a Ledger

TRIAL BALANCE CHAPTER -14 T.S.Grewal Solution question number -2 Class-11 accounts session (2022)

Financial Accounting Chapter-4 | Trial Balance | BCom/BBA 1st Year | CWG for BCOM

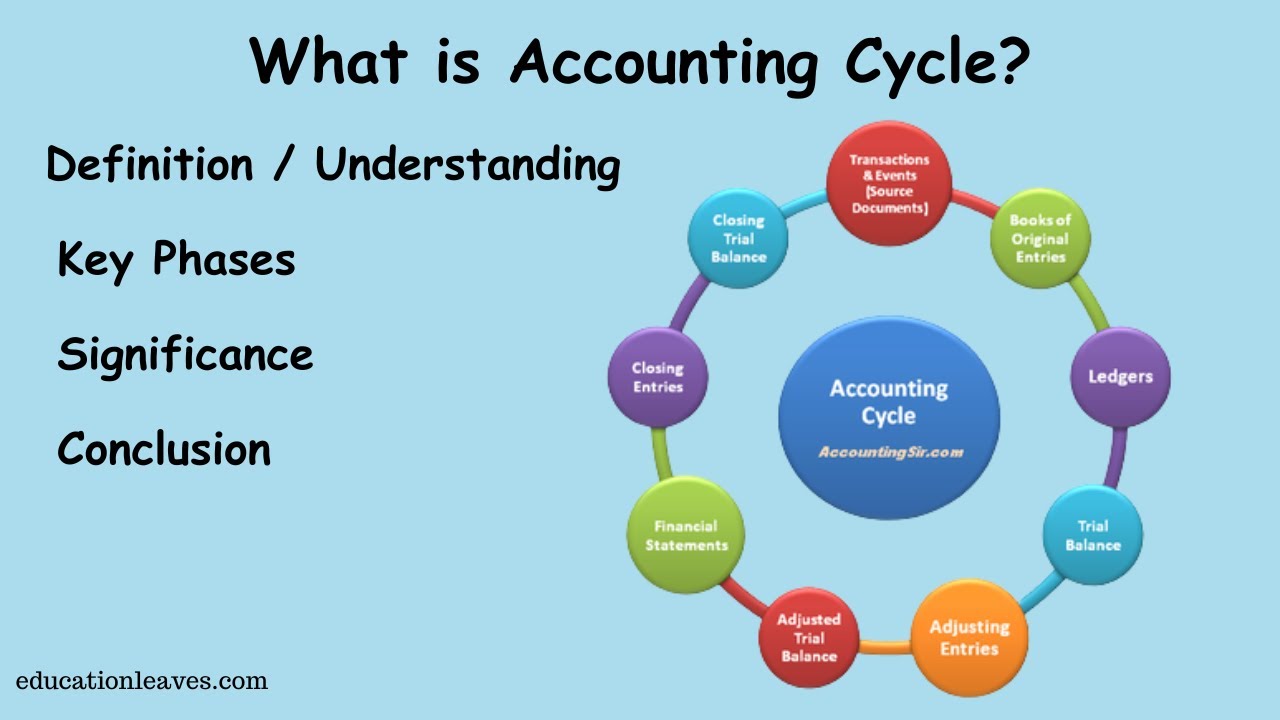

What is Accounting cycle? | Key phase, Significance of Accounting cycle

Lesson 031 - Accounting for Merchandising Operations 5: Special Journals and Subsidiary Ledgers

5.0 / 5 (0 votes)