APLIKASI BARISAN DAN DERET (ANUITAS) || Kelas X Kurikulum Merdeka

Summary

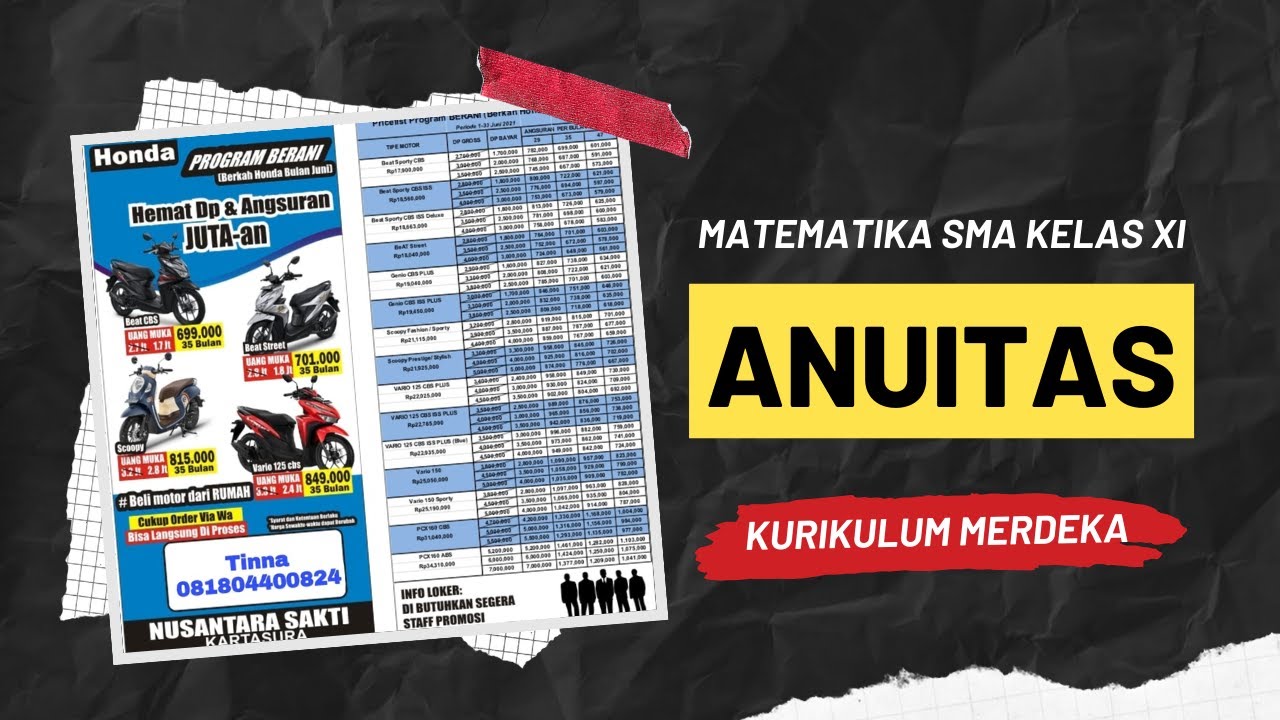

TLDRIn this video, the concept of 'Anuitas' (annuity) is explored in the context of mathematics, explaining how fixed payments are made over a set period, combining both principal and interest. The script begins with a review of previous topics like simple and compound interest before delving into annuities, illustrating the difference between 'angsuran' (installment) and 'anuitas.' A detailed example is provided where a smartphone purchase is financed over six months with a 5% interest rate, demonstrating how the monthly payment and the breakdown of principal and interest evolve over time. The video aims to clarify the mechanics of annuities and their application in everyday finance.

Takeaways

- 😀 Anuitas refers to a series of equal payments made at regular intervals, consisting of both principal and interest.

- 😀 Anuitas is different from angsuran (installment) because it includes both principal and interest payments.

- 😀 The common misunderstanding is that people use 'angsuran' to refer to 'anuitas', but they are distinct concepts.

- 😀 The formula for calculating anuitas is: A = (M × i) / (1 - (1 + i) ^ -n), where A is the anuitas, M is the principal, i is the interest rate, and n is the number of periods.

- 😀 Anuitas ensures equal monthly payments, but the amount allocated to interest and principal changes over time.

- 😀 Anuitas is typically used for loans, such as credit purchases for items like smartphones or vehicles.

- 😀 In the example of a smartphone purchase, the anuitas calculation involves the price of the smartphone, interest rate, and loan term.

- 😀 The first step in calculating anuitas involves determining the loan amount (M), the interest rate (i), and the number of periods (n).

- 😀 The anuitas amount is constant each month, but the installment (angsuran) changes with each payment due to the reduction in the principal.

- 😀 As payments progress, the interest portion of each payment decreases, while the principal portion increases, despite the same total monthly anuitas.

Q & A

What is the main topic of the video?

-The main topic of the video is about 'Annuities' as an application of sequences and series, explaining how annuities are used in finance, specifically in loans and installments.

How does the video distinguish between 'angsurans' and 'annuities'?

-'Angsurans' refers to a payment plan that is often confused with annuities. While angsurans generally refers to a simple installment without considering interest, annuities are a series of equal payments that include both principal and interest over a set period.

What is the formula for calculating annuities as mentioned in the video?

-The formula to calculate annuities is: A = M * i / (1 - (1 + i)^(-n)), where A is the annuity, M is the principal amount (loan or present value), i is the interest rate per period, and n is the number of periods.

What does the term 'anuitas' refer to in the video?

-'Anuitas' refers to a fixed amount that is paid periodically in equal installments, which includes both the principal repayment and the interest on a loan or investment.

How do you calculate the interest for the first period in an annuity?

-To calculate the interest for the first period (B1), you multiply the principal amount (M) by the interest rate (i). The result gives the interest for the first period.

How is the first installment calculated in an annuity payment schedule?

-The first installment (A1) is calculated by subtracting the interest for the first period (B1) from the total annuity (A). This gives the portion of the payment that is allocated to the principal.

What is the importance of 'n' in the annuity formula?

-In the annuity formula, 'n' represents the number of periods over which the payments will be made. It is crucial for calculating the total duration of the loan or investment and helps in determining the amount of each payment.

What is the role of interest rate 'i' in the annuity calculation?

-The interest rate 'i' plays a key role in calculating how much of the total payment goes toward the interest and how much goes toward repaying the principal. It directly affects the annuity amount for each period.

Why is it important not to round off intermediate values in annuity calculations?

-It is important not to round off intermediate values because doing so can introduce significant errors in the final calculation, especially when dealing with money where small differences can add up over time.

How do annuity payments change over time in the given example?

-In the example provided in the video, although the annuity amount remains fixed, the distribution of the payment between the principal and interest changes over time. Early payments consist mostly of interest, while later payments pay off more of the principal.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)