ICT Mentorship Core Content - Month 03 - Market Maker Trap Head Shoulders Pattern

Summary

TLDRThis script delves into the concept of false tops and bottoms, focusing on head and shoulders patterns and their misinterpretation by retail traders. The speaker contrasts the classical understanding of these patterns with institutional order flow techniques. While retail traders often view head and shoulders as bearish and inverted head and shoulders as bullish, the speaker encourages looking at higher timeframes and understanding institutional market flow. By emphasizing the importance of order flow and avoiding simplistic pattern-based analysis, the speaker provides valuable insights for traders seeking to align their strategies with institutional practices, particularly using GBP/USD as a key example.

Takeaways

- 😀 Retail traders often misinterpret classical head and shoulders patterns, especially when they appear at significant price lows.

- 😀 The head and shoulders pattern is typically a topping formation that appears at intermediate or long-term highs.

- 😀 Inverted head and shoulders patterns are considered false bottom patterns and often misinterpreted by retail traders on lower time frames.

- 😀 The problem with head and shoulders patterns is that they are often taught in retail trading books, leading traders to force them onto charts without considering broader market context.

- 😀 Institutional traders focus on higher time frames and use order flow analysis to avoid the misapplication of classical patterns like head and shoulders.

- 😀 Instead of picking tops and bottoms, institutional traders focus on capturing intermediate-term highs and lows, avoiding the pitfalls of retail trading strategies.

- 😀 A 'turtle soup' strategy involves buying or selling when a neckline break happens, with the expectation that the price will retrace before continuing in the original direction.

- 😀 Inverted head and shoulders patterns are often misinterpreted as bullish breakouts, but institutional traders may view them as setups for a bearish move.

- 😀 Retail traders may target false objectives when using classical patterns, such as expecting large price movements from head and shoulders patterns, while institutional traders focus on liquidity and order flow.

- 😀 The concept of liquidity runs is crucial for institutional traders, where they aim to trigger stop losses by running through key price levels, then reversing to capture the real market move.

Q & A

What is the classical head and shoulders pattern, and how is it interpreted by retail traders?

-The classical head and shoulders pattern is a chart formation that suggests a bearish reversal. It typically involves a price high, followed by a retracement, a higher high, and another lower high. Retail traders interpret this as a signal to sell once the neckline (formed by connecting the peaks) is broken.

Why do retail traders often struggle with head and shoulders patterns?

-Retail traders often struggle with head and shoulders patterns because they tend to apply them on lower timeframes or at significant price lows, which can lead to false signals. These patterns are more reliable when formed at intermediate or long-term highs or lows, but retail traders may miss this context.

What is an inverted head and shoulders pattern, and how is it typically viewed?

-An inverted head and shoulders pattern is the opposite of the classical head and shoulders. It forms at a low with a lower low followed by a higher low. Retail traders typically view this as a bullish reversal pattern, expecting price to rise once the neckline is broken.

How do institutional traders view head and shoulders and inverted head and shoulders patterns?

-Institutional traders view these patterns differently. They often recognize them as false signals or traps. For example, when a head and shoulders pattern appears but the higher timeframe suggests bullish movement, they might look to buy into the breakdown, seeing it as a liquidity run. Conversely, an inverted head and shoulders pattern may indicate a shorting opportunity when the higher timeframe suggests bearishness.

What does the speaker mean by a 'false top' in relation to head and shoulders patterns?

-A 'false top' refers to a head and shoulders pattern that is misinterpreted by retail traders as a bearish reversal, while institutional traders see it as an opportunity to buy into the market. The speaker emphasizes that these patterns can be traps when they form in the context of a higher timeframe bullish trend.

Why is picking tops and bottoms considered a bad strategy for new traders?

-Picking tops and bottoms is difficult because price action often moves unpredictably at extremes. Even seasoned professionals avoid this approach. The speaker advises new traders to avoid attempting to pick tops and bottoms and instead focus on intermediate term lows and highs.

How does institutional order flow help in identifying trade opportunities?

-Institutional order flow helps traders understand where large orders are likely to push the market. By analyzing higher timeframe trends and patterns, traders can identify liquidity zones and more accurately predict price movements, going against the retail crowd's expectations in the process.

How can retail traders be trapped by classical chart patterns?

-Retail traders can be trapped by classical chart patterns because they often rely on these patterns to make trade decisions without considering the larger market context. For instance, a head and shoulders pattern might be seen as a sell signal, but if the overall trend is bullish on higher timeframes, the breakdown could actually be a buying opportunity, trapping the retail trader in a losing position.

What is the concept of a 'turtle soup' long trade in relation to head and shoulders patterns?

-A 'turtle soup' long trade refers to a strategy where traders buy when the market breaks below the neckline of a head and shoulders pattern, expecting a run on sell stops and a reversal. The idea is that the breakdown triggers false selling pressure, and the market will eventually reverse upward, providing a profitable buying opportunity.

What role do liquidity runs play in the strategies described in the transcript?

-Liquidity runs are central to the strategies described. Institutional traders often look for areas with accumulated stop orders (buy or sell stops) and take advantage of these by pushing the market through these levels, creating false signals for retail traders. The traders then capitalize on the liquidity by entering trades in the opposite direction.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

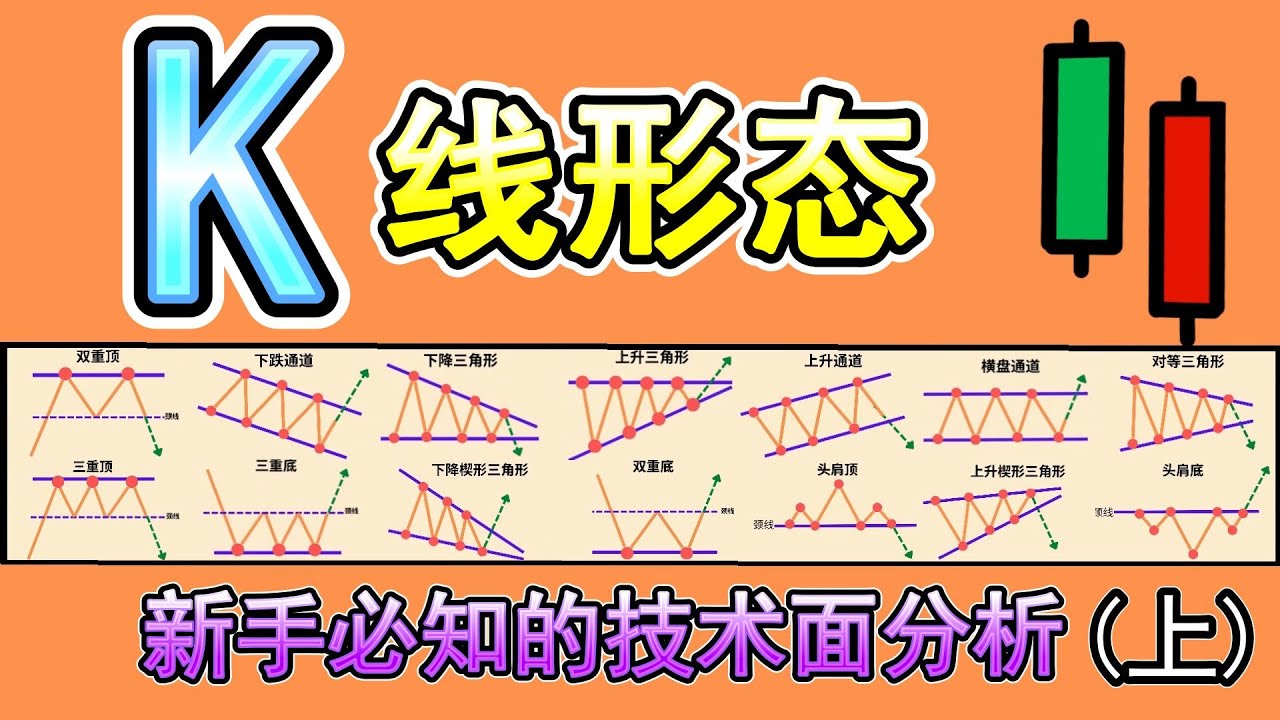

【K线形态 技术面分析】(上)你必知的18种K线形态完整教学|K线形态交易策略大公开|技术分析新手入门教学|专业交易员必备的K线形态技术分析|Chart Pattern Analysis

Best Bank Nifty Scalping Strategy || Golden 10% Q&A

How Banks Manipulate Stop Losses: Strategies for Avoiding Price Reversals?

Padrões de Reversão

ICT Mentorship Core Content - Month 04 - Double Bottom Double Top

ICT Forex - Higher Time Frame Concepts

5.0 / 5 (0 votes)