ICT Mentorship Core Content - Month 02 - Market Maker Trap False Breakouts

Summary

TLDRThis teaching focuses on the concept of false breakouts in market maker traps, particularly in bearish and bullish markets. The video explores how market makers manipulate price to create false breakouts by targeting buy and sell stops, and how these movements facilitate liquidity provision. It explains how traders, especially breakout traders, can fall into these traps, and how understanding market maker behavior and liquidity dynamics can help traders align with the market. The lesson emphasizes recognizing market shifts, consolidations, and expected price movements to anticipate profitable trades.

Takeaways

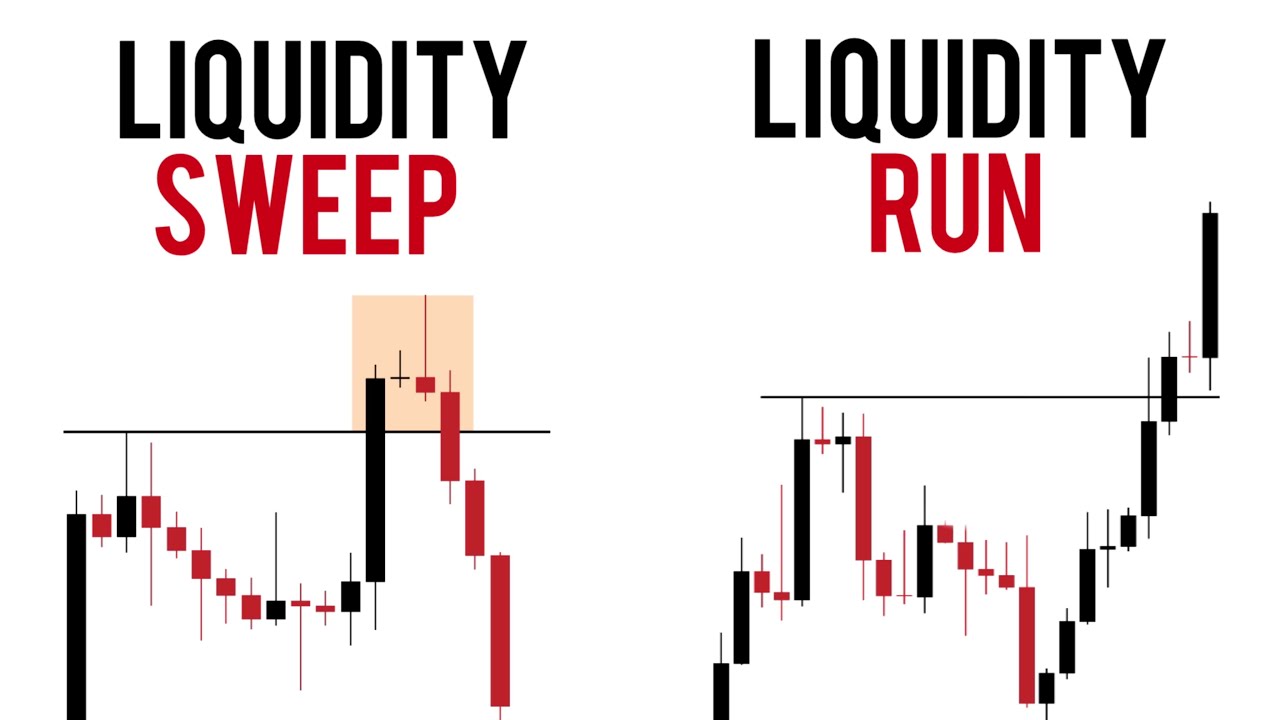

- 😀 False breakouts above price consolidations occur in bearish markets, where market makers aim to neutralize buy stops by pushing prices above the range.

- 😀 In bullish markets, false breakouts below price consolidations happen, with market makers neutralizing sell stops by pushing prices below the range.

- 😀 Breakout traders often bracket the market with buy stops above recent highs and sell stops below recent lows, hoping to capture long-term trends.

- 😀 Market makers manipulate price by seeking liquidity above old highs and below old lows to facilitate their trading and accumulate positions.

- 😀 Sell stops below a consolidation area are used by market makers to pair long positions and absorb liquidity from less informed traders.

- 😀 After a false breakout below a consolidation, prices often rise to seek buy stops above old highs, where liquidity is found.

- 😀 Liquidity is concentrated above the bodies of candlesticks, not in the wicks, so market makers typically target these areas for profit-taking.

- 😀 Every time the market consolidates and breaks below a range, it is usually a false breakout, and the market makers will then push price higher to liquidate their long positions.

- 😀 The process of expanding price to seek liquidity above and below the market helps market makers execute their strategy and provides opportunities for traders to scale off positions.

- 😀 Market efficiency and liquidity are key to understanding price action, and recognizing the behaviors of market makers can help traders align with their strategy for more accurate trade setups.

Q & A

What is the main focus of the eighth and final teaching in the October ICT mentorship?

-The main focus is on understanding market maker traps, specifically false breakouts, and how these traps operate in both bullish and bearish market conditions.

How do false breakouts typically manifest in a bearish market?

-In a bearish market, a false breakout above a consolidation zone is expected. Market makers push the price above the consolidation to trigger buy stops before reversing the price back down.

What role do breakout traders play in the market's price movements?

-Breakout traders attempt to capture trends by placing buy orders above recent highs and sell orders below recent lows, aiming to profit from price moves once they believe a breakout is occurring.

How do market makers neutralize the buy and sell stops placed by breakout traders?

-Market makers manipulate price by moving it above or below key levels, triggering the buy or sell stops, and then using this liquidity to move the price in the opposite direction.

What is the concept of 'market efficiency paradigm' discussed in the script?

-The market efficiency paradigm suggests that the market always seeks liquidity, and by understanding where liquidity resides (buy stops above highs and sell stops below lows), traders can predict price movements more effectively.

How do market makers book long positions when the market is bullish?

-Market makers absorb sell stops below consolidations to take long positions and then move the price higher to capture liquidity from buy stops above previous highs, facilitating their exits and hedging activities.

What is the significance of consolidation zones in this context?

-Consolidation zones are critical as they represent areas where price moves sideways, allowing traders to place stops. Market makers seek out these areas to trigger liquidity, either by moving price above or below the consolidation before reversing direction.

What is the typical sequence of events in a false breakout scenario?

-In a false breakout, price first breaks out above or below a consolidation zone to trigger buy or sell stops. After this, the price reverses direction, collecting liquidity and continuing to the opposite side, aligning with the market maker's objectives.

How does the market maker’s behavior differ in a bullish market versus a bearish market?

-In a bullish market, market makers push price below consolidation zones to absorb sell stops and then move price higher. In a bearish market, they push price above the consolidation to absorb buy stops and then reverse the price lower.

What should traders look for when identifying potential false breakouts?

-Traders should observe consolidations where price breaks below or above the zone. If the price quickly reverses direction, this may indicate a false breakout, with the market maker absorbing liquidity before pushing the price in the opposite direction.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)