3 Perjanjian Kredit dan Pembiayaan Syariah

Summary

TLDRThis video discusses various types of financing in banking, focusing on the duration, withdrawal methods, payment methods, and types of contracts used. It covers short-term, intermediate, and long-term financing, as well as direct and indirect financing methods. The video also explores bilateral and syndicated financing, along with different payment structures such as installments and lump sums. It delves into financing contracts based on buy and sell agreements, partnerships, leasing, and loans, providing an overview of Islamic banking principles and their applications in real-world financial scenarios.

Takeaways

- 😀 Short-term financing typically lasts up to 1 year, intermediate financing is between 1 to less than 3 years, and long-term financing can extend up to 15 years, such as mortgages (KPR).

- 😀 Financing can be withdrawn in a lump sum or in installments, depending on the agreement with the bank.

- 😀 Direct financing allows the customer to use the funds immediately after approval, while indirect financing (e.g., Letters of Credit) restricts immediate use of the funds.

- 😀 Bilateral financing is provided by a single bank to one borrower, whereas syndicated financing involves multiple banks providing funds for a large project.

- 😀 Syndicated financing is typically used for large projects requiring substantial capital and involves one bank as the administrator of the loan.

- 😀 Repayment methods for financing can be either lump-sum at maturity or in installments, depending on the agreement between the bank and the borrower.

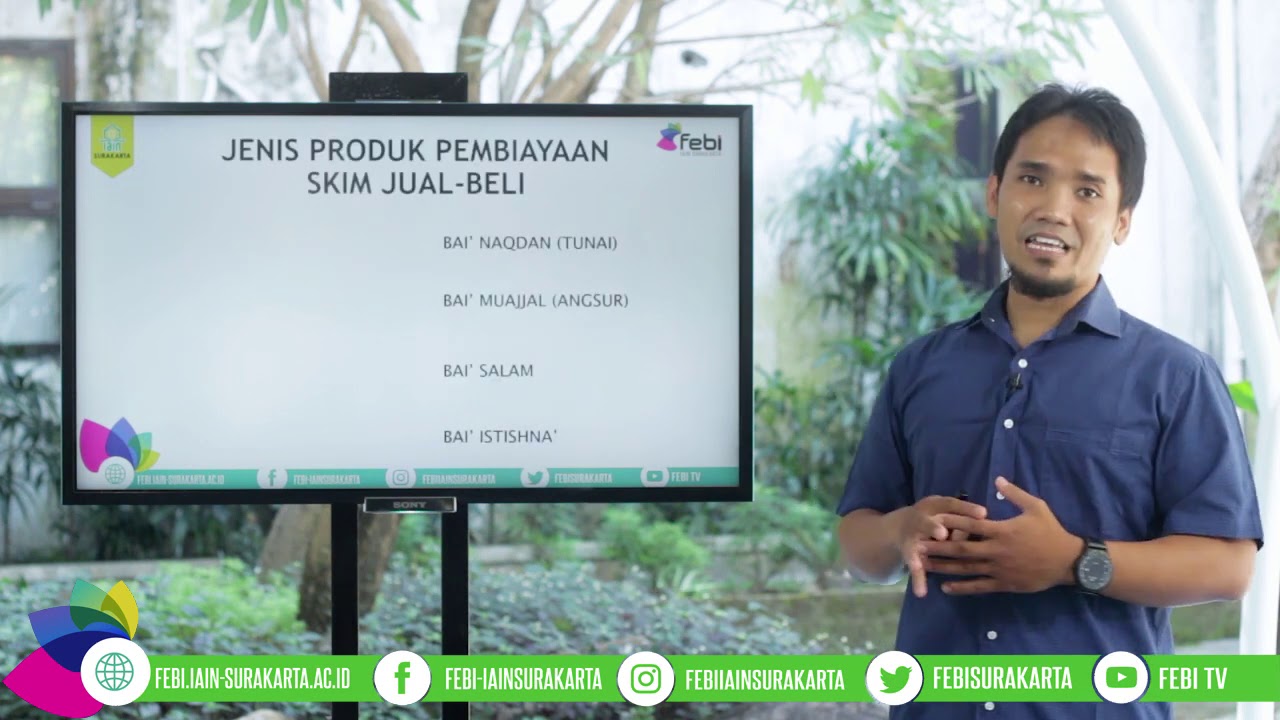

- 😀 Financing methods are categorized based on contracts like sale contracts (Murabahah, Salam, Istisna), partnership contracts (Mudharabah, Musharakah), and lease contracts (Ijarah).

- 😀 Murabahah involves a sale contract where the bank buys an item and sells it to the customer at a marked-up price, while Salam and Istisna are specialized sale contracts for specific goods.

- 😀 Mudharabah and Musharakah are partnership financing methods where profits and losses are shared between the bank and the borrower.

- 😀 Ijarah is a lease agreement, where the bank allows the borrower to use an asset for a specified time in exchange for rental payments.

- 😀 Qard (loan contracts) are based on the principle of lending without expecting profit, focusing solely on the repayment of the principal amount.

Q & A

What are the different types of financing based on time duration?

-The types of financing based on time duration are short-term (usually 1 year), intermediate (1 to less than 3 years), and long-term (more than 3 years, such as home loans up to 15 years).

What is an example of long-term financing mentioned in the transcript?

-An example of long-term financing mentioned is KPR (Kredit Pemilikan Rumah), which is a home loan that can extend for up to 15 years.

What are the two main withdrawal methods for financing?

-The two main withdrawal methods for financing are a lump-sum withdrawal (in one go) and staged withdrawals, which follow a predetermined schedule.

What is the difference between direct and indirect financing?

-Direct financing allows the funds to be used immediately by the customer once the bank approves it. Indirect financing involves situations where the customer cannot immediately access the funds, such as in the case of a bank guarantee or Letter of Credit.

What is the difference between bilateral and syndicated financing?

-Bilateral financing involves one bank providing financing to one company, whereas syndicated financing involves multiple banks collaborating to finance a large project.

What is a key characteristic of a syndicated financing project?

-A syndicated financing project is usually a large project that requires substantial funding, and one of the banks is designated as the agent to manage the administration of the financing.

How are financing repayments typically structured?

-Financing repayments are typically structured as either installments (spread out over time) or as a lump-sum payment due at a specific maturity date, based on the agreement between the bank and the customer.

What are the key financing methods based on the contract type mentioned in the transcript?

-The key financing methods based on the contract type include sale contracts (such as *Murabaha*, *Salam*, *Istisna*), partnership models (*Mudharabah*, *Musyarakah*), leasing (*Ijarah*), and loan contracts (where the bank does not expect profit).

What is *Murabaha*, and how does it relate to banking?

-*Murabaha* is a sale contract where the bank purchases an asset and sells it to the customer at a marked-up price, which includes the bank's profit margin.

What is the role of *Mudharabah* and *Musyarakah* in Islamic finance?

-*Mudharabah* is a partnership where one party provides capital, and the other provides labor or expertise, sharing profits according to a pre-agreed ratio. *Musyarakah* is a joint partnership where both parties contribute capital and share both profits and losses based on their contributions.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Manajemen Pembiayaan Bank Syariah Bagian 1 | Rais Sani Muharrami, M.E.I

Tugas Perbankan Syariah

Akad-akad dalam Bank Syariah • Perbankan Syariah #5

Alat Pembayaran Tunai dan Non Tunai | Ekonomi Kelas X - KHATULISTIWA STUDIO

Produk Pembiayaan Syariah | Rais Sani, M.EI.

SELAYANG PANDANG ANALISIS PEMBIAYAAN PERBANKAN SYARIAH : PRODUK DAN RESIKO / BASIC ANALITICS

5.0 / 5 (0 votes)