SELAYANG PANDANG ANALISIS PEMBIAYAAN PERBANKAN SYARIAH : PRODUK DAN RESIKO / BASIC ANALITICS

Summary

TLDRThe transcript focuses on explaining the key aspects of Islamic banking financing products and their associated risks. It highlights various Islamic finance contracts such as Murabahah, Salam, Istisna, Ijarah, and Sukuk, detailing their unique features and applications. The video also discusses the potential risks tied to each product, such as payment failures, fraud, and market fluctuations. Furthermore, it emphasizes the importance of effective risk management and the role of technology in improving Islamic banking operations. The presentation concludes with an outlook on the future of Islamic banking, stressing innovation and digital transformation in the sector.

Takeaways

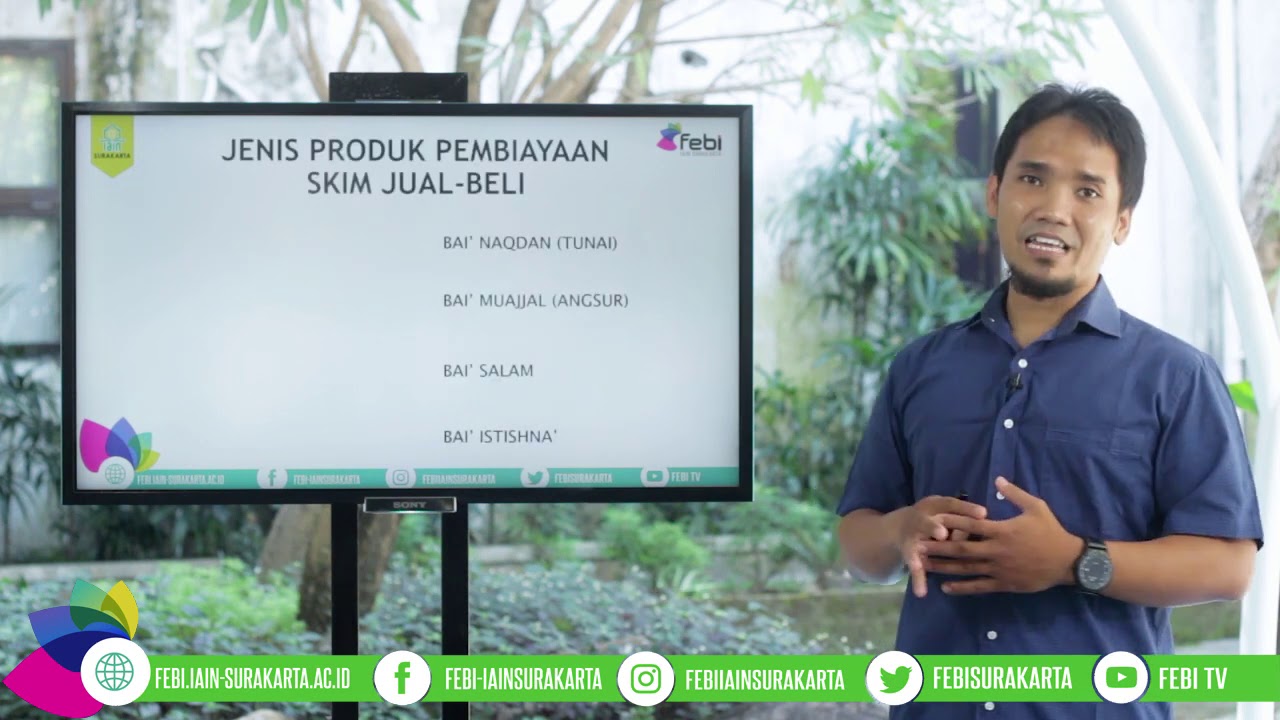

- 😀 Islamic banking offers a variety of financing products, including Murabahah, Salam, Istisna, Ijarah, and Sukuk, each designed to serve different needs and purposes.

- 😀 Murabahah is a buy-and-sell financing scheme where the bank purchases goods and resells them at a profit margin to the customer.

- 😀 Salam is a financing model where the customer receives funds upfront to produce goods, typically in agriculture, which are delivered later.

- 😀 Istisna is used for the manufacturing of goods, where the bank finances the production and the customer pays upon completion.

- 😀 Ijarah is a leasing agreement, allowing customers to rent assets such as property or equipment, with an option to buy at the end of the lease term.

- 😀 Sukuk are Sharia-compliant investment certificates, representing ownership in real assets and offering a way to finance projects like infrastructure.

- 😀 Each Islamic financing product comes with associated risks, such as payment failures, fraud, crop failure, production delays, and market fluctuations.

- 😀 Proper risk management is crucial in Islamic banking to ensure sustainability and long-term success, including identifying risks and developing mitigation strategies.

- 😀 Technological advancements, such as data analytics and automation, can enhance the efficiency of Islamic banking operations and help manage risks more effectively.

- 😀 Financial literacy and public awareness of Islamic finance products are essential to increase their adoption and success in the market.

- 😀 The session concluded with a reminder to sign in, subscribe, and like the video for future learning content, encouraging further engagement with educational materials.

Q & A

What is Murabahah in Islamic banking financing?

-Murabahah is a financing method where the bank purchases a product and sells it to the customer at a higher price, with a predetermined profit margin agreed upon between both parties.

What risks are associated with Murabahah financing?

-Risks include payment failure, fraud, and inflation affecting the product's cost, which can alter the agreed-upon price.

How does Salam financing work in Islamic banking?

-Salam is an advance payment financing method, where a customer makes full payment for goods to be delivered in the future, typically used in agricultural financing.

What are the potential risks in Salam financing?

-Salam financing risks include crop failure, price fluctuations, and product damage, which can affect the delivery or value of the goods.

What is Istisna financing?

-Istisna is a contract where the bank finances the production of goods or services, and payment is made once the goods are delivered or completed.

What risks are associated with Istisna financing?

-The risks include production delays, increased production costs, and a reduction in demand for the goods, affecting the financial outcome.

What is Ijarah in Islamic finance?

-Ijarah is a lease-based financing arrangement where the bank rents out an asset to a customer, who may later purchase the asset at the end of the lease term.

What are the risks involved in Ijarah financing?

-Ijarah risks include payment defaults by the customer, potential damage to the leased asset, and depreciation of the asset’s value over time.

What is Sukuk and how does it relate to Islamic finance?

-Sukuk are Sharia-compliant securities that represent ownership in an asset or project, used to raise funds for various initiatives like infrastructure or housing.

What risks are associated with Sukuk investments?

-Sukuk risks include liquidity issues, credit risk (failure of the issuer to repay), and market risk due to fluctuations in interest rates or inflation.

Why is risk management important in Islamic banking financing products?

-Risk management is crucial in Islamic banking to ensure financial stability, protect investments, and avoid potential losses due to unforeseen circumstances, such as payment defaults or market fluctuations.

How does technology play a role in Islamic banking and financing?

-Technology enhances efficiency in Islamic banking by enabling data analytics, automation, and better data security, which help in managing risks and streamlining operations in financing.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Produk Pembiayaan Syariah | Rais Sani, M.EI.

Manajemen Pembiayaan Bank Syariah Bagian 1 | Rais Sani Muharrami, M.E.I

Tugas Perbankan Syariah

BANK SYARIAH DAN KONVENSIONAL SAMA AJA??? - Dr. M. Syafii Antonio, M.Ec.

Kuliah Bank dan Lembaga Keuangan - Ep. 10 Bank Syariah

Use of KIBOR in Murabaha Financing (Part-1)

5.0 / 5 (0 votes)