Produk Pembiayaan Syariah | Rais Sani, M.EI.

Summary

TLDRThis informative session focuses on Islamic banking financing products, highlighting key contracts such as Mudharabah, Musyarakah, Ijarah, and Salam. It emphasizes the importance of product knowledge for both banking professionals and customers to understand the implications of their transactions. The speaker explains various financing methods, including investment, working capital, and consumer loans, detailing the contractual agreements that govern them. By breaking down complex concepts, the aim is to equip participants with a clear understanding of how Islamic banking operates, ensuring transparency and compliance with Shariah principles.

Takeaways

- 😀 Islamic banking acts as an intermediary between surplus and deficit units, facilitating financial transactions.

- 😀 Key financing products in Islamic banks include mudharabah (profit-sharing), musyarakah (joint venture), and murabahah (cost-plus financing).

- 😀 Mudharabah involves one party providing capital while the other manages the investment, sharing profits as per a pre-agreed ratio.

- 😀 Musyarakah allows both parties to contribute capital and share profits and losses according to their investment proportions.

- 😀 Murabahah is a sales contract where the bank buys an item and sells it to the customer at a marked-up price, with clear disclosure of costs.

- 😀 Ijarah (leasing) is used for providing benefits from an asset without transferring ownership, while ijarah muntahiya bittamlik leads to ownership transfer after leasing.

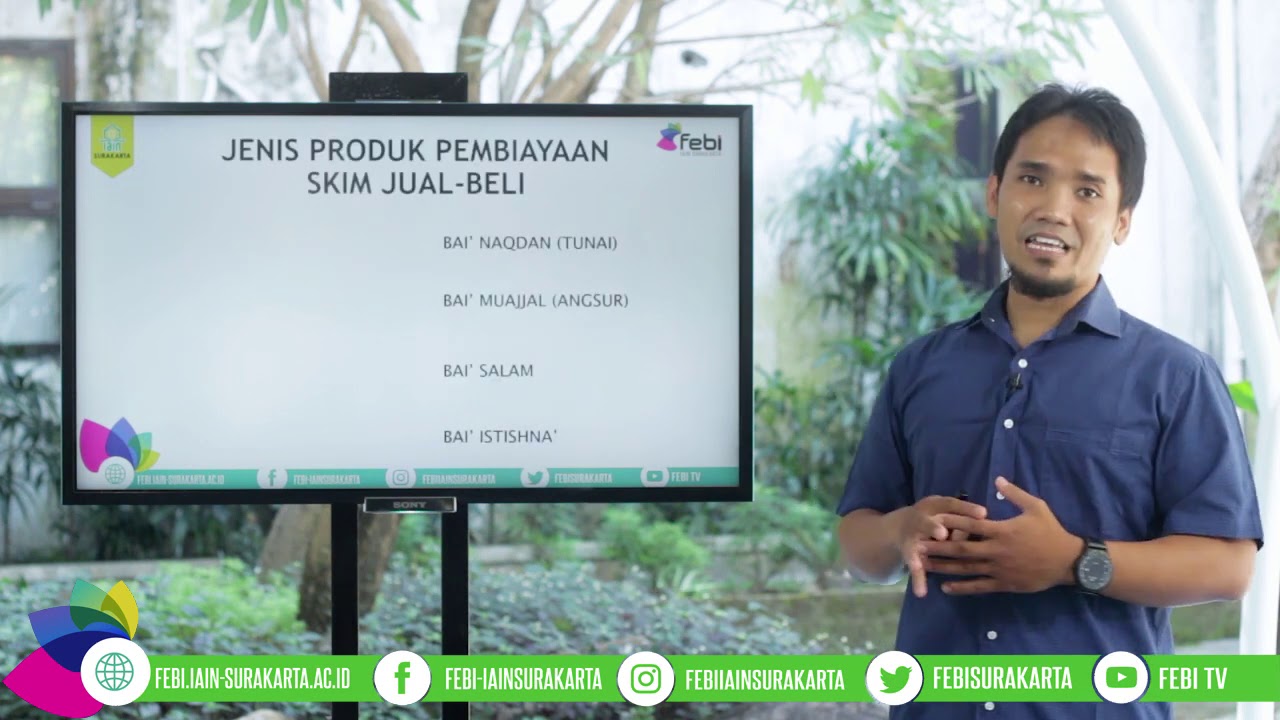

- 😀 The akad salam (forward sale) allows a bank to purchase goods from a customer at a future date, providing immediate cash for the customer.

- 😀 Istishna is similar to murabahah but is specifically for manufactured goods, where the bank commissions production before purchase.

- 😀 It's essential for clients to understand the implications of each transaction type, including the profit-sharing agreements and risk-sharing arrangements.

- 😀 Proper documentation and agreements are crucial in Islamic banking transactions to ensure transparency and compliance with sharia principles.

Q & A

What is the primary focus of the presentation?

-The presentation focuses on financing products in Islamic banking, specifically how to communicate product knowledge to customers.

What role does Islamic banking play between surplus and deficit units?

-Islamic banking serves as an intermediary, connecting surplus units (those with excess funds) with deficit units (those in need of funds), while adhering to Sharia principles.

What are the three main types of contracts discussed in the financing products?

-The three main types of contracts are Mudharabah (profit-sharing), Musyarakah (partnership), and Murabahah (cost-plus sale).

How does Mudharabah differ from Musyarakah?

-In Mudharabah, only the bank provides capital while the customer manages the business. In contrast, Musyarakah involves both parties contributing capital and sharing profits and losses.

What is the key feature of the Murabahah contract?

-Murabahah involves the bank purchasing goods and selling them to the customer at a profit margin, which is disclosed to the customer.

What is Ijarah and how does it function?

-Ijarah is a leasing contract where the bank provides an asset for use without transferring ownership, and the customer pays rent for that asset.

What distinguishes Ijarah Muntahiya Bittamlik from standard Ijarah?

-Ijarah Muntahiya Bittamlik is a lease-to-own contract, where ownership of the asset is transferred to the customer at the end of the lease period.

What are Istishna and its practical applications?

-Istishna is a manufacturing contract where the bank orders goods from a third party before selling them to the customer, often used in manufacturing and construction financing.

How is Salam different from other financing contracts?

-Salam is a forward sale contract where the bank buys goods to be delivered at a later date, typically used in agricultural financing.

Why is it important for customers to understand these financing products?

-It is crucial for customers to understand these products to grasp the implications of their transactions and ensure compliance with Islamic principles.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

SELAYANG PANDANG ANALISIS PEMBIAYAAN PERBANKAN SYARIAH : PRODUK DAN RESIKO / BASIC ANALITICS

Bab 4 Asuransi, Bank, dan Koperasi Syariah | Bagian Kedua Perbankan Syari'ah | Kurikulum Merdeka

Tugas Perbankan Syariah

Desain Kontrak Syariah_Manajemen Perbankan dan Keuangan SYariah

Manajemen Pembiayaan Bank Syariah Bagian 1 | Rais Sani Muharrami, M.E.I

PENGHIMPUNAN DANA || AKT PERBANKAN & SYARI'AH

5.0 / 5 (0 votes)