ch 22 demand for money part 3 of 5 (Keynes's Liquidity Preference theory)

Summary

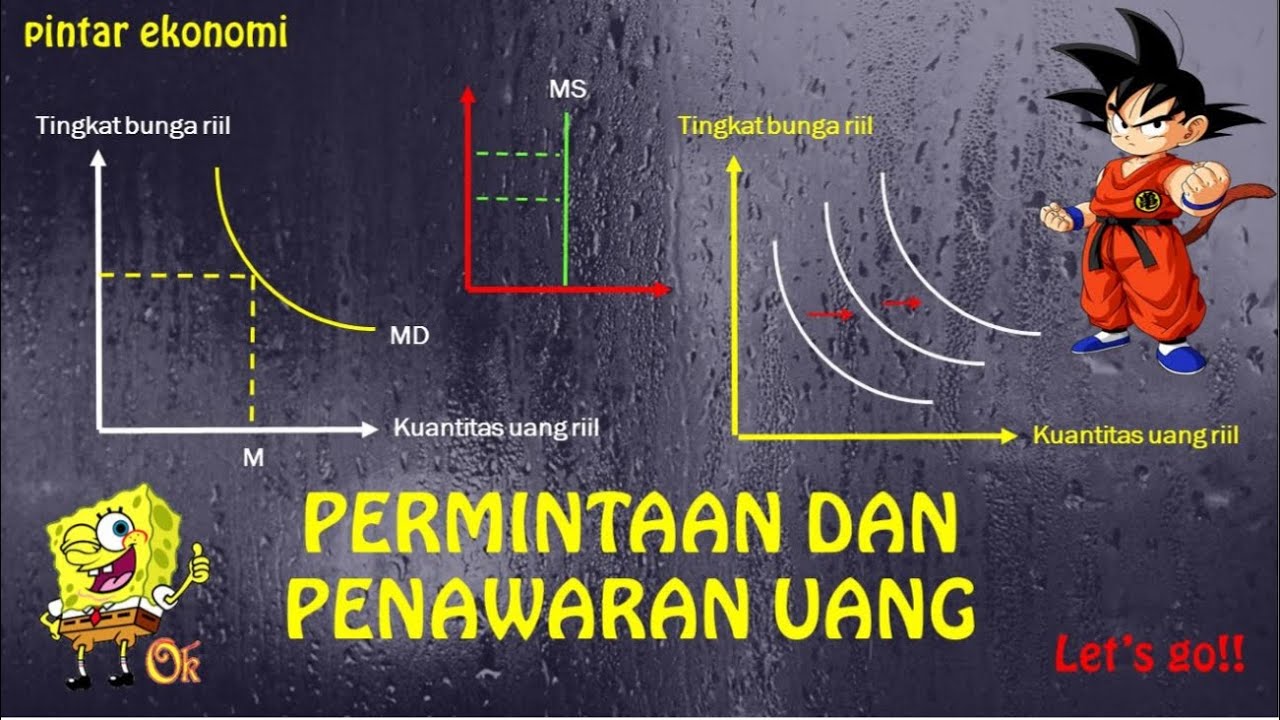

TLDRThe transcript discusses various economic theories, focusing on money demand and its relationship with different motives, such as transaction, precautionary, and speculative motives, based on Keynes' liquidity preference theory. It explores how individuals allocate funds for daily transactions, unexpected needs, and investments. Additionally, the discussion covers bond investment decisions, explaining how interest rates impact bond prices and the strategies investors use, like purchasing bonds at a discount to secure higher returns. The session emphasizes the interplay between these economic concepts and their implications for decision-making in finance.

Takeaways

- 😀 The theory of money demand involves different motives for holding money, as explained by Keynes, including transaction, precautionary, and speculative motives.

- 😀 Keynes differentiates the transaction and precautionary motives from speculative motives, with the latter focusing on investment decisions rather than day-to-day financial needs.

- 😀 The transaction motive refers to the need for money for everyday spending, with the amount depending on factors like income and expenses.

- 😀 The precautionary motive involves holding money for unforeseen circumstances, such as emergencies or unexpected expenses.

- 😀 The speculative motive focuses on holding money for potential investment opportunities, like buying bonds with the expectation of earning higher returns.

- 😀 The concept of liquidity preference is central to Keynes's theory, which contrasts with the classical quantity theory of money.

- 😀 The quantity theory of money, associated with classical economists, suggests that money demand is determined by the level of income and transaction needs.

- 😀 In Keynes's view, interest rates play a crucial role in determining money demand, especially with speculative motives influencing investment choices.

- 😀 Bonds are used as an investment instrument where the buyer lends money to an issuer, receiving periodic interest (coupon) payments, and the principal amount back at maturity.

- 😀 The price of a bond is inversely related to interest rates: when interest rates rise, bond prices fall, and vice versa, affecting investor decisions.

- 😀 The lecture explains how a company issuing bonds with a fixed interest rate may see the bond's value decrease if higher-interest bonds are available, offering investors better returns.

- 😀 The decision-making process of investors, such as choosing between bonds with varying interest rates and prices, reflects speculative motives based on expected returns.

Q & A

What is the main difference between Keynes' theory of money demand and the classical quantity theory of money?

-The main difference is that Keynes introduced the liquidity preference theory, which emphasizes the importance of holding money based on individual motives such as transactions, precautionary needs, and speculation. In contrast, the classical quantity theory of money focuses on the relationship between the money supply and overall economic activity, primarily driven by income levels.

What are the three main motives for holding money according to Keynes?

-According to Keynes, the three main motives for holding money are: (1) Transaction motive, which refers to holding money for daily purchases and expenses; (2) Precautionary motive, which refers to holding money for unforeseen events or emergencies; and (3) Speculative motive, where individuals hold money in anticipation of better investment opportunities.

How does the transaction motive relate to money demand?

-The transaction motive implies that people hold money to conduct everyday transactions. The demand for money for transaction purposes increases as people's income rises, since higher income leads to more spending and thus a greater need for cash.

What is the precautionary motive for holding money?

-The precautionary motive refers to holding money for unexpected events, such as medical emergencies or urgent financial needs. This amount is generally set aside beyond daily expenses but is available when unforeseen circumstances arise.

How does the speculative motive differ from the transaction and precautionary motives?

-The speculative motive is focused on holding money for investment purposes, anticipating that future changes in market conditions or interest rates will present better opportunities for wealth generation. This contrasts with the transaction and precautionary motives, which are driven by day-to-day needs and unexpected expenses.

How does the liquidity preference theory explain interest rates?

-Liquidity preference theory suggests that the demand for money is influenced by the desire to hold cash as a form of security, particularly in anticipation of investment opportunities. As interest rates rise, people prefer to hold less cash and invest more, which decreases the demand for money, thereby influencing the overall market interest rates.

What is the relationship between bond prices and interest rates as explained in the script?

-As interest rates rise, the prices of existing bonds fall. This is because newer bonds issued at the higher interest rates become more attractive, causing investors to discount the value of older bonds that pay lower rates of return.

How do investors respond to changes in bond yields, according to the script?

-Investors respond to changes in bond yields by adjusting their purchases. For instance, if a new bond offers a higher yield (such as 15% compared to an older bond with a 10% yield), investors may choose to sell the older bonds at a discount in order to invest in the higher-yielding bonds.

What role does the expected return play in investment decisions as per the script?

-Expected returns influence investment decisions by guiding investors toward the most profitable opportunities. In the case of bonds, investors may weigh the returns offered by different bonds, considering both the interest rate and any potential capital gains when making their investment choices.

What does the concept of capital gain mean in the context of bonds?

-Capital gain refers to the profit made when an investor buys a bond at a lower price than its value upon maturity. For example, if an investor buys a bond at a discounted price and holds it until maturity, they will gain the difference between the purchase price and the face value of the bond, which includes interest payments over time.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Motif Memegang Uang

Permintaan Uang, Kebijakan Moneter, Fungsi LM dan Keseimbangan Pasar (Man 21B)

Permintaan dan Penawaran Uang | Ekonomi SMA Kelas 11

Permintaan dan Penawaran Uang - Indeks Harga dan Inflasi Part 3 - Materi Ekonomi Kelas 11

TEORI PERMINTAAN UANG | Ekonomi Kelas XI

"PERMINTAAN DAN PENAWARAN UANG" MATERI EKONOMI KELAS 11

5.0 / 5 (0 votes)