How to trade deviations (best strategy!)

Summary

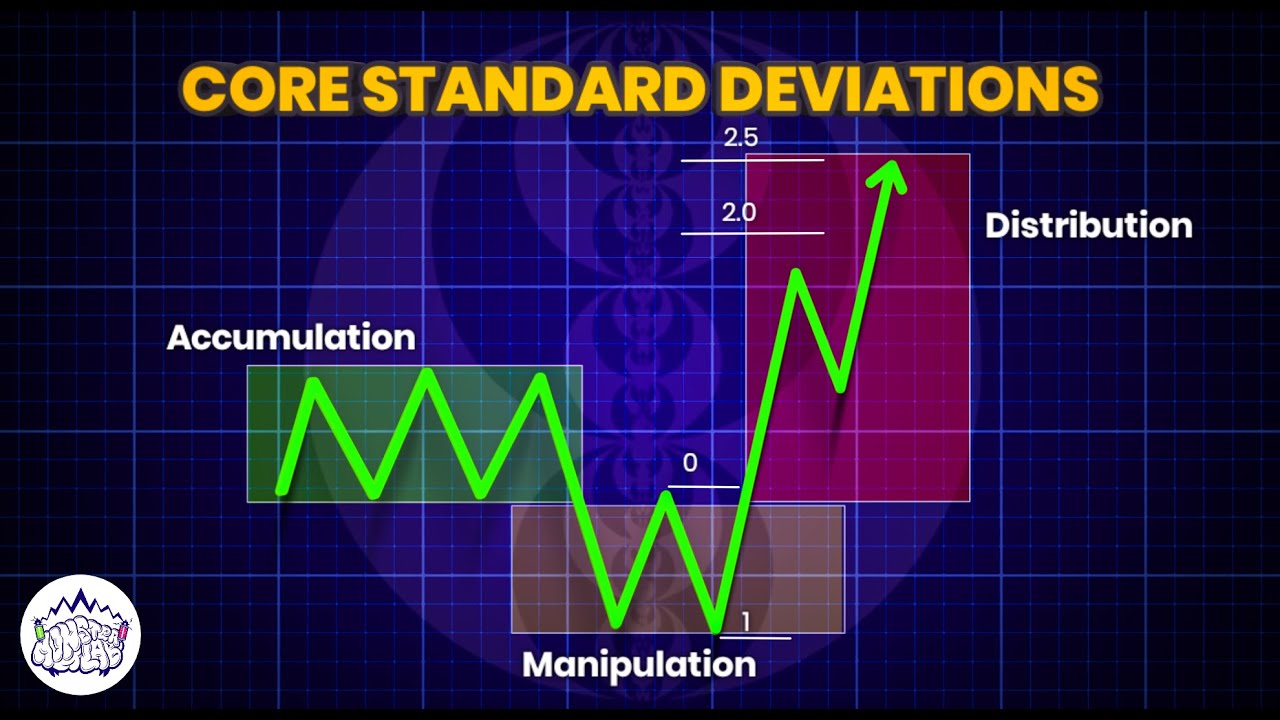

TLDRThis video explains the concept of trading deviations, focusing on how to avoid common mistakes and effectively capitalize on market movements. It covers what deviations are, why they occur, and the strategy to trade them. The key idea is that retail traders often react impulsively to price breaks, but smart money uses these movements to create liquidity and trap unsuspecting traders. By understanding market structure and waiting for key price actions like retests and sweeps, traders can align themselves with bigger players, setting up high-probability trades with excellent risk-reward ratios.

Takeaways

- 😀 A deviation occurs when the price breaks out above or below key levels, such as range highs or lows, after consolidating in a range.

- 😀 Liquidity pools are created above range highs and below range lows, where smart money can exploit retail traders' positions.

- 😀 Retail traders often make the mistake of breakout longing or breakdown shorting, not realizing they are entering a liquidity trap.

- 😀 Smart money uses breakout and breakdown points to absorb retail traders' positions, either by selling into buying pressure or buying into selling pressure.

- 😀 The reason we trade deviations is to capitalize on these liquidity pools, by trading against the majority of retail traders.

- 😀 To execute trades, first identify the range, then set alerts around the key levels like the range high and low.

- 😀 After price breaks a key level, wait for a perfect retest of the range low or high before considering an entry.

- 😀 A sweep of the first local low or high often happens after the retest, creating a fake break of structure that traps retail traders.

- 😀 After the local low or high is swept, wait for a price reclaim in conjunction with a valid break of structure to trigger an entry.

- 😀 Use aggressive entries with stops beneath or above the local lows/highs and set high risk/reward targets for maximum profitability.

- 😀 Deviation trading focuses on capturing high-probability setups with good risk/reward ratios, by aligning with market makers rather than following retail traders.

Q & A

What is a deviation in trading?

-A deviation occurs when the price, after establishing a range and key levels, breaks above the range high or below the range low. This breakout or breakdown creates a potential opportunity for traders to identify key price levels and understand market movements.

Why is it important to understand deviations in trading?

-Understanding deviations is important because they represent moments when retail traders often make mistakes by chasing breakouts. These deviations provide liquidity pools where big players can absorb trades, and understanding them allows traders to take advantage of these opportunities rather than following the crowd.

What common mistake do retail traders make when price breaks out of a range?

-Retail traders tend to enter positions as soon as the price breaks out of a range, either buying into a breakout or shorting into a breakdown. This reaction, driven by FOMO, often results in buying or selling at the wrong time, as they don’t realize they are entering a liquidity pool where smart money might unload or accumulate positions.

How does smart money use deviations to their advantage?

-Smart money takes advantage of deviations by accumulating or distributing larger positions using the liquidity provided by retail traders. They sell to retail traders who breakout long and buy from those who breakout short, essentially using their positions to fill their own bigger buy or sell orders.

What is the significance of liquidity in the context of deviations?

-Liquidity is crucial because it allows larger market players to execute substantial buy or sell orders without causing significant price changes. Deviations create liquidity pools above the range high and below the range low, which can be used by smart money to absorb retail trades and manipulate market direction.

How should a trader execute a trade after identifying a deviation?

-A trader should wait for the price to break out or break down, then look for a retest of the range high or low. After the retest, they should wait for a sweep of the local low or high, followed by a reclaim of the range. This setup ensures that the price is likely reversing and provides a better entry point for the trade.

What is meant by a 'sweep of the local low' in trading?

-A sweep of the local low occurs when the price briefly dips below the previous low, triggering stop-losses for those who are trading in the opposite direction. This creates a false break of structure, which is often used by smart money to trap retail traders into taking the wrong positions.

Why is it important to wait for a 'reclaim of the range low' before entering a trade?

-Waiting for a reclaim of the range low is important because it indicates that the price has reversed after a false break and that the market is likely to continue in the direction of the range. This helps traders avoid entering too early and ensures that the trade has a higher probability of success.

What does a 'break of structure' mean in the context of trading deviations?

-A break of structure refers to a significant shift in market direction, typically marked by a clear candle close above a local high or below a local low. This event confirms that the market has changed its behavior, and traders use it to confirm that the deviation is valid and the trend is reversing.

How can a trader improve the probability of success when trading deviations?

-To improve the probability of success, traders should follow a clear strategy that involves waiting for a perfect retest, a sweep of local lows, and a reclaim of the range. Additionally, combining these setups with proper risk management and understanding the market's behavior ensures higher-quality trades and better risk-to-reward ratios.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

【日本株爆益戦略④】超勝率が上がる大暴落回避パターン!!これを知れば損失回避&利益に繋がるぞ!!これで皆損失を回避してるで。米国株、FX、仮想通貨何でも使える‼️

Liquidity Sweeps Explained

Asian Range:- ICT Time and Price Theory

This ICT Model Prints Money — 70% Win Rate Explained!

Liquidity Tells You Everything (Beat Stop Loss Hunts)

Core Standard Deviations + PO3 | ICT Concepts | DexterLab

5.0 / 5 (0 votes)