Fiqh al-Muamalat | Topic 37: MURABAHAH (2) (Components of Muarabahah - Contracting Parties)

Summary

TLDRThis video script provides an in-depth exploration of the Murabaha contract, a key concept in Islamic finance. It covers essential elements such as the contracting parties (buyer and seller), legal competency requirements, the role of agents, and the process of contract formation through offer and acceptance. The script also discusses how modern communication methods, including e-signatures, align with Sharia law. The flexibility of Murabaha contracts is highlighted, with an emphasis on additional stipulations and conditions that do not violate Sharia principles. The complexity of these contracts is explained, noting that most conditions are designed to manage risks and comply with legal and market practices.

Takeaways

- 😀 The contracting parties in a Murabaha contract are the buyer and the seller, as it is a sales-based contract.

- 😀 The contracting parties must have the legal capacity to enter into the Murabaha contract, which includes competency requirements like age, mental soundness, and legal documentation.

- 😀 Murabaha contracts can involve natural persons or legal entities (e.g., corporations), and agents may act on behalf of either party.

- 😀 The Murabaha contract is established through an offer and acceptance process, which can be done through various communication methods such as verbal communication, e-signatures, or online platforms.

- 😀 Offer and acceptance can be expressed through traditional methods (e.g., signing documents) or digital means (e-signatures, online agreements), all of which are valid under Sharia law as long as they do not contradict its principles.

- 😀 Sharia law allows the addition of non-Sharia conditions in the contract, as long as these conditions do not make permissible actions impermissible or vice versa.

- 😀 While Sharia law provides basic guidelines, contracting parties are free to add additional conditions to manage their risks and interests, as long as these do not violate Sharia principles.

- 😀 The age requirement for competency is crucial, as it determines whether an individual can legally enter into a Murabaha contract.

- 😀 Sharia law places minimal restrictions on transaction conditions, offering flexibility to the parties involved in the Murabaha contract to include terms as needed for business or legal reasons.

- 😀 The conditions stipulated by the contracting parties are typically more extensive than the Sharia requirements, as these parties address their interests and potential risks, resulting in contracts that may include numerous pages of terms and conditions.

Q & A

What are the main parties involved in a Murabaha contract?

-The main parties involved in a Murabaha contract are the buyer and the seller. It is a sales-based contract rather than a lease.

What are the key components of a Murabaha contract?

-The key components of a Murabaha contract are the buyer and seller, offer and acceptance (syria), subject matter, and price.

Why is the concept of buyer and seller central to Murabaha contracts?

-The concept of buyer and seller is central to Murabaha because it is a sales contract, where the buyer purchases assets from the seller at an agreed price, rather than a lease or loan agreement.

What legal requirements must contracting parties meet to enter a Murabaha contract?

-Contracting parties must meet legal competency requirements, such as age and mental soundness. For individuals, the required age is typically 18 years, while legal entities must be recognized and compliant with the law.

Can a Murabaha contract involve legal entities or just individuals?

-Yes, a Murabaha contract can involve both natural persons (individuals) and legal persons (such as corporations).

Is it possible for someone to enter into a Murabaha contract through an agent?

-Yes, parties can enter into a Murabaha contract either directly or through an agent. The agent must act within the scope of the authority granted by the principal.

How is the offer and acceptance process carried out in a Murabaha contract?

-Offer and acceptance in a Murabaha contract are typically carried out through communication, which can be verbal, via phone, social media, internet platforms, or formal meetings. E-signatures are also an accepted method.

Can the offer and acceptance process be done digitally in Murabaha contracts?

-Yes, the offer and acceptance process can be done digitally, such as through emails, e-signatures, or online platforms, especially in modern circumstances where transactions are increasingly conducted remotely.

What role do stipulations and additional conditions play in Murabaha contracts?

-Both parties in a Murabaha contract can stipulate additional conditions to protect their interests, as long as these conditions do not violate Sharia law. These additional stipulations are common in complex contracts.

Are there any restrictions on the types of conditions that can be added to a Murabaha contract?

-Yes, conditions can be added to a Murabaha contract, but they must not contravene Sharia principles. Conditions cannot make the non-permissible permissible or vice versa.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Fiqh al-Muamalat | Topic 36: Murabahah (1)

Desain Kontrak Syariah_Manajemen Perbankan dan Keuangan SYariah

Advokasi EkSya 11 - Murabahah dan Sengketa di Pengadilan Agama

#2 Types of Islamic Finance - ACCA / CPA / SFM -By Saheb Academy

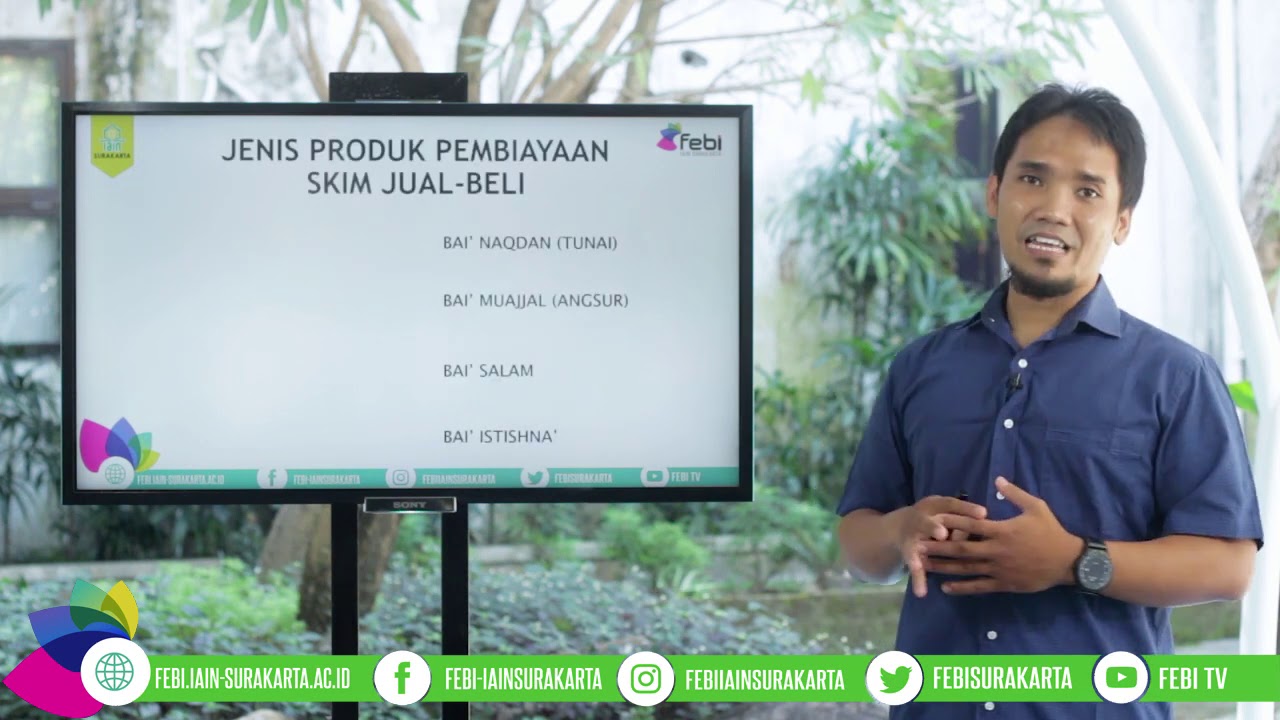

Manajemen Pembiayaan Bank Syariah Bagian 1 | Rais Sani Muharrami, M.E.I

Business law, lecture 1 ,BBA 3rd sem,MG University

5.0 / 5 (0 votes)