Regresi Data Panel Eviews 12 Lengkap dengan Penjelasannya

Summary

TLDRIn this tutorial, the presenter demonstrates how to perform panel data regression using EViews 12, with a focus on analyzing financial data of Sharia banks from 2017 to 2021. The steps include model selection using Chow, Hausman, and LM tests, followed by assumption tests for multicollinearity and heteroscedasticity. The tutorial also covers hypothesis testing for the impact of variables like FDR, NPF, and Bopo on ROA. The analysis concludes with the calculation of R-squared and a discussion of the model's explanatory power, offering a clear and comprehensive guide to panel data regression in EViews 12.

Takeaways

- 😀 The tutorial focuses on panel data regression using EViews 12, with a specific example involving five Islamic banks over five years (2017-2021).

- 😀 The tutorial explains how to set up a balanced panel dataset with 5 cross-sections and 5 time series, making a total of 25 observations.

- 😀 The first hypothesis tests the effect of FDR (Financing to Deposit Ratio) on ROA (Return on Assets), with results indicating no significant effect of FDR on ROA.

- 😀 The second hypothesis tests the effect of NPF (Non-Performing Financing) on ROA, which is found to have a significant effect.

- 😀 The third hypothesis examines the effect of BOPO (Operating Expenses to Operating Income Ratio) on ROA, showing a significant positive relationship.

- 😀 The tutorial discusses how to conduct model selection tests using EViews, starting with a Chow test to select between Fixed Effects (FE) or Random Effects (RE).

- 😀 The Chow test results indicate that Fixed Effects Model (FM) is selected, followed by further testing using Hausman and LM tests.

- 😀 The Hausman test suggests using the Random Effects Model (RE), while the LM test confirms that the final model choice is the Common Effects Model (CEM).

- 😀 Classical assumption tests, such as multicollinearity and heteroskedasticity, are performed. The results show that multicollinearity is not an issue, but heteroskedasticity is present in some variables (X2 and X3).

- 😀 Heteroskedasticity is addressed using transformation methods, and the tutorial emphasizes the importance of checking residual plots for further validation.

- 😀 The regression results are presented, showing that when the coefficients for the independent variables are positive, they positively impact ROA, while negative coefficients indicate a negative relationship.

- 😀 Hypothesis testing results indicate that NPF and BOPO are significant predictors of ROA, while FDR does not have a significant effect. The F-test results confirm that all three variables (FDR, NPF, and BOPO) collectively influence ROA.

- 😀 The coefficient of determination (adjusted R-squared) is 97.75%, indicating a very strong explanatory power of the model in predicting ROA.

Q & A

What is the purpose of this tutorial?

-The tutorial provides a step-by-step guide on performing panel data regression using EViews 12, complete with explanations for each stage of the analysis.

What kind of data is used in this tutorial?

-The data used is panel data, which combines cross-sectional data (5 Islamic banks) with time-series data (5 years, from 2017 to 2021).

What is the model selection process discussed in the video?

-The model selection process involves several tests: the Chow test (for model selection), Hausman test (for choosing between fixed or random effects), and LM test (for determining the most suitable model).

How are the hypothesis tests structured in the tutorial?

-There are four hypotheses tested. Hypothesis 1 tests the effect of FDR on ROA, Hypothesis 2 tests the effect of NPF on ROA, Hypothesis 3 tests the effect of BOPO on ROA, and Hypothesis 4 tests these variables together in a simultaneous test.

What does the outcome of the Chow test indicate in this tutorial?

-The Chow test result (p-value of 0.0242) is less than 0.05, which suggests the model with fixed effects (FM) is preferred over the random effects model (CM).

How is the Hausman test used in this context?

-The Hausman test is conducted after selecting the fixed effects model. The p-value (0.1658) indicates that the random effects model (RM) is more appropriate in this case.

What does the LM test conclude in the regression process?

-The LM test result (p-value of 0.9345) suggests the use of the random effects model (CM), as the p-value is greater than 0.05.

What are the assumptions tested in the regression analysis?

-The assumptions tested include multicollinearity and heteroskedasticity. These tests help validate the model's reliability.

What does the multicollinearity test show in the tutorial?

-The multicollinearity test shows that the correlation coefficients between variables are all below 0.85, meaning the model passes the multicollinearity test and is not affected by it.

What is the result of the heteroskedasticity test, and how is it interpreted?

-The heteroskedasticity test indicates that there is no heteroskedasticity in the data, as the residuals remain within an acceptable range of ±500.

How are the hypothesis tests (T-tests) interpreted in the context of this tutorial?

-The T-tests for variables X1, X2, and X3 suggest that only NPF (X2) and BOPO (X3) significantly affect ROA, while FDR (X1) does not, based on the p-values and the comparison with the critical value.

What is the coefficient of determination, and what does it tell us?

-The coefficient of determination (R-squared) is 0.977, indicating that 97.75% of the variance in ROA can be explained by the independent variables FDR, NPF, and BOPO.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

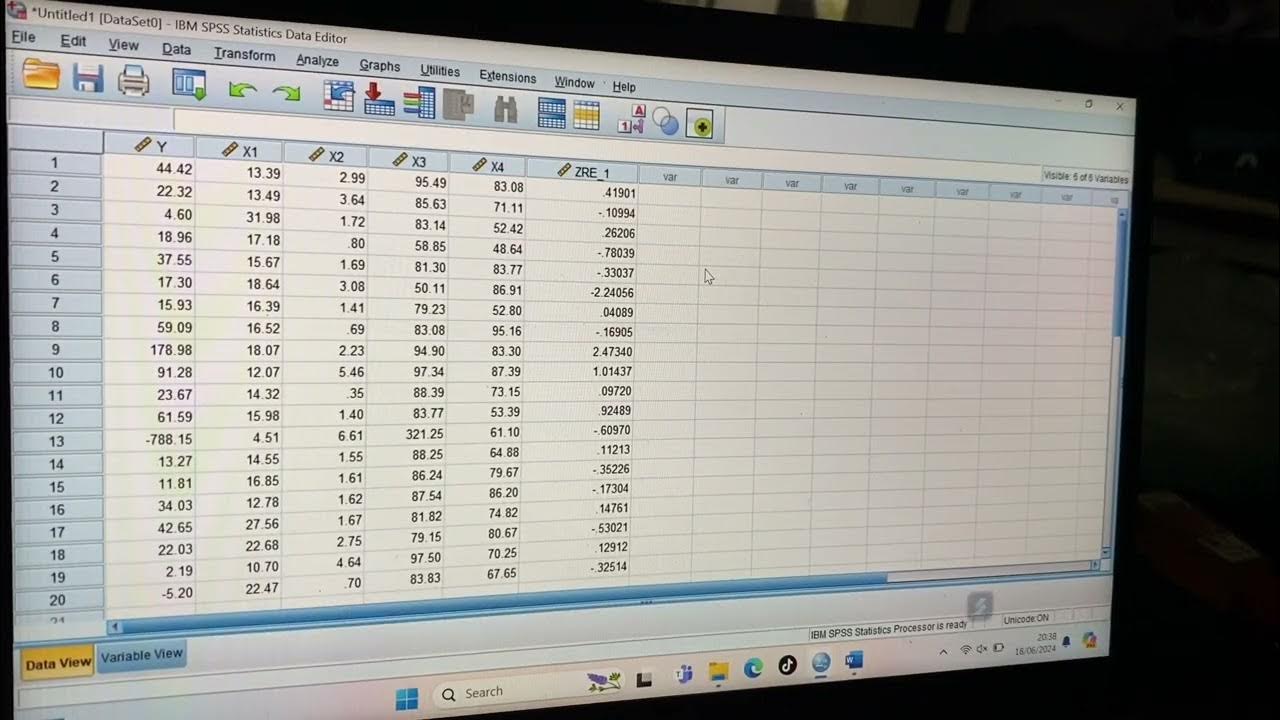

Tutorial Menggunakan Spss untuk data Panel

Cara Menghitung Analisis Regresi Sederhana secara Manual

REGRESI DENGAN DUMMY VARIABEL LEBIH DARI 2 KATEGORI Oleh Agus Tri Basuki Part 2

Week 4 - Soil Data Analysis

Machine Learning Tutorial Python - 8: Logistic Regression (Binary Classification)

Cara Analisis Regresi Linear Berganda dengan Jamovi

5.0 / 5 (0 votes)