Finding Entries Into Trend - ICT Concepts

Summary

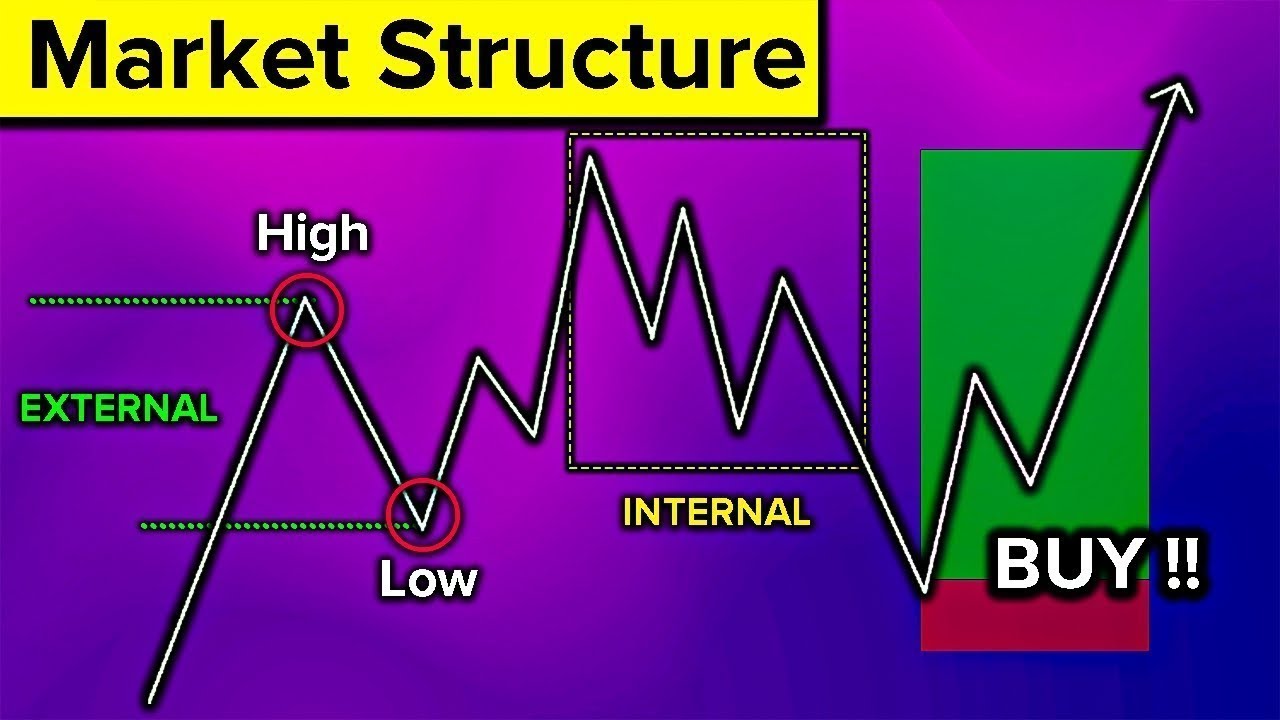

TLDRThis video delves into advanced trading strategies for entering trends effectively. The speaker explains how to identify and enter bullish and bearish trends through inducement setups, mitigation block entries, and cheat code entries. Emphasis is placed on using aggressive price movements, fair value gaps, and lower timeframe setups to manage risk and target objectives. The video also showcases practical examples of these strategies in action, offering viewers a clear understanding of how to apply these techniques for higher-reward trades with minimal risk.

Takeaways

- 😀 A trend is defined as an aggressive move towards an objective, such as a 4-hour or daily order block.

- 😀 There are four main ways to enter a trend: inducement setup, mitigation block entry, cheat code entry, and lower time frame fair value gap entry.

- 😀 In a bullish trend, an inducement setup involves raiding stop levels and waiting for a retracement before entering long.

- 😀 In a bearish trend, a high is broken, followed by a retracement back into the range, then targeting a lower objective.

- 😀 Mitigation block entries involve taking a position when an aggressive trend breaks a previous high, then retests the level for entry.

- 😀 Cheat code entry occurs immediately after a key candle closes, entering at the open of the next candle with a small stop loss.

- 😀 Lower time frame fair value gaps are used for precise entries by watching smaller time frames (e.g., 15-second charts) for setups.

- 😀 When price fails to displace below a low in a bearish trend, it suggests the trend may continue downward, providing a shorting opportunity.

- 😀 Tight stop losses are crucial to improving risk-to-reward ratios, often set one point above or below key price levels.

- 😀 Using smaller candles (mitigation blocks) can confirm trend direction and help traders enter positions with minimal risk.

Q & A

What is the definition of a trend according to the speaker?

-The speaker defines a trend as an aggressive move reaching towards an objective, such as a 4-hour point of interest or order block, with the price action aggressively targeting these areas.

What are the four ways the speaker looks to enter a trend?

-The four ways to enter a trend are: 1) Inducement setups, 2) Mitigation block entry, 3) Cheat code entry, and 4) Lower time frame models or fair value gap setups.

What is an inducement setup in a bullish trend?

-In a bullish trend, an inducement setup involves raiding stops, moving back into the range, and then entering a long position to target a higher objective or high.

How does the mitigation block entry work?

-The mitigation block entry involves taking a position after an aggressive trend up when a down-close candle forms. If the high is invalidated or broken, the trader enters when the price retests the high or the open of the candle with a stop placed at the low.

What is a 'cheat code entry' in trading?

-A 'cheat code entry' is an entry strategy where the trader enters a position immediately after the close of a key candle, taking a position at the open of the next candle, with a tight stop and expecting the trend to continue.

How does the speaker use fair value gaps in a trending market?

-The speaker uses fair value gaps to identify potential entry points, but prefers to look for lower time frame setups to avoid large stop losses typically associated with trending markets.

How does the speaker handle risk when entering a trade based on a fair value gap?

-When entering a trade based on a fair value gap, the speaker typically uses a smaller time frame like the 1-minute or 15-second chart and sets a tight stop, such as a 4-point stop instead of a larger stop.

What does 'displacement' mean in the context of trend trading?

-Displacement refers to a significant movement of price in the direction of the trend, indicating a strong momentum. The speaker uses displacement to assess whether a trend is likely to continue or reverse.

What is a turtle soup entry?

-A turtle soup entry involves shorting above a high in a bearish trend, with a fixed stop loss, expecting more downside movement based on the idea that the market will reverse after reaching a certain high.

How does the speaker approach a situation when a high in a bearish trend is not displaced?

-When a high in a bearish trend is not displaced, the speaker watches for an inducement setup where the price reaches a high, and then enters short either immediately or after the price moves back into the range, targeting a lower objective.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

🔴 (98% WINRATE STRATEGY) Combines 3 Important Tools: The MACD, Stochastic Oscillator, and RSI

The Exact Supply Demand System That Makes Me $100k/mo (Full Guide)

Market Structure Simplified (For Beginner to Advanced Traders)

market trend analysis strategies

Advanced Market Structure Course (Full Tutorial)

How To Improve Day Trading Entries (Timeframe Alignment)

5.0 / 5 (0 votes)