Mengelola Dokumen Transaksi#Akuntansi#Part1#SMKTarakanita

Summary

TLDRIn this educational video, the speaker from SMK Tarakanita introduces basic accounting concepts, focusing on managing transaction documents. The video explains the importance of transaction proofs in accounting and discusses various types, such as internal and external transaction evidence. Examples like receipts, cash notes, invoices, credit and debit notes, memos, checks, and giro slips are introduced, along with their specific use cases. The video also provides guidance on how to properly create and identify these documents, emphasizing their significance in maintaining accurate financial records.

Takeaways

- 📄 Every transaction must be supported by transaction documents, known as business papers, to ensure proper accounting records.

- 🏢 Transaction documents are classified into two types: internal documents created by the company and external documents provided by external parties.

- 🧾 Receipts serve as payment proof and must be stamped based on applicable regulations (IDR 3,000 for payments between IDR 200,000 - 1,000,000, and IDR 6,000 for payments above IDR 1,000,000).

- 🛒 Cash notes (Nota Kontan) are used as proof of cash purchases, and the original is given to the buyer, while the copy is kept by the seller.

- 📜 Invoices (Faktur) are used for credit transactions, and they serve as proof for both the buyer and seller for sales and purchase of goods or services.

- 📉 Credit notes (Nota Kredit) are used by the seller to reduce accounts receivable when goods are returned or adjustments are made.

- 📊 Debit notes (Nota Debet) are issued by the buyer to adjust or return goods that do not meet the order specifications.

- 📝 Memorial vouchers are internal transaction records, typically used for internal adjustments or memos from management to accounting departments.

- 💸 Checks are payment orders given to a bank, instructing them to pay a specified amount to a person or bearer.

- 🏦 Bilyet Giro is a transfer order issued by a customer to their bank to transfer funds to another account holder.

Q & A

What is the importance of transaction evidence in accounting?

-Transaction evidence is crucial in accounting because it supports each financial transaction. Without it, transactions cannot be recorded, ensuring that all financial records are based on actual, factual events.

What are the two main sources of transaction evidence?

-Transaction evidence comes from two main sources: internal and external. Internal evidence is created within the company, while external evidence comes from outside parties involved in the transaction.

What are some examples of internal transaction evidence?

-Internal transaction evidence includes documents such as memos or internal records generated by the company to track financial activities.

What are some examples of external transaction evidence?

-Examples of external transaction evidence include receipts, invoices, checks, and bilyet giro, which are provided by third parties or customers outside the company.

How is a receipt (kwitansi) structured, and when is it used?

-A receipt is used as proof of payment. It includes details like the date, recipient, amount, purpose of payment, and the issuer's signature. If the amount exceeds a certain threshold, a stamp is required, such as a 3000 IDR stamp for amounts up to 1 million IDR and a 6000 IDR stamp for amounts above 1 million IDR.

What is a cash note (nota kontan), and how does it differ from a receipt?

-A cash note is a proof of purchase issued by the seller for cash transactions. Unlike a receipt, which shows payment, a cash note details the goods sold, their quantity, and price. The original is given to the buyer, while a copy is kept by the seller.

What is the purpose of an invoice or faktur?

-An invoice serves as proof of a credit sale. It is issued by the seller to the buyer, detailing the goods or services provided, the total cost, and the payment terms, which typically allow the buyer to pay within a specified period, such as 30 days.

How does a credit note (nota kredit) function?

-A credit note is issued by the seller to reduce the buyer's outstanding debt, often due to returned goods or a pricing error. It indicates that the buyer’s account has been credited.

What is a debit note (nota debet), and when is it issued?

-A debit note is issued by the buyer to reduce the amount owed to a seller, usually due to returned goods or overcharged amounts. It decreases the buyer's payable amount.

What is the difference between a check (cek) and a bilyet giro?

-A check is a written order to a bank to pay a specific amount to the bearer or the person named on the check, while a bilyet giro is an instruction for the bank to transfer funds from one account to another without physically handing over cash.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

KONSEP AKUNTANSI PENDAPATAN - AKUNTANSI INSTANSI PEMERINTAH (Part 1)

Macam - macam Bukti Transaksi

BELAJAR AKUNTANSI DASAR SAMPAI PAHAM! Langsung Jago Akuntansi

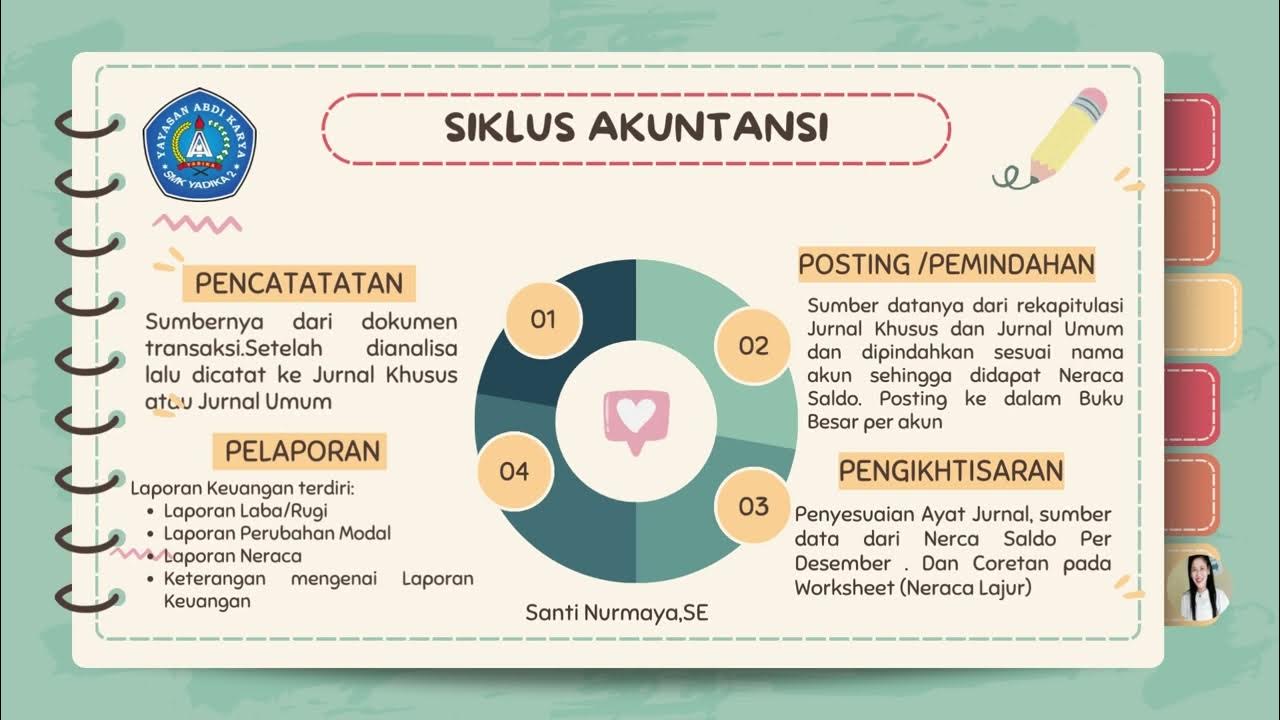

Mengelola Jurnal Khusus dan umum,Buku Besar, Laporan Keuangan Perusahaan Jasa,Dagang dan Manufaktur.

Persamaan Dasar Akuntansi Perusahaan Jasa bag-2 #belajardirumah #ekonomi kelas 12

Procedimentos Contábeis Básicos

5.0 / 5 (0 votes)