Day Trader gives advice on getting entries

Summary

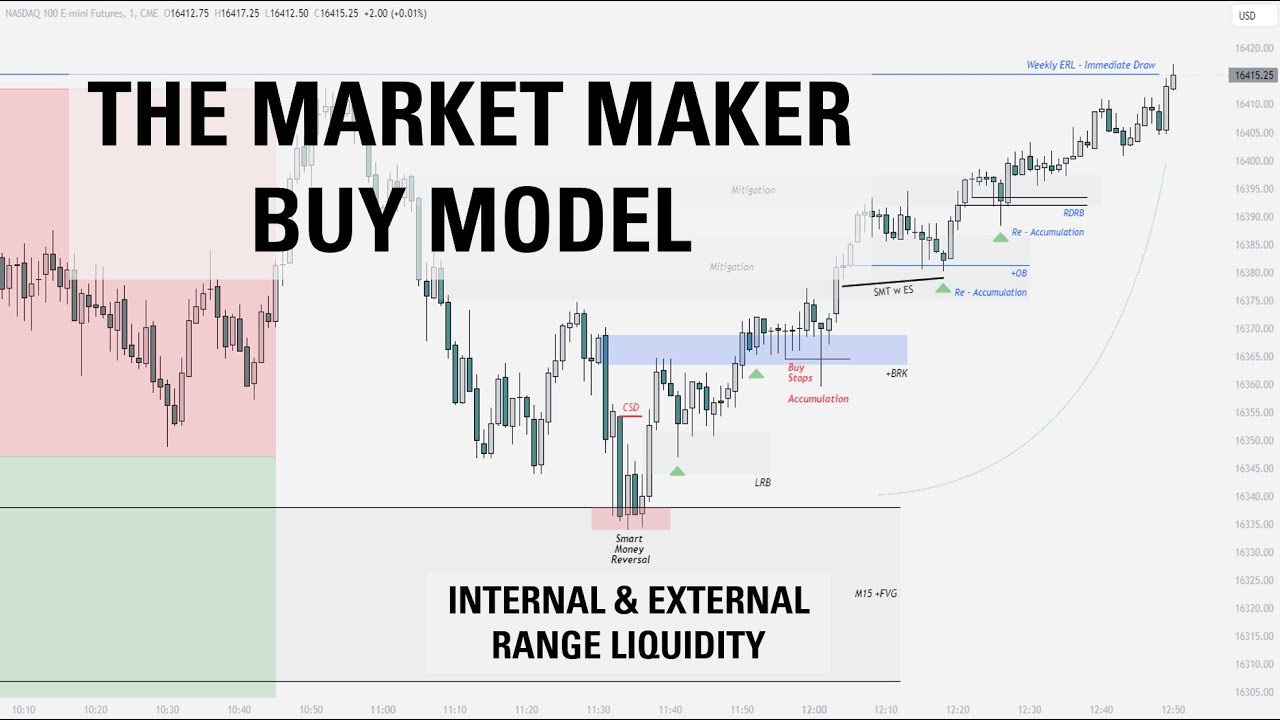

TLDRThis video tutorial explains a simple, step-by-step approach to identifying and executing successful trades. The focus is on using support and resistance levels to guide buy and sell decisions, primarily on the 30-minute time frame. The trader highlights key patterns, such as breakouts and pullbacks, to predict price movements. Emphasis is placed on following the trend, entering after key price reactions, and using tight stop losses for risk management. The trader also provides practical insights on trade execution for Forex pairs, offering tips for both beginners and more experienced traders.

Takeaways

- 😀 Identify key support and resistance levels on a chart to guide trade decisions.

- 😀 Support is the price level where price tends to stop falling and begins to rise.

- 😀 Resistance is the price level where price tends to stop rising and begins to fall.

- 😀 Look for a breakout above resistance or below support to determine market direction.

- 😀 After a breakout, wait for a pullback before entering a trade, confirming the trend is continuing.

- 😀 Use multiple timeframes (e.g., 30 minutes, 1 hour) to assess market conditions and find trade setups.

- 😀 Once price breaks above a key resistance, it is likely to continue rising, making it a signal to buy.

- 😀 Set stop losses for Forex trades between 5 to 15 pips, depending on your trading style and pair.

- 😀 Target a risk-to-reward ratio of 1:3 or 1:5 to ensure profitable trades.

- 😀 Follow the market trend to maximize profitability—this strategy works best when aligned with the trend.

- 😀 Real-time examples, such as the NASDAQ trade, demonstrate how to apply support and resistance analysis to make trading decisions.

Q & A

What is the first step in analyzing a trade setup according to the script?

-The first step is to identify a key support or resistance level on the chart. Support is where the price tends to rise after falling, and resistance is where the price tends to reverse after rising.

How do you define resistance and support for beginners?

-Resistance is the price level at which the price stops rising and starts to fall, while support is the price level at which the price stops falling and starts to rise again.

What does it mean when price breaks above a resistance level?

-When price breaks above a resistance level, it suggests that the buying pressure is strong enough to push the price higher, and this can signal a potential continuation of an uptrend.

Why does the trader delete certain levels after marking support and resistance?

-The trader deletes unnecessary levels once they are confirmed as irrelevant for the current trade setup, focusing only on the levels that provide actionable insights.

What is the importance of the pullback after a breakout?

-The pullback after a breakout is important because it offers an opportunity to enter the trade with a lower risk, as it confirms that the breakout level is being respected before price continues in the desired direction.

What should you do once price breaks back above a previously identified resistance level?

-Once price breaks back above a previously identified resistance level, it's an indication to enter a buy position, as this suggests the continuation of the bullish trend.

How do you determine your target after a breakout and pullback?

-Your target is typically set at the next significant resistance level in an uptrend or the next support level in a downtrend, based on the previous price action and trend direction.

What is the suggested stop loss distance for Forex pairs?

-For Forex pairs, the suggested stop loss is between 5 to 15 pips, depending on the volatility of the market and personal risk tolerance.

What is the recommended risk-to-reward ratio for trades according to the script?

-The recommended risk-to-reward ratio is 1:3 or 1:5, meaning you should aim to make three to five times the amount you're willing to risk on a trade.

Why is following the trend emphasized as important in the script?

-Following the trend is important because it increases the probability of success in your trades. By aligning your trades with the prevailing market trend, you're more likely to capitalize on large price movements.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

This Secret Trading Plan Will Skyrocket Your Profits! | The Best ICT & SMC trading strategy #SMC#ICT

BEST US30 STRATEGY IN 2024

Market Maker Models Explained | Step By Step Approach | ICT Concepts

2022 ICT Mentorship Episode 2

The Market Maker Buy Model | Full Trade Breakdown $NQ

Best Order Block Trading Strategy of All Time!

5.0 / 5 (0 votes)