This Secret Trading Plan Will Skyrocket Your Profits! | The Best ICT & SMC trading strategy #SMC#ICT

Summary

TLDRThis episode of 'Smart Risk' introduces the 'Whale Scoop' trading model, a strategy designed to enhance win rates by leveraging liquidity sweeps and stop hunts in key market areas. The video offers a step-by-step guide on identifying valid whale scoop patterns, executing trades with both aggressive and conservative entry models, and emphasizes the importance of backtesting for successful trading. Real trade examples illustrate the model's application, aiming to help traders become consistently profitable.

Takeaways

- 🚀 The 'whale scoop model' is an exclusive trading strategy that aims to revolutionize market approach and potentially increase win rates significantly.

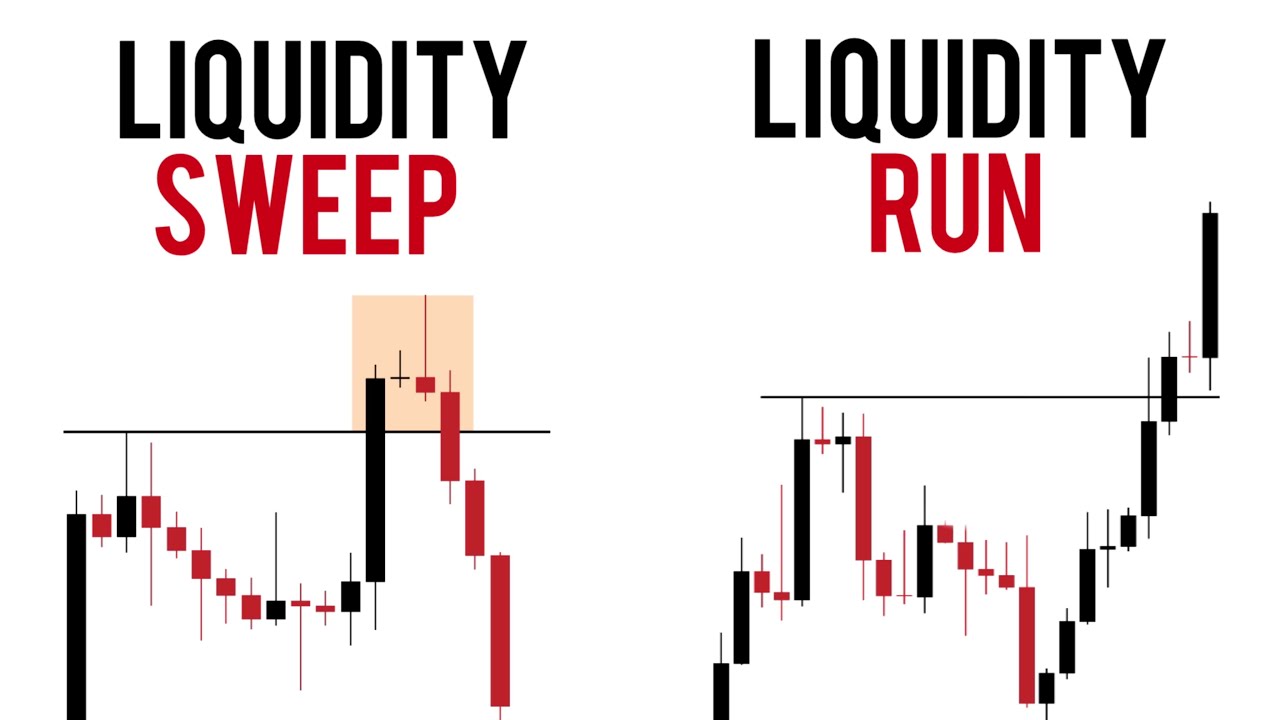

- 🧠 The core mindset of the model involves recognizing liquidity sweeps and stop hunts in key static liquidity areas, such as major highs and lows, to capitalize on market sentiment shifts.

- 💡 The model is based on the idea that after a key static liquidity pool is cleared out, the price often moves towards the opposing side's liquidity, aligning with the market's overall direction.

- 📈 Traders should consider the whale scoop as a high probability setup, especially when liquidity below a recent low has been swept, triggering stop losses and increasing buying pressure.

- 🔍 Identifying valid whale scoop patterns on a price chart is crucial and involves looking for specific candlestick patterns that sweep out recent key areas and then immediately reverse direction.

- 🕰 The whale scoop often features a long wick, especially on higher time frames, and the subsequent candles should not exceed the initial candle's body or wick in determining pattern validity.

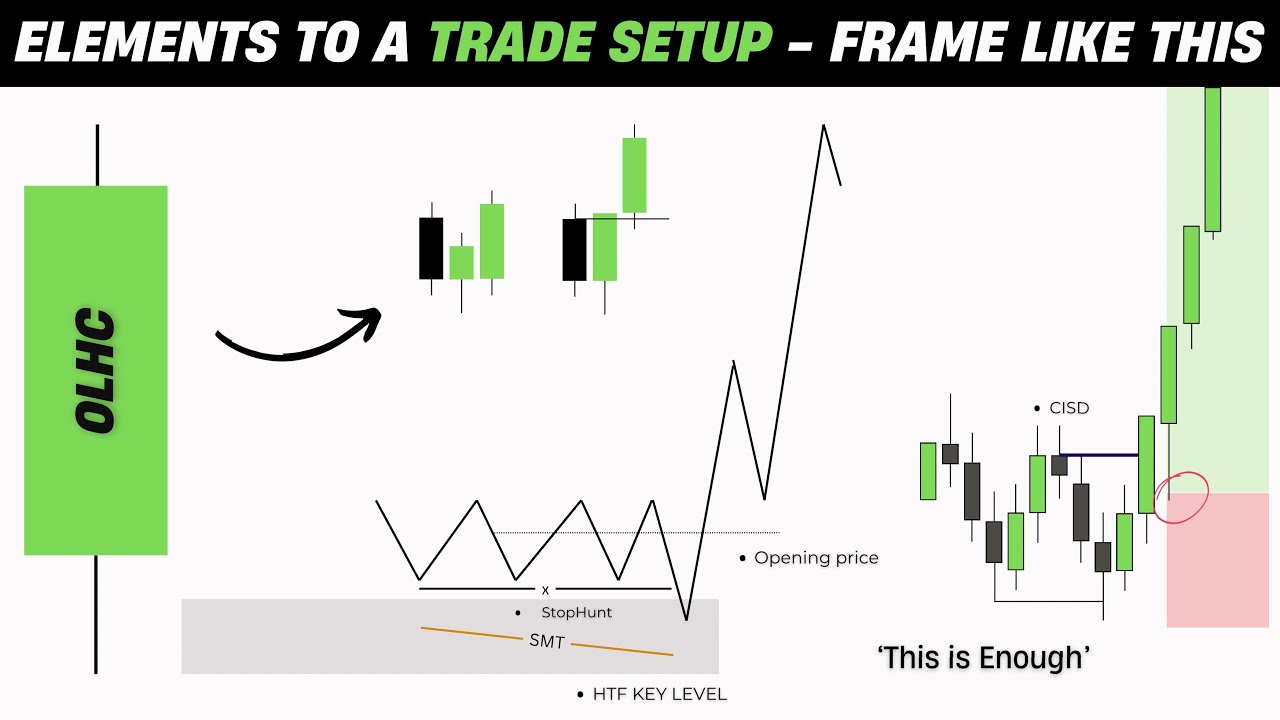

- 📉 Two main entry models are discussed: the aggressive entry model, which uses a single time frame for analysis and execution, and the conservative entry model, which uses two time frames for analysis and confirmation before execution.

- 📝 Backtesting is emphasized as a critical step in the trading journey, with the recommendation to test strategies at least 100 times before applying them to a real account.

- 📉 Real trade examples are provided to illustrate the application of the whale scoop model, demonstrating how to identify patterns and execute trades with both aggressive and conservative entry models.

- ⏳ The importance of timing is highlighted, noting that there are specific times on the chart when the whale scoop plan is more likely to be successful.

- 🔗 The video encourages viewers to subscribe, engage with the content, and provide feedback for future topics, emphasizing the value of community interaction in enhancing the trading experience.

Q & A

What is the main purpose of the 'whale scoop' trading model discussed in the video?

-The 'whale scoop' trading model is designed to revolutionize the way traders approach the market, with the potential to significantly increase their win rates by identifying specific liquidity sweep patterns and capitalizing on market sentiment shifts.

What are the key liquidity areas that the whale scoop model focuses on?

-The model focuses on key static liquidity areas such as major highs and lows, key supply and demand zones, and other external range liquidity areas in the market.

How does the whale scoop model take advantage of market behavior after a liquidity sweep?

-The model exploits the market behavior where, after a liquidity sweep on one side (buy or sell), there is often an immediate reversal in the intended direction, causing a shift in market sentiment and attracting traders to the side where liquidity has yet to be cleared out.

What is considered a high probability setup in the whale scoop model?

-A high probability setup in the whale scoop model occurs when liquidity below a recent low has been swept, triggering many stop losses, leading to a sharp increase in buying pressure and bullish momentum.

How does the whale scoop model identify valid patterns from a candlestick perspective?

-The model identifies valid patterns by looking for a sequence of candles that sweep out a recent key area, followed by an immediate return to the key area's range and a rapid market shift. A critical rule is that none of the subsequent candles' bodies or wicks should exceed the initial candle that triggered the whale scoop.

What are the two main entry models for executing trades with the whale scoop trading strategy?

-The two main entry models are the aggressive entry model, which uses a single time frame for analysis and trade execution, and the conservative entry model, which employs two different time frames for market analysis and entry confirmation.

How does the aggressive entry model work in the whale scoop model?

-In the aggressive entry model, traders identify a valid whale scoop pattern and execute orders within the same time frame. They wait for an engulfing candle that engulfs the previous candles of the whale scoop and set their entry at the closure of this candle.

What is the conservative entry model in the whale scoop trading strategy?

-The conservative entry model uses a higher time frame for market analysis and a lower time frame for entry confirmation and order execution. Traders switch to a lower time frame after detecting a valid whale scoop on the higher time frame and wait for a valid change of character pattern to confirm the market structure shift.

Why is backtesting important in trading, and what tool is mentioned in the video for this purpose?

-Backtesting is crucial as it allows traders to evaluate the performance of a trading strategy before applying it to a real account. The video mentions the Trader Edge platform as a tool for backtesting exclusive trading strategies.

Can you provide an example of how the whale scoop model is applied in a real trade scenario?

-In one of the examples provided, the price breaks below a structure with inefficiency, marking an unmitigated supply zone. After a brief pause, the price retraces upward, enters the supply zone, and triggers stop losses. The price then reverses direction, closing below the supply area with an engulfing candle, forming a valid whale scoop pattern. This scenario is an opportunity to execute a sell order using the aggressive entry model of the whale scoop model.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Liquidity Run Or Liquidity Sweep ( Purge Or Bos )

How Smart Money Manipulate YOUR Trades….(leaked video)

How To Identify Liquidity in Trading (SMC Trading)

ICT Mentorship Core Content - Month 04 - Liquidity Pools

ICT Concepts - Elements To A Trade Setup

Backtesting a Simple ICT Entry Model Using FX Replay!

5.0 / 5 (0 votes)