Konsep Dasar Akuntansi Biaya dan Akuntansi Manajerial

Summary

TLDRIn this presentation on managerial accounting, the speaker introduces the fundamental concepts and classifications of costs. Key topics include cost classification based on function (production vs. period costs), traceability (direct vs. indirect costs), and three types of production costs: direct materials, direct labor, and overhead. Using relatable examples such as making fried bananas, the speaker explains how different costs are categorized and their impact on cost management. This overview sets the stage for deeper exploration into cost flows and financial reporting in manufacturing settings.

Takeaways

- 😀 The speaker introduces himself as an expert in managerial accounting with over 15 years of teaching experience at Universitas Airlangga.

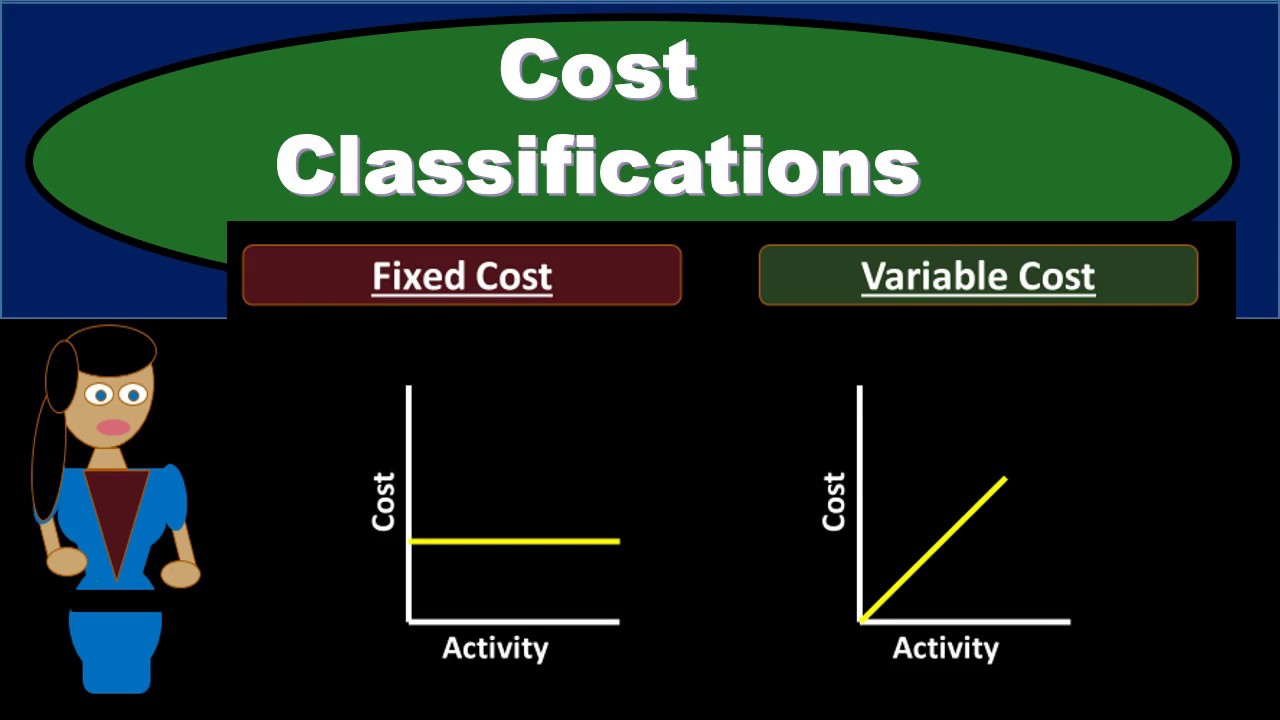

- 😀 The lecture focuses on the basic concepts and principles of managerial accounting, with a specific emphasis on cost classifications.

- 😀 A key concept introduced is the **cost object**, which refers to anything that receives attention from management regarding cost allocation (e.g., product, customer, department).

- 😀 Costs are classified into two main categories based on function: **product costs** (related to production) and **period costs** (related to time, not production).

- 😀 **Product costs** include direct materials, direct labor, and manufacturing overhead, while **period costs** cover items like sales, marketing, and administrative costs.

- 😀 Another key classification is based on **traceability**, distinguishing between **direct costs** (easily traceable to products) and **indirect costs** (difficult to trace).

- 😀 Direct costs include direct materials (like bananas) and direct labor (like cooks), while indirect costs include items like factory rent and utilities.

- 😀 **Overhead costs** are all the indirect production costs that are not direct materials or direct labor. Examples include factory utilities and depreciation on machinery.

- 😀 Real-world examples, such as the production of fried bananas, help clarify how costs are categorized as direct materials, direct labor, or overhead.

- 😀 **Depreciation** is explained as an example of an indirect cost, where the cost of a long-term asset (e.g., frying pans) is allocated over time rather than accounted for as a direct material expense.

- 😀 The importance of understanding cost classifications is emphasized for effective managerial decision-making, such as setting prices, controlling costs, and maximizing efficiency.

Q & A

What is the main focus of the lecture in the video?

-The lecture focuses on introducing the basic concepts of managerial accounting, particularly cost classification, and the principles involved in cost management, specifically production costs and period costs.

What are the two main categories of costs based on their function?

-The two main categories of costs based on their function are product costs and period costs. Product costs are directly related to the production of goods or services, while period costs are not directly related to production but are necessary for business operations.

How are product costs and period costs different from each other?

-Product costs are associated with the production process and vary with production volume, while period costs are incurred over a specific time period and are not tied to production. For example, production costs might include raw materials and direct labor, whereas period costs could include rent, administrative salaries, and promotional expenses.

What are direct costs and indirect costs based on traceability?

-Direct costs are those that can be easily traced to a product or service, such as raw materials and direct labor. Indirect costs are more difficult to trace to a specific product and typically include overhead expenses like rent, utilities, and factory maintenance.

What are the three types of production costs mentioned in the video?

-The three types of production costs are direct materials, direct labor, and manufacturing overhead. Direct materials are the raw materials used in production, direct labor refers to wages paid to workers directly involved in production, and manufacturing overhead includes indirect costs associated with production.

Can you provide an example of direct materials in the context of a fried banana business?

-In the context of a fried banana business, direct materials would include bananas, flour, and oil because these ingredients are directly used in the production of fried bananas.

How does the speaker differentiate between direct labor and indirect labor in the video?

-Direct labor refers to the wages paid to workers who are directly involved in the production process, such as cooks or machine operators. Indirect labor, on the other hand, refers to workers whose contributions are not directly tied to the production process, such as maintenance workers or managers.

What role does overhead play in production costs, and can you give an example?

-Overhead plays a role as the indirect costs of production that cannot be traced directly to the product. Examples include factory rent, utilities, and depreciation of machinery. These costs are essential for production but are spread across many products and not directly attributable to any one product.

What does the speaker mean by the term 'cost object' in the video?

-A 'cost object' refers to anything that a manager focuses on when analyzing costs. This could be a product, a department, a customer, or even a specific project. The cost object is where costs are tracked and assigned in order to make informed managerial decisions.

In the example of fried bananas, why is electricity considered an overhead cost?

-Electricity is considered an overhead cost because it is an indirect cost that supports the production process, but it cannot be directly traced to the production of each individual fried banana. It is part of the overall operating costs of the production facility.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs

Basic Cost Concepts...with a touch of humor | Managerial Accounting

Pengambilan Keputusan Taktis, Part 1

KONSEP BIAYA DAN AKUNTANSI BIAYA

KONSEP BIAYA DAN KLASIFIKASI BIAYA (BAGIAN 1)

Biaya Tenaga Kerja | Akuntansi Biaya

5.0 / 5 (0 votes)