Strategic Sourcing in Supply Chain: Elevating Procurement for Business Success

Summary

TLDR欢迎参加MIT供应链管理微硕士项目的直播活动。课程负责人Miguel Rodriguez和Palo Sosa Junior介绍了本次系列直播活动。特邀嘉宾Niranjini Kumar,麦肯锡管理顾问,将分享战略采购和供应链管理的见解。她讲述了如何提升采购专业人员的价值。课程内容包括供应链管理的基本原理、供应链动态、供应商关系管理、数字化和人工智能在采购中的应用等。活动还提醒参与者课程认证的重要性,提供认证链接以便参与者获得MIT证书并支持项目的持续运作。

Takeaways

- 🔍 供应链管理网络研讨会介绍了MIT的Micromasters项目及其课程。

- 🎓 主讲人是McKinsey的管理顾问Niranjini Kumar,她拥有MIT供应链管理硕士学位。

- 🔗 供应链管理的“源到付”过程涵盖了从选择供应商到支付供应商的所有活动。

- 📊 详细讲解了如何进行类别管理、供应商选择和谈判、以及合同管理。

- 🛠️ 强调了“主数据管理”的重要性,确保在整个采购过程中保持数据一致性。

- 💡 介绍了应急计划的重要性,以及如何评估和应对供应链中断风险。

- 🔬 通过“应该成本模型”示范了如何从材料成本、人工成本等各个方面进行成本谈判。

- 🤝 强调了供应商关系管理(SRM)在战略和日常运营中的重要性。

- 🌐 数字化和AI在现代采购中的应用,涵盖了从数据分析到合同管理的多方面。

- 📈 通过采购过程的整体视角,展示了如何通过捕捉、保留和推动价值来实现企业的增长和效率。

Q & A

MIT微硕士供应链管理的现场活动的主讲人是谁?

-主讲人是Miguel Rodriguez,他是MIT交通与物流中心的研究员,也是SE1x供应链基础课程的负责人。

这次活动的联合主持人是谁?

-联合主持人是Paolo Sosa Junior,他是SC3x供应链动态课程的负责人。

这次活动的主要议程是什么?

-议程包括:嘉宾演讲约25分钟,然后是观众提问环节,主持人会选出问题向嘉宾提问。

这次活动的嘉宾是谁?

-嘉宾是Niranjini Kumar,她是麦肯锡的管理顾问,主要经验在运营、战略和采购领域。

Niranjini Kumar的教育背景是什么?

-她拥有MIT供应链管理的硕士学位,并且是2021年混合课程的校友。

供应商关系管理(SRM)是供应链管理过程的哪个部分?

-SRM涉及源到合同和采购到支付两个方面,确保战略和事务性两方面的信息互通。

什么是应价模型?

-应价模型是通过从底层构建成本模型,根据市场数据和供应商提供的信息进行成本分析和谈判,以确保最优的采购成本。

数字化和AI在采购中的影响是什么?

-数字化通过高效的ERP系统和自动化流程提高效率,而AI可以用于花费管理、合同管理和供应商关系管理等方面。

采购价值不仅仅是节约成本,还有哪些方面?

-采购的价值还包括产品质量和可靠性、创新能力、生产效率、运营不中断、可持续性和合规性等方面。

如何制定和实施供应链的应急计划?

-应急计划包括评估风险水平、测试和分析数据、制定应急措施,并确保有防范措施和合同要求来减少供应链中断的影响。

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Leveraging AI in Supply Chain Management: From Data to Delivery

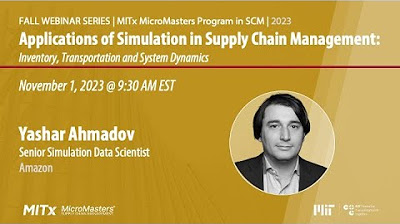

Applications of Simulation in Supply Chain Management

Supply Chain Risk Management and X shoring

Global Supply Chains: How Did All This Stuff Get Here?

What You Missed At The Gartner Supply Chain Symposium 2022

The Critical Role of Supply Chains in Business and Society

5.0 / 5 (0 votes)