Return On Invested Capital (ROIC): The Paradigm For Linking Corporate Performance To Valuation

Summary

TLDRThis video discusses an analytical approach to investing using return on invested capital (ROIC) and forensic accounting. The firm emphasizes the importance of real cash flows and profitability in determining stock value, offering insights into both undervalued stocks to target and dangerous ones to avoid. Their tools include detailed reports, newsletters, and case studies, with a focus on helping investors make informed decisions based on data rather than traditional price performance. With transparency and a unique bottom-up approach, they aim to guide investors to safer, more profitable long-term investments.

Takeaways

- 📉 Write-downs can serve as a leading indicator of potential fraud charges, highlighting the need for careful analysis of financial records.

- 📊 The company has demonstrated a strong track record of accurate investment predictions, despite occasional misjudgments like Netflix.

- 💡 Return on Invested Capital (ROIC) is a critical financial metric used to assess company performance and valuation, providing consistent, unlevered comparisons across industries.

- 📈 Through regression analysis, the company estimates implied stock valuations based on ROIC, showing how maintaining certain profitability levels can boost market value.

- 🧠 Transparency is a cornerstone of the company's approach, with educational materials, detailed methodologies, and forensic accounting data accessible to clients.

- 🌐 The company has been recognized by top clients and featured in major media outlets, establishing credibility in the financial analysis field.

- 📣 The 'Danger Zone' analysis identifies high-risk stocks for investors to avoid, contributing to safer investment strategies.

- 📚 Free resources, including tutorials and webinars, are offered to help users understand the analysis models and navigate financial data effectively.

- 💼 The company evaluates mutual funds and ETFs using a unique methodology focused on the underlying stocks, contrasting with traditional past-performance ratings.

- 🔎 The firm's investment research focuses on identifying both promising and dangerous stocks, aiding clients in making informed decisions and achieving long-term success.

Q & A

What is Return on Invested Capital (ROIC) and why is it important?

-Return on Invested Capital (ROIC) is a metric that measures how efficiently a company generates profit from its capital investments. It's important because it links a company's profitability to its market value, providing a clearer picture of how well a company is performing compared to traditional financial metrics.

Why is ROIC considered a better metric than other financial measures?

-ROIC is considered superior because it captures the true profitability of a company relative to the capital invested. Unlike earnings or revenue, it accounts for both operating efficiency and the cost of capital, offering a more accurate assessment of value creation.

What challenges do investors face when calculating ROIC?

-The main challenge in calculating ROIC lies in accurately adjusting financial statements for non-GAAP earnings, write-downs, and other accounting anomalies. This requires specialized knowledge and tools to ensure the metric reflects the true economic performance of a company.

How does New Constructs help investors calculate and analyze ROIC?

-New Constructs provides proprietary technology that automates the analysis of financial filings, enabling investors to calculate ROIC accurately. This tool adjusts for complex accounting nuances and offers a transparent, consistent approach to evaluating company performance.

What is the significance of write-downs in the context of ROIC and corporate performance?

-Write-downs can distort a company’s true profitability, making its financial performance look worse than it actually is. New Constructs highlights the importance of adjusting for write-downs to provide a more accurate picture of a company’s ROIC and overall market value.

How does New Constructs distinguish itself from traditional financial analysis methods?

-New Constructs focuses on using unlevered ROIC, which provides an apples-to-apples comparison of companies across industries. This contrasts with traditional methods that may rely on GAAP earnings, which often omit important factors affecting a company's actual profitability.

What role do institutional investors play in the investment landscape, and how does it affect value investing?

-Institutional investors largely focus on short-term trading or closet indexing, which diminishes the value placed on fundamental analysis. This shift has made it harder for value investors to find well-researched, underpriced stocks, but also creates opportunities for firms like New Constructs to identify overlooked investments.

What are some ways New Constructs helps investors avoid dangerous stocks?

-New Constructs provides tools like monthly newsletters, detailed write-ups on specific companies, and risk analyses to help investors avoid stocks that may be overvalued or financially unstable. Their Danger Zone reports offer insights into companies with poor financial health.

How can New Constructs' insights be applied to mutual funds and ETFs?

-New Constructs evaluates mutual funds and ETFs by assessing the ROIC and valuation of the stocks they hold. This bottoms-up analysis gives investors a more accurate understanding of the funds' potential performance, compared to traditional fund ratings which focus on past price performance.

Why is transparency important in the services New Constructs offers?

-Transparency is key because it allows investors to understand the methodology behind the calculations and analyses. New Constructs provides clear documentation and access to their models, making it easier for investors to see how their conclusions are drawn and ensuring trust in the results.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

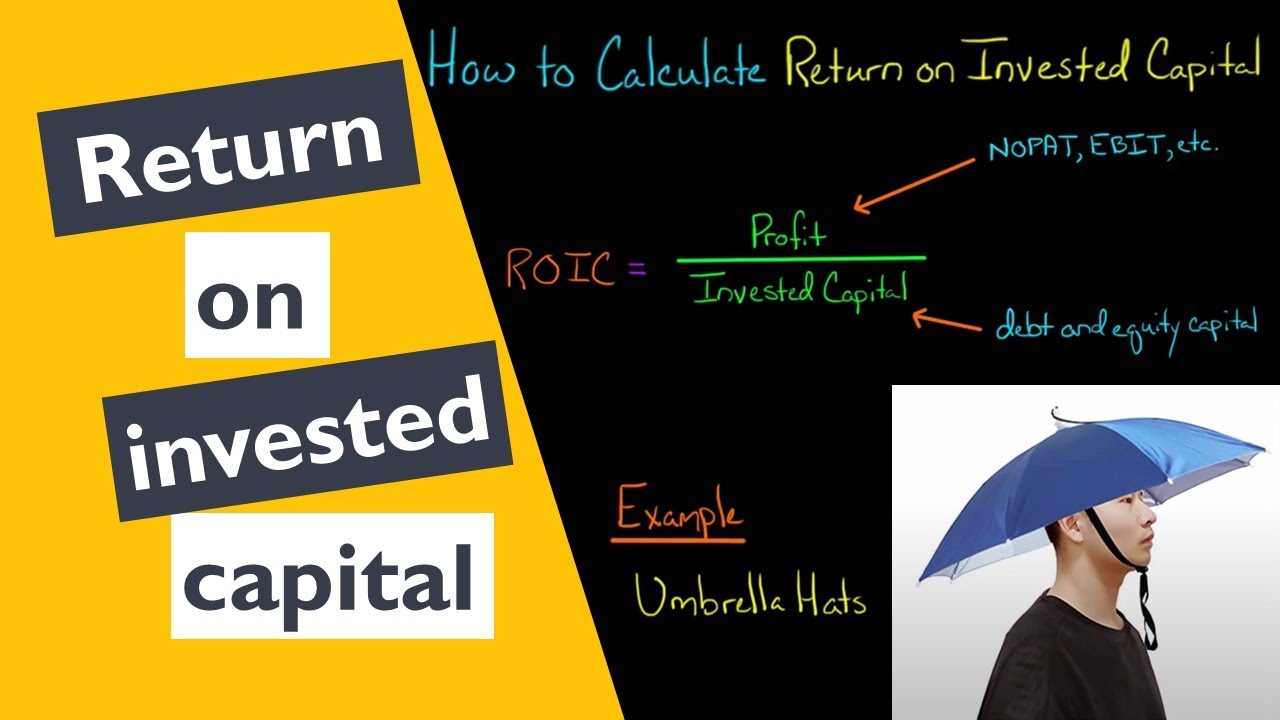

How to Calculate Return on Invested Capital

WACC (Weighted Average Cost of Capital) Formula and Definition | Learn With Finance Strategists

ROIC Return On Invested Capital

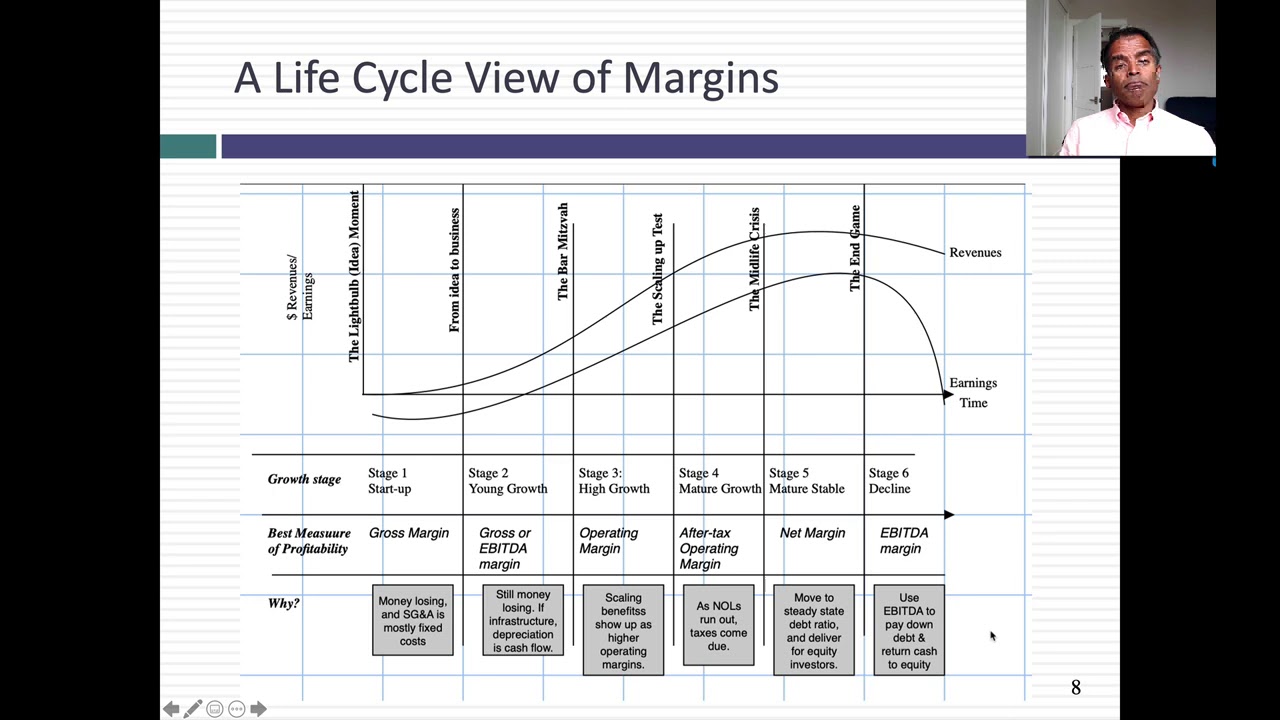

Session 6: Financial Ratios

#1 Capital Budgeting | SYBCOM | TYBAF | SEM 3 | SEM 5 | F M | Siraj Shaikh | B.Com/M.Com/CA/CS/CWA

Cara Mudah Memahami Persamaan Akuntansi

5.0 / 5 (0 votes)