ROIC Return On Invested Capital

Summary

TLDRThis video explains how to calculate Return on Invested Capital (ROIC) by first reviewing Return on Assets (ROA). It highlights how ROIC differs from ROA in terms of its numerator and denominator, with ROIC considering both debt and equity. The video dives into the specific ROIC definitions used by companies like 3M, General Motors, and Home Depot, comparing their methods and clarifying how each company calculates ROIC. Viewers will learn the importance of understanding these definitions before making comparisons between companies, as ROIC is a non-GAAP metric. Practical examples make these concepts more relatable and clear.

Takeaways

- 😀 ROIC (Return on Invested Capital) is closely related to ROA (Return on Assets) but focuses on a more comprehensive measure of returns for both equity and debt holders.

- 😀 ROA is calculated as Net Income divided by Total Assets, whereas ROIC involves returns generated for debt and equity holders, typically using NOPAT (Net Operating Profit After Tax).

- 😀 The numerator for ROA is simply Net Income, while for ROIC it includes Net Income plus after-tax interest or NOPAT.

- 😀 ROA is easier to calculate than ROIC because it only involves Total Assets and Net Income from the income statement.

- 😀 ROIC uses a denominator of Debt plus Equity, which is lower than Total Assets, making ROIC typically higher than ROA.

- 😀 Always check the specific definition of ROIC for each company, as different companies may define and calculate ROIC in varying ways.

- 😀 3M defines ROIC as adjusted net income (Net Income + after-tax interest expense) divided by average invested capital (equity + debt).

- 😀 GM uses a unique 'ROIC-adjusted' metric, which starts with EBIT-adjusted (adding back extraordinary losses and adjustments) and divides by average net assets.

- 😀 Home Depot uses NOPAT in the numerator and average debt and equity in the denominator, with slight exclusions such as short-term debt, which leads to a higher ROIC.

- 😀 In practice, ROIC is generally higher than ROA because it accounts for a broader range of capital and includes after-tax interest.

- 😀 ROIC provides a more complete view of how well a company uses its capital to generate returns, making it a critical metric for investors and analysts.

Q & A

What is the relationship between ROIC and ROA?

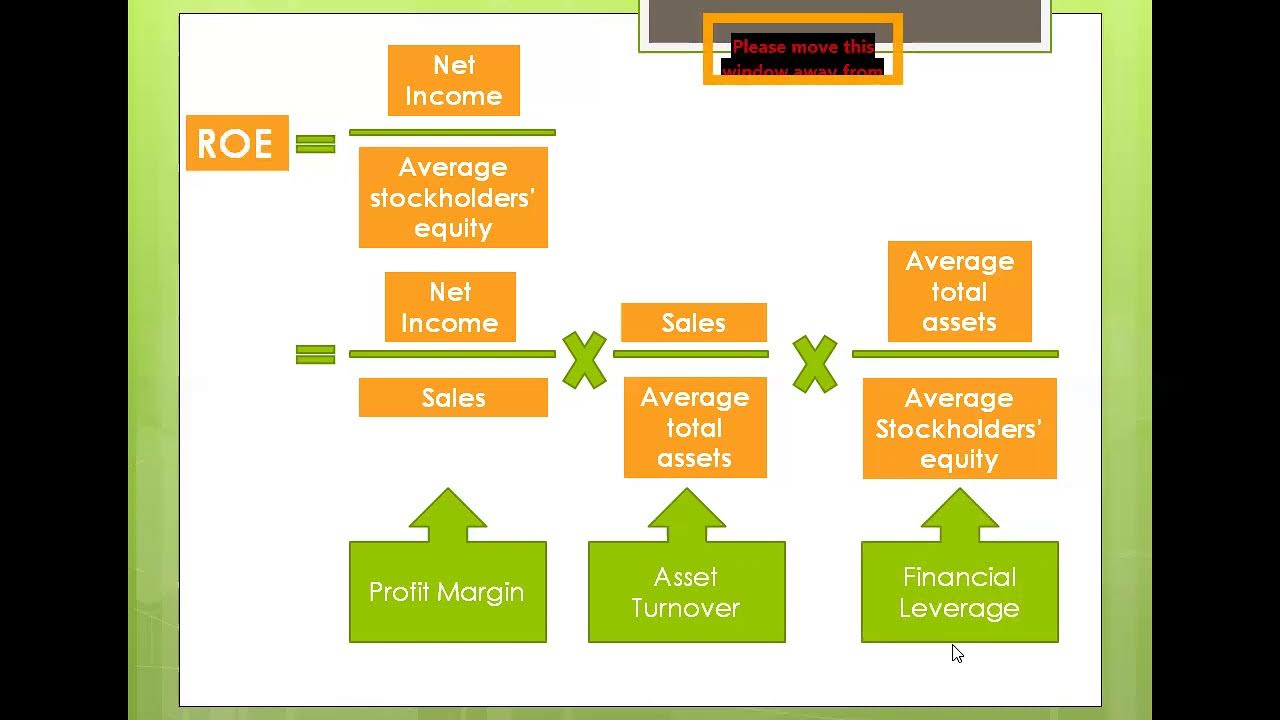

-ROIC (Return on Invested Capital) is closely related to ROA (Return on Assets), but ROIC is a more refined metric. While ROA is calculated as net income divided by total assets, ROIC uses NOPAT (Net Operating Profit After Tax) in the numerator and the sum of debt and equity in the denominator. ROIC usually gives a higher result than ROA due to its smaller denominator and inclusion of both debt and equity in its calculation.

How is ROA calculated?

-ROA is calculated by dividing Net Income (found at the bottom of the income statement) by Total Assets (found on the balance sheet). This metric measures how well a company generates profit from its total assets.

What are the key components of ROIC?

-ROIC is calculated by dividing NOPAT (Net Operating Profit After Tax) by the sum of debt and equity. NOPAT includes after-tax interest and net income, while the denominator includes both debt and equity as invested capital.

Why is the denominator in the ROIC calculation smaller than total assets?

-The denominator in ROIC is smaller because it only includes debt and equity, while total assets also account for other liabilities that do not directly contribute to the capital invested in the business. Therefore, ROIC focuses on the capital used to generate profits.

How does ROIC differ from ROA in terms of its numerator?

-The numerator in ROIC includes both after-tax interest and net income, which is typically higher than net income alone (the numerator of ROA). This makes the ROIC numerator more reflective of the returns for both debt and equity holders.

Why is ROIC generally higher than ROA?

-ROIC is typically higher than ROA because its numerator includes both net income and after-tax interest, while ROA only includes net income. Additionally, the denominator in ROIC is smaller, as it only includes debt and equity, not total assets.

How does 3M calculate its ROIC?

-3M calculates its ROIC by using the sum of net income plus after-tax interest expense as the numerator. The denominator is the average invested capital, which is the average of the company's debt and equity over four quarters.

What is GM’s approach to calculating ROIC?

-GM uses a variant called ROIC-adjusted, where the numerator starts with a loss in net income, then adds adjustments for one-time items like restructuring costs and changes in tax law. The denominator includes adjusted equity to get average net assets. This method differs from standard ROIC calculations.

How does Home Depot calculate its ROIC?

-Home Depot calculates its ROIC by using NOPAT (Net Operating Profit After Tax) as the numerator. The denominator is the average of debt and equity, excluding short-term debt. This method results in a slightly higher ROIC compared to other companies that include short-term debt in their calculations.

Why is it important to understand how a company defines ROIC?

-It is important to understand a company's specific definition of ROIC because it is a non-GAAP metric, and different companies may adjust the calculation in various ways. For example, some companies may exclude certain liabilities or make other adjustments that affect comparability between firms.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)