كيف تتخلص من الديون وتصبح أغنى شخص في العالم؟ | بوكافيين

Summary

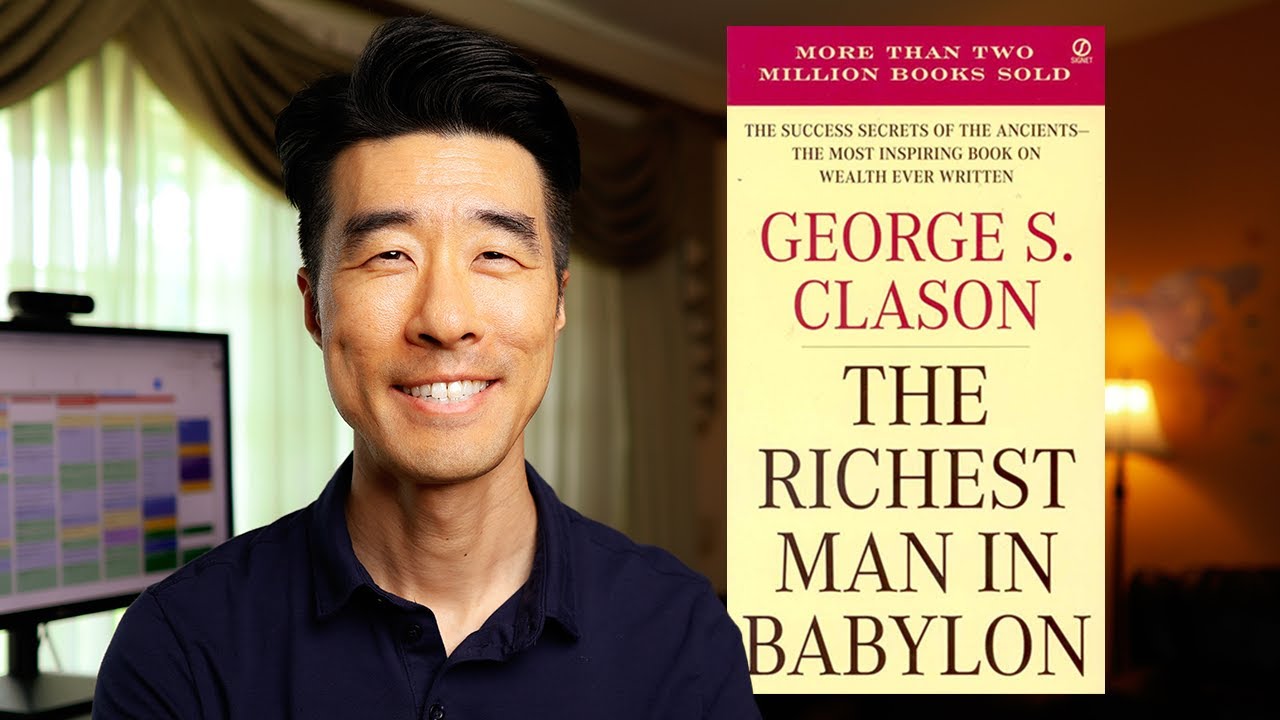

TLDRIn this enlightening tale inspired by 'The Richest Man in Babylon,' Aarkad learns timeless lessons on wealth-building from a seasoned merchant. The story reveals seven essential principles for financial success: pay yourself first, control expenditures, invest wisely, safeguard your wealth, make your home an investment, ensure future income, and continually enhance your ability to earn. Through patience and discipline, Aarkad transforms from a humble worker to the wealthiest man in Babylon, illustrating that true prosperity comes not from luck, but from consistent effort and sound financial habits.

Takeaways

- 😀 Seize Opportunities: When a suitable opportunity arises, take full advantage of it to achieve your goals.

- 😀 Save a Portion of Your Income: Consistently save at least 10% of your income to build wealth over time.

- 😀 Live Below Your Means: Spend less than you earn, distinguishing between necessary expenses and personal desires.

- 😀 Seek Expert Advice: Consult those with experience and knowledge before making investments or financial decisions.

- 😀 Invest Wisely: Ensure your saved money is working for you by investing it in reliable, income-generating opportunities.

- 😀 Protect Your Wealth: Avoid high-risk investments, especially in the early stages of wealth-building. Focus on secure and steady returns.

- 😀 Improve Your Earning Potential: Continuously develop your skills, financial knowledge, and business acumen to increase your income.

- 😀 Financial Discipline is Key: The path to wealth requires careful planning, discipline in spending, and wise investments.

- 😀 Learn from Past Mistakes: Failure is inevitable, but it’s important to learn from it and refine your approach to wealth-building.

- 😀 Understand the Power of Compound Interest: Investments grow over time; it’s not just about saving money, but making your money grow.

Q & A

What is the main lesson Banser learns in the story?

-Banser learns that wealth and financial success are not the result of luck, but of applying certain principles consistently. He understands the importance of taking control of his finances and the value of seeking wisdom from experienced individuals like Arkad.

What does the character Kobi suggest to Banser when he is frustrated about his financial situation?

-Kobi suggests that Banser seek advice from Arkad, the wealthiest man in Babylon, to learn how he accumulated his wealth and to understand the principles of financial success.

How does Arkad become the wealthiest man in Babylon?

-Arkad becomes wealthy by learning and applying principles of money management, such as saving a portion of his earnings, controlling his expenditures, and making smart investments. He also learns from experienced individuals, like the merchant who teaches him how to build wealth.

What is the first principle of wealth-building that Arkad teaches?

-The first principle Arkad teaches is to 'pay yourself first.' This means saving a portion of your income before spending on anything else. Even setting aside a small percentage, like 10%, can eventually build significant wealth.

What is the significance of the conversation between Arkad and the elderly merchant?

-The conversation highlights the importance of financial discipline and the role of continuous learning. Arkad's encounter with the elderly merchant is the turning point where he learns that the key to wealth is not merely working hard but learning how to manage and grow money effectively.

What are some of the specific lessons Arkad learns from the elderly merchant?

-Arkad learns the importance of saving a portion of his earnings, avoiding unnecessary expenditures, seeking wise investments, and ensuring his money works for him by generating passive income. The merchant emphasizes the need to consult experts before making investment decisions.

Why does Arkad reject the idea of buying a house in the beginning, and what is his later stance?

-In the beginning, Arkad views purchasing a house as a major financial burden. However, after learning the importance of investments and securing future income, he later advocates for owning a home as a long-term investment, provided it fits into a broader financial strategy.

What are the key principles Arkad shares with the people of Babylon to help them manage their finances?

-Arkad shares seven key principles: 1) Pay yourself first by saving a portion of your income, 2) Control your expenditures, 3) Invest wisely, 4) Protect your wealth, 5) Make your home an investment, 6) Ensure a steady future income, and 7) Increase your earning potential by learning and growing financially.

How does the principle of controlling expenditures relate to the other lessons in the story?

-Controlling expenditures is closely tied to other principles like saving and investing. By limiting unnecessary spending, individuals can free up more funds to save and invest, which ultimately leads to wealth accumulation. It ensures that one's income is allocated wisely, prioritizing savings and investments over indulgent spending.

What role does 'seizing opportunities' play in the path to wealth in the story?

-Seizing opportunities is a recurring theme in the story. Banser learns that wealth is often about recognizing and taking action on opportunities when they arise. Whether it's investing in a profitable venture or finding ways to increase income, making the most of the right opportunities is crucial to financial success.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The Richest Man In Babylon // 10 Timeless Wealth Lessons

9 Timeless Money Lessons from The Richest Man in Babylon

أقيم أشهر الكتب… هل يبيعون كلام؟

ENCONTRE O EQUILÍBRIO ENTRE INVESTIR E APROVEITAR O PRESENTE

11 Langkah Mencapai Sukses Karir Bagi Pelajar (Part 2)

राजा और उनके व्यापारी मित्र की कहानी-raja or vyapari mitra ki kahani | hindi kahani| letast stories

5.0 / 5 (0 votes)