Trading Account | Final Accounts | Financial Statements | Trading A/c

Summary

TLDRIn this video, Pooja Singh explains the concept of trading accounts as part of financial statements. She covers the importance of financial statements like the trading account, profit & loss account, and balance sheet, focusing on their role in determining the financial health of an organization. The video explains key components such as gross profit, net profit, and cost of goods sold, with practical tips on how to record these elements. Additionally, Pooja emphasizes the significance of these accounts for understanding profitability and making informed financial decisions. Viewers are encouraged to share, like, and subscribe for more insightful accounting lessons.

Takeaways

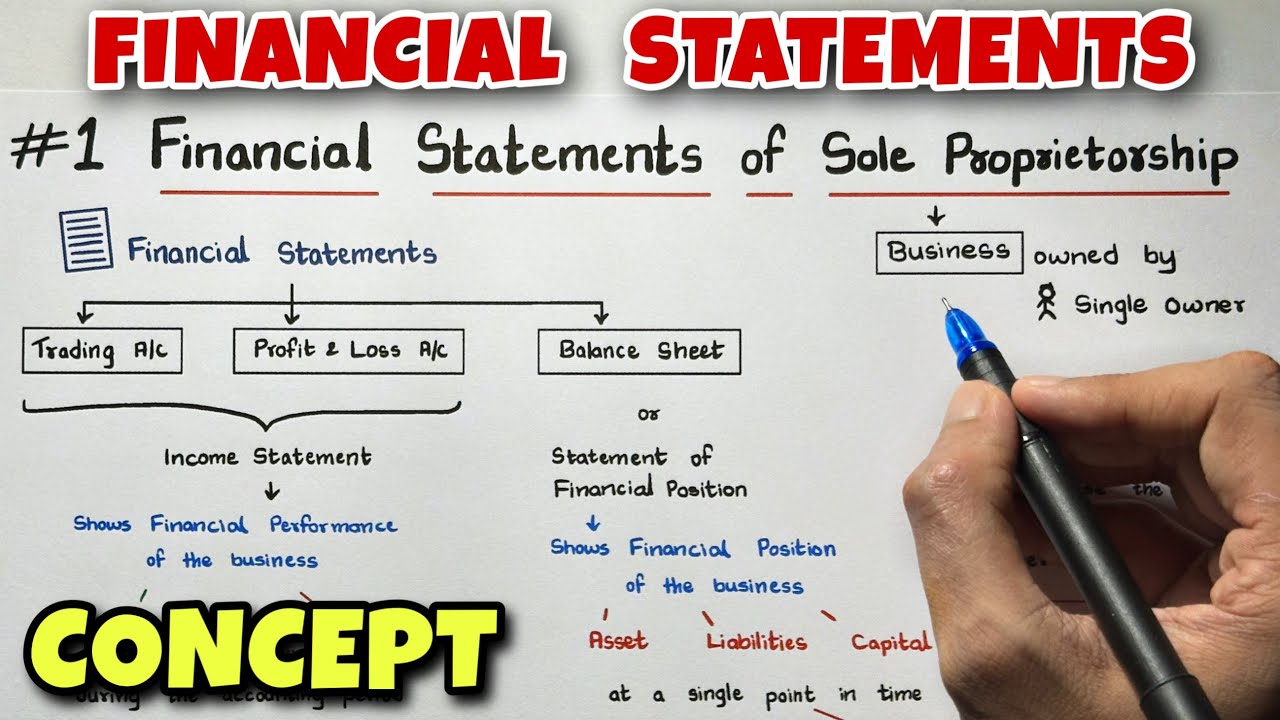

- 😀 Understanding the purpose of financial statements is crucial for assessing the financial position of an organization. Key statements include the Trading Account, Profit & Loss (P&L) Account, and Balance Sheet.

- 😀 The Trading Account is the first step in preparing final accounts and helps determine gross profit by comparing sales with the cost of goods sold.

- 😀 The Profit & Loss (P&L) Account follows the Trading Account and calculates net profit, which is then transferred to the Balance Sheet.

- 😀 The Balance Sheet shows an organization’s financial position at a specific date, revealing assets, liabilities, and equity.

- 😀 Key financial ratios like gross profit ratio, net profit ratio, and operating ratio can be calculated using the Trading and P&L Accounts.

- 😀 Direct expenses such as purchases, wages, and factory costs are recorded in the Trading Account, while indirect expenses are recorded in the P&L Account.

- 😀 The Trading Account helps identify areas where expenses are high, thus allowing businesses to control costs and increase profits.

- 😀 Understanding terms like ‘cost of goods sold’ (COGS) and ‘direct expenses’ is critical for accurate accounting and financial reporting.

- 😀 The Trading Account and P&L Account play a vital role in financial analysis, allowing businesses to evaluate performance over time through comparisons.

- 😀 After preparing the Trading Account, the next step is to balance it by ensuring the credit side matches the debit side, which reflects the gross profit or loss.

Q & A

What is the primary purpose of preparing financial statements?

-The primary purpose of preparing financial statements is to assess the financial position of an organization, including its liabilities and assets. This helps in understanding the financial health of the organization and supports decision-making.

What are the three main components of a final account in accounting?

-The three main components of a final account in accounting are the Trading Account, Profit and Loss (P&L) Account, and the Balance Sheet.

Why is the Trading Account considered the first stage in preparing final accounts?

-The Trading Account is considered the first stage in preparing final accounts because it calculates the gross profit, which is then transferred to the Profit and Loss Account. It helps determine the profitability of an organization's buying and selling activities.

What does the Trading Account help determine?

-The Trading Account helps determine the gross profit or loss resulting from the buying and selling of goods and services during a particular accounting period.

What is meant by 'Cost of Goods Sold' in the Trading Account?

-The 'Cost of Goods Sold' refers to the direct expenses incurred in producing or acquiring goods that are sold during an accounting period. It includes opening stock, purchases, direct expenses, and subtracts closing stock.

What are 'direct expenses' in the context of the Trading Account?

-Direct expenses are those costs directly associated with the production or procurement of goods for sale. These include wages, power, fuel, factory expenses, insurance, customs clearing, and transportation costs.

How do you calculate Gross Profit from the Trading Account?

-Gross Profit is calculated by subtracting the Cost of Goods Sold from the total sales revenue. If the sales revenue is greater than the cost of goods sold, a profit is made; otherwise, a loss occurs.

What is the significance of the Profit and Loss Account in final accounts?

-The Profit and Loss Account is crucial because it calculates the net profit or net loss after considering all indirect expenses and incomes. It helps in assessing the overall profitability of the organization after accounting for all costs.

What information can be derived from the Balance Sheet?

-The Balance Sheet provides detailed information on the financial position of an organization at a specific point in time. It shows the assets, liabilities, and equity, which can be compared with previous years to assess growth or changes in financial health.

Why is it important to compare financial statements with previous years' data?

-Comparing financial statements with previous years' data helps identify trends, such as whether an organization is increasing its assets or reducing liabilities. It also provides insight into the company’s growth, profitability, and financial stability.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

"CARA MUDAH MEMAHAMI SIKLUS AKUNTANSI PERUSAHAAN DAGANG "

LAPORAN KEUANGAN KONSOLIDASI PUSAT DAN CABANG

FİNANSAL MUHASEBE - Ünite 2 Konu Anlatımı 1

Video Pembelajaran Akuntansi : Jurnal Penyesuaian (Perusahaan Dagang)

#1 Financial Statements - Concept - Easiest Way - Class 11 - By Saheb Academy

Financial Accounting Chapter-4 | Trial Balance | BCom/BBA 1st Year | CWG for BCOM

5.0 / 5 (0 votes)