14. THEORY OF INTEREST | YIELD RATES

Summary

TLDRIn this week’s lecture, the focus is on understanding yield rates and reinvestment rates. The video introduces discounted cash flow analysis, which extends the study of annuities and involves calculating the present value of investments. The yield rate is defined as the interest rate that equates the present value of an investment’s contributions to its returns or withdrawals. The video explains the relationship between cash flows and how they influence the yield rate, which can be unique or non-unique, depending on cash flow patterns. Key concepts such as net present value, internal rate of return, and the conditions for unique yield rates are explored through examples.

Takeaways

- 😀 Yield rates are introduced as an extension of discounted cash flow analysis, which is a key concept in valuing investments.

- 😀 An annuity refers to a series of payments made at equal intervals of time, which can be either level or non-level.

- 😀 In discounted cash flow analysis, the goal is to calculate the present value of all future payments at time zero.

- 😀 Cash inflows (positive cash flows) are represented by positive values (C_t) in the investment fund's perspective, and outflows (negative cash flows) are represented by negative values.

- 😀 The net present value (NPV) is calculated by discounting future cash flows to time zero, using a constant rate of interest (i).

- 😀 The yield rate is the interest rate (i) that makes the net present value (NPV) equal to zero, balancing the present value of contributions and withdrawals.

- 😀 Yield rate also measures how favorable an investment is for the investor, with a higher yield rate being more favorable.

- 😀 The yield rate may be negative, indicating a loss for the investor, or zero, meaning no return on the investment.

- 😀 The yield rate is not always unique, and multiple yield rates can occur when cash flows are inconsistent, as demonstrated by an example involving payments made at different times.

- 😀 The yield rate is unique when cash flows in one direction (such as contributions) occur before those in the opposite direction (such as withdrawals).

Q & A

What is the focus of the lecture in week 7?

-The focus of week 7 is on yield rates and reinvestment rates. The lecture explains how yield rates are defined and how reinvestment rates affect them in the context of discounted cash flow (DCF) analysis.

What is an annuity, and how does it relate to this lecture?

-An annuity is a series of payments made at equal intervals of time. It can be level (constant) or non-level (variable). This concept is important in the lecture as discounted cash flow analysis is an extension of annuity studies, where payments are evaluated over time.

What is discounted cash flow (DCF) analysis?

-Discounted cash flow analysis is a method for determining the present value of future cash flows by applying a discount rate. This process is used to evaluate investments by bringing all payments to a common time point (usually time 0).

What is the difference between the viewpoint of the investment fund and the investor?

-From the investment fund's viewpoint, a deposit is a positive cash flow, while a withdrawal is negative. From the investor's viewpoint, the signs are reversed, so a deposit is negative, and a withdrawal is positive.

How is the net present value (NPV) calculated?

-Net present value (NPV) is calculated by discounting each cash flow (both positive and negative) to time 0 using a specific interest rate. The sum of all these discounted cash flows gives the NPV.

What is a yield rate, and how is it determined?

-A yield rate is the interest rate that makes the net present value (NPV) of an investment equal to zero. It is calculated by setting the NPV equation to zero and solving for the rate of interest that satisfies this condition.

What happens if the yield rate is negative?

-A negative yield rate indicates that the investor is losing money on the investment. In this case, the return is less than the original investment, resulting in a financial loss.

Can the yield rate be unique for all investment scenarios?

-No, the yield rate is not always unique. If the cash flows alternate between positive and negative values over time, there may be multiple solutions for the yield rate. However, if all cash flows in one direction happen before the opposite direction, the yield rate is unique.

What is the equation of value in relation to yield rates?

-The equation of value states that the present value of an investment’s contributions (deposits) is equal to the present value of its returns (withdrawals). The yield rate is the interest rate that satisfies this equation, making the present value of all cash flows equal.

What is the relationship between internal rate of return (IRR) and yield rate?

-The internal rate of return (IRR) is another term used for the yield rate. Both terms refer to the interest rate that makes the net present value (NPV) of an investment equal to zero, indicating the effective return on the investment.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The Term Structure of Interest Rates Spot, Par, and Forward Curves (2024 CFA® Level I Exam – FI 9)

Lecture 1: Introduction to 14.02 Principles of Macroeconomics

(Class 3) Data Analytics & Excel - Clear Waters Communication & Problem Statements

Session 5: Estimating Hurdle Rates - The Risk free Rate

Fluid Mechanics: Pipes in series (19 of 34)

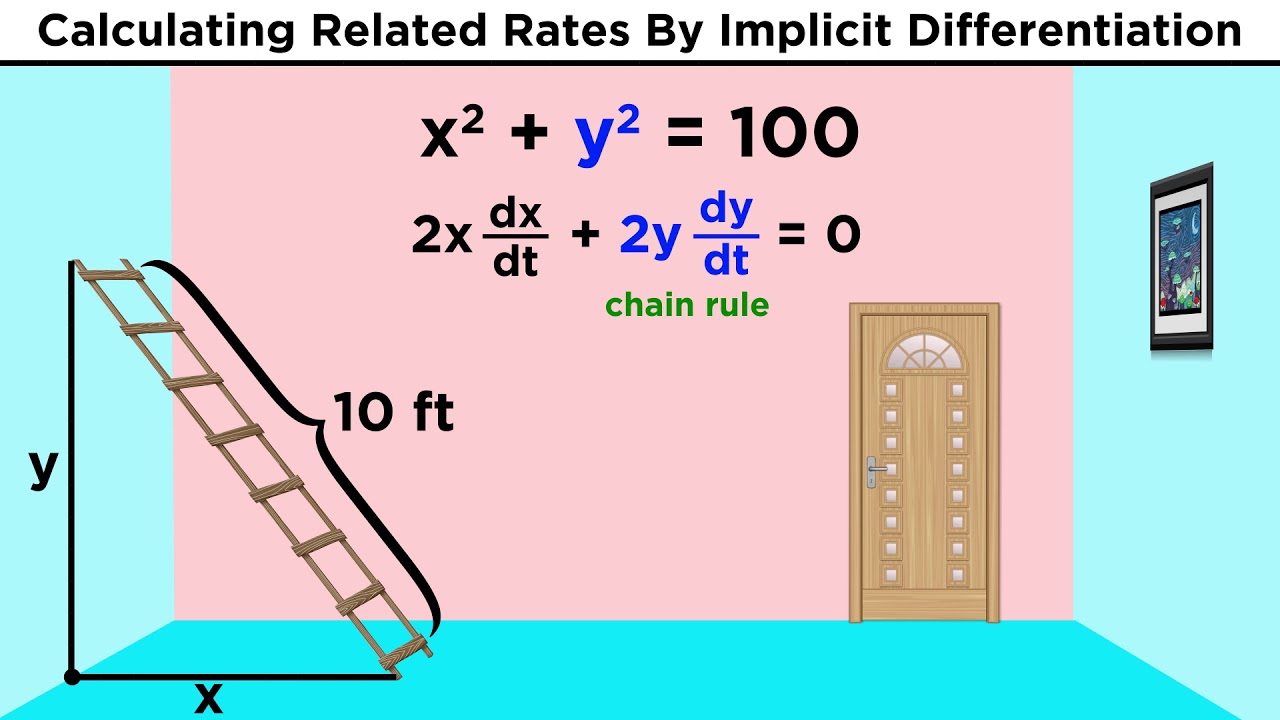

Related Rates in Calculus

5.0 / 5 (0 votes)