(Class 3) Data Analytics & Excel - Clear Waters Communication & Problem Statements

Summary

TLDRIn this lecture on Data Analytics and Visualization, the focus is on understanding the process of data analytics, the tools involved, and the challenges faced by a telecom company. The example involves analyzing why a telecom company is struggling with low acquisition rates for new customers applying for services like handsets and plans. The credit analytics team evaluates applications based on criteria like visa status and payment history. The company aims to address issues like incomplete applications, low approval rates, and enhance customer acquisition through data-driven insights and potential solutions.

Takeaways

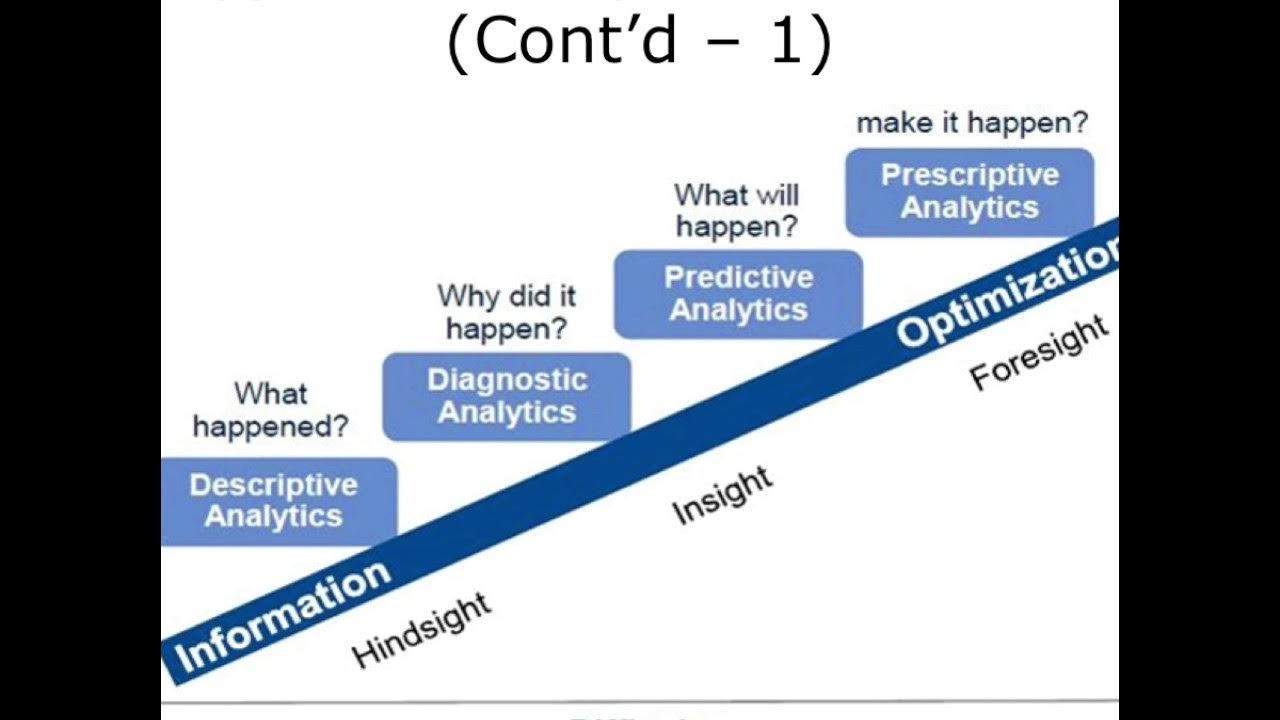

- 😀 Data analytics and visualization were introduced as essential tools for decision-making in business, with a focus on their application in telecom companies.

- 😀 The lecture revisits the fundamental concepts from previous lessons, emphasizing the importance of understanding data analytics processes and tools.

- 😀 The main problem faced by Clear Water Analytics, a telecom company, is the low approval rate of customer applications for new services like handsets and contracts.

- 😀 Applications can be declined or delayed due to errors in customer data, incomplete applications, or poor customer payment history, affecting the acquisition rate.

- 😀 A major part of the application process involves credit analytics, where the company assesses if the customer meets certain criteria before approving their request.

- 😀 Examples are provided where applications are rejected due to missing or incorrect data, such as errors in customer identity documents or income proof.

- 😀 The course aims to show how data analytics can be used to identify the root causes of issues like low approval rates and suggest actionable solutions.

- 😀 Data analytics teams at Clear Water Analytics must analyze large amounts of application data to pinpoint trends, identify bottlenecks, and suggest improvements.

- 😀 The application approval process involves manual reviews, especially when customer information is incomplete or unclear, leading to delays or declines.

- 😀 The solution to improving application approval rates involves using data to ensure more accurate and complete applications, leveraging predictive analytics to flag errors early in the process.

- 😀 The lecture highlights the practical importance of data accuracy and completeness in the decision-making process, underscoring how analytics can improve customer service and business outcomes.

Q & A

What is the main issue faced by Clearwater Analytics in the telecom industry?

-Clearwater Analytics is facing a low acquisition rate of new customers for their services, with many applications being rejected due to various reasons like incomplete information or credit issues.

What are the key factors that influence the approval or rejection of customer applications?

-Key factors include the completeness of the application (e.g., correct name, salary slips), the customer’s credit history, affordability of the requested service, and verification of submitted documents (e.g., visa details, Aadhar card).

How does the credit analytics team decide whether to approve or reject an application?

-The credit analytics team reviews the application to ensure all required information is accurate and complete. If discrepancies or issues are found, like expired visas or incomplete documents, the application may be rejected. Otherwise, it is approved based on creditworthiness and other criteria.

What role does data analytics play in addressing Clearwater Analytics' problems?

-Data analytics helps the team understand the reasons behind low approval rates by analyzing patterns in the applications, identifying issues causing rejections, and suggesting improvements to the evaluation process.

What are some common reasons for rejecting customer applications?

-Common reasons include incorrect or missing information (e.g., wrong name on documents), poor credit history, low affordability for high-end products, and incomplete or expired documentation.

What could Clearwater Analytics do to improve their customer acquisition rate?

-Clearwater Analytics can improve their acquisition rate by streamlining the application process, making it easier for customers to submit complete and accurate information, and analyzing customer profiles to identify patterns that lead to approval.

Why is the application acquisition rate considered low, and what impact does this have?

-The low acquisition rate is due to a high number of rejections, which impacts the business by limiting new customer acquisitions. For example, only a small percentage (like 20%) of applications are approved, leading to missed opportunities for customer growth.

What is the significance of verifying the customer's documents, such as visa details or salary slips, during the application process?

-Verifying documents ensures the legitimacy of the application and confirms that the customer can afford the requested services. It helps identify potential risks, like expired visas or low income, which could lead to rejection.

How can the system handle situations where customer information is incorrect or incomplete?

-The system can flag applications with incorrect or missing information, prompting the credit analytics team to review and request additional details from the customer. This ensures that only valid applications are processed further.

What are the potential solutions Clearwater Analytics might explore to address the problem of low application approval rates?

-Clearwater Analytics might explore solutions such as refining their application review process, enhancing document verification methods, offering clearer guidelines for customers, and utilizing predictive analytics to improve decision-making.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

🚀 Introduction to Microsoft Fabric | Microsoft Fabric Playlist

What is marketing analytics?! | Unlock growth by understanding data and analytics

1-Course Introduction

Overview of Health Care Data Analytics

3 Skills You Need to Make You Stand Out for DATA ANALYST Jobs (DO THIS)

Top Data Analyst Tools for 2025

5.0 / 5 (0 votes)