CORPORATE RISK MANAGEMENT

Summary

TLDRThis lecture on corporate risk management covers the strategies and processes organizations use to protect people and assets from financial loss or injury. It explores the role of Enterprise Risk Management (ERM) in addressing uncertainties and improving decision-making. The lecture highlights the importance of risk identification, assessment, and response, including both economic and book value approaches to business risk. Key topics include credit risk, operational risk, market risk, and risk management frameworks, emphasizing the need for a collaborative and proactive approach to effectively manage risks in a dynamic business environment.

Takeaways

- 😀 Corporate risk management ensures the safety of people and assets, protecting organizations from injury and financial loss.

- 😀 Enterprise Risk Management (ERM) provides a framework to respond to business uncertainties and opportunities with relevant risk insights.

- 😀 ERM enhances organizational resiliency by improving decision-making, governance, and fostering a risk-intelligent culture.

- 😀 The corporate risk management process is ongoing and affects people at all levels of the organization.

- 😀 Risk management involves identifying events that may affect an organization and managing risks within its risk appetite to achieve objectives.

- 😀 Risk managers need to engage with people creatively and think proactively to recognize emerging risks faster.

- 😀 Risk identification includes distinguishing between risks and opportunities, and it is crucial to address hazards with control measures based on a hierarchy of hazard controls.

- 😀 The risk assessment process includes documenting hazards, identifying significant risks, and implementing control measures to mitigate potential harm.

- 😀 The goal of risk treatment is to reduce or manage unacceptable risks through options such as avoiding, reducing, transferring, or accepting the risk.

- 😀 Regular monitoring and reviewing of the risk management process ensures that it remains effective and up-to-date with the changing risk environment.

Q & A

What is the primary goal of corporate risk management?

-The primary goal of corporate risk management is to ensure the safety of people and assets in an organization, guarding them against the risk of injury or financial loss.

What does Enterprise Risk Management (ERM) provide to an organization?

-ERM provides a framework to understand and respond to business uncertainties and opportunities, delivering relevant risk insight through integrated risk identification, analysis, and management. It enhances organizational resiliency by improving decision-making, strengthening governance, and supporting a risk-intelligent culture.

What is the role of the Chief Risk Officer (CRO) in a bank, according to the script?

-The Chief Risk Officer (CRO) is responsible for managing and identifying emerging risk issues, ensuring timely communication, simplifying information, and improving cooperation among all involved parties in risk assessment.

How does corporate risk management affect an organization?

-Corporate risk management is an ongoing process that is applied at every level of the organization. It aims to identify potential events that may affect the entity and manage risks within its risk appetite, providing reasonable assurance regarding the achievement of organizational objectives.

What are the key components of Enterprise Risk Management (ERM)?

-The eight key components of ERM are internal environment, objective setting, risk identification, risk assessment, risk response, control activities, information and communication, and monitoring.

What are the five steps to completing a risk assessment in the construction industry?

-The five steps are: 1) Document the activity; 2) Identify significant hazards; 3) Document the control measures; 4) Identify who is responsible for implementing controls; and 5) Monitor and review the process.

What is the hierarchy of hazard controls, and how should it be applied?

-The hierarchy of hazard controls includes: 1) Elimination, 2) Substitution, 3) Isolation, 4) Engineering controls, 5) Administrative controls, and 6) Personal protective equipment. It should be applied from top to bottom to eliminate or control risks.

What are the main categories of risks according to financial risk management?

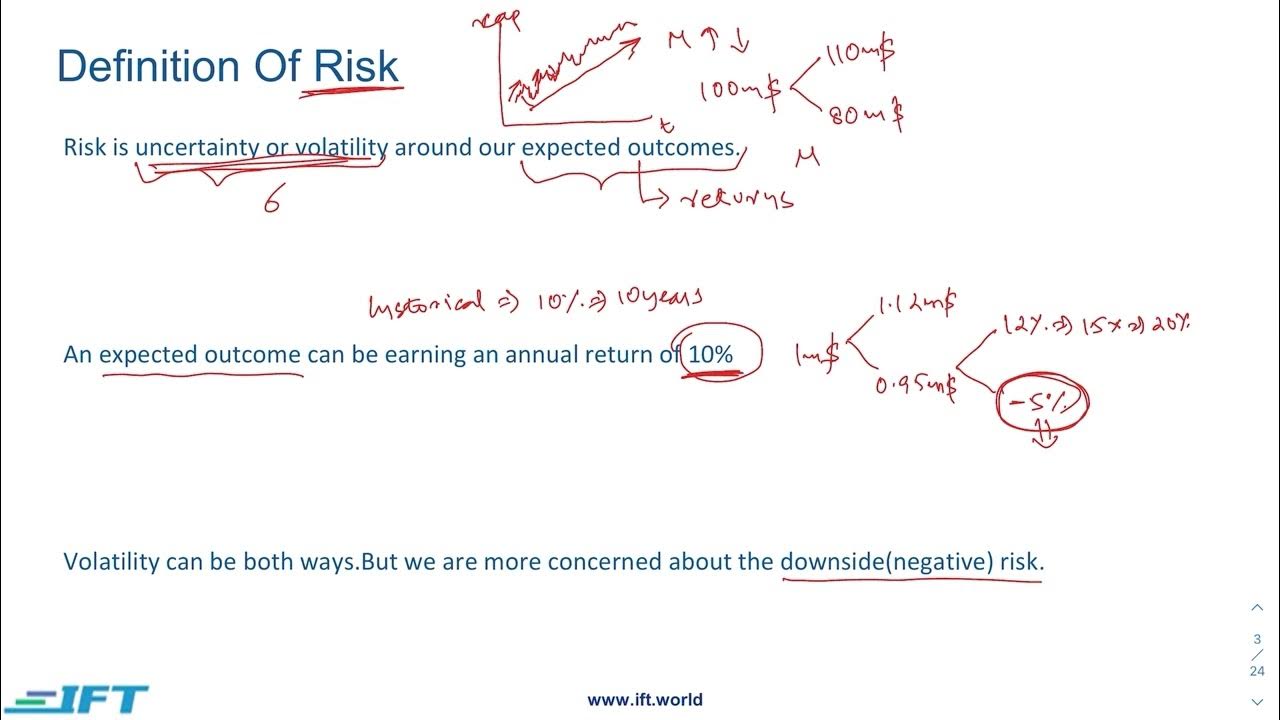

-The main categories of financial risk are market risk (exposure to uncertain market prices), business risk (risk related to assets or liabilities that cannot be marked to market), and credit risk (risk due to uncertainty in a counterparty's ability to meet financial obligations).

How does operational risk differ from other types of financial risk?

-Operational risk refers to the risk of loss resulting from inadequate or failed internal processes, systems, or external events, such as terrorism or natural disasters. Unlike financial risks, operational risks are often best managed within the departments in which they arise.

What is the concept of economic value in risk management, and how is it applied?

-Economic value refers to the intrinsic value of an asset, calculated using market value or predictive models. It is used in financial risk management to assess the value of assets that do not have a clear market value, and techniques like Value at Risk (VaR) are applied based on these economic values.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)