Fair Value Gap vs. Order Block - Which Works Best for You?

Summary

TLDRThis video explores the effectiveness of fair value gaps and order blocks as entry points for traders. It discusses how to identify suitable areas for entry by analyzing price movements and structural breaks. The speaker emphasizes that overlapping support levels with fair value gaps can indicate a higher likelihood of price reversals compared to order blocks. The video also outlines scenarios where order blocks may be preferable, particularly when significant imbalances exist. Ultimately, understanding the market's response to these areas is crucial for making informed trading decisions.

Takeaways

- 😀 The fair value gap and order block are both significant areas for trading entries.

- 😀 An order block is identified as the last bearish candle before a bullish movement.

- 😀 The fair value gap is defined by the range between the high of the first candle and the low of the third candle.

- 😀 Understanding price movement before these formations is crucial for effective trading decisions.

- 😀 Resistance and support levels are pivotal; the break of resistance can create a stronger support level.

- 😀 A fair value gap that overlaps with a support level has a higher likelihood of leading to a price reversal.

- 😀 If no support level overlaps, consider using the order block for entry.

- 😀 Price may still reverse at a fair value gap, but it's important to monitor for new lows.

- 😀 Slow market movements may make order blocks more favorable than fair value gaps for entries.

- 😀 Distinguishing between price movement due to order blocks versus imbalances is essential for successful trading.

Q & A

What is the primary focus of the video?

-The video focuses on determining when to use fair value gaps versus order blocks as entry points for trading.

How is an order block defined in the context of this video?

-An order block is defined as the last bearish candle before a strong upward movement.

What constitutes a fair value gap?

-A fair value gap is the gap between the high of the first candle and the low of the third candle.

Why is the examination of price movement important?

-Examining price movement helps identify whether a break of structure is caused by an order block or a fair value gap.

What role do support and resistance levels play in this analysis?

-Support and resistance levels indicate potential price reversal areas, particularly when a resistance level becomes support.

What happens when a resistance level fails?

-When a resistance level fails, it transforms into support, increasing the likelihood of a price reversal at that level.

What should a trader consider if there is no support level overlap?

-In the absence of support level overlap, traders should consider entering at the order block.

How should traders react if a fair value gap is mitigated?

-If a fair value gap is mitigated, traders should close the order and wait for the price to reach the order block.

What is the suggested approach in slow markets?

-In slow markets, it is recommended to prioritize order blocks as entry areas since fair value gaps may not indicate significant market activity.

What does it mean when a fair value gap results in another fair value gap?

-When a fair value gap creates another fair value gap with noticeable imbalance, it suggests that there are unexecuted orders at that price, indicating potential price direction changes.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Order Block Entry VS Fair Value Gap Entry

Order Blocks vs. Fair Value Gaps: The Ultimate Guide to Smarter Entries!

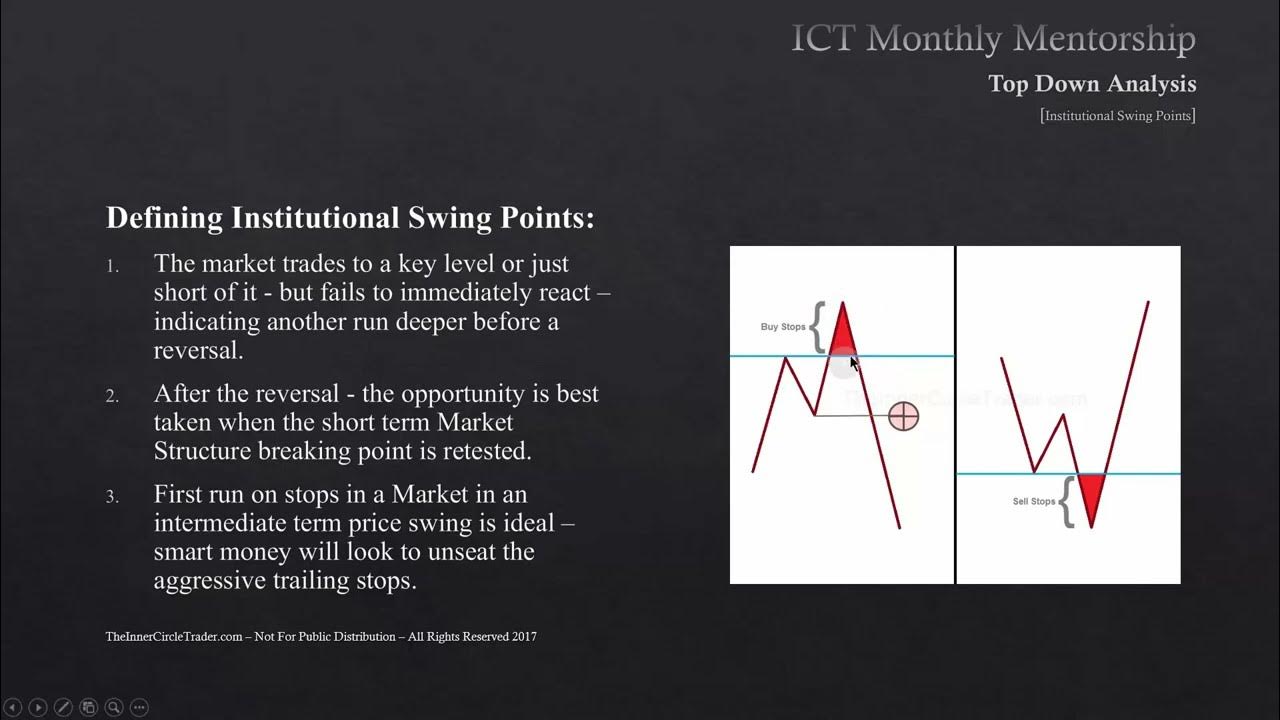

ICT Mentorship Core Content - Month 05 - Defining Institutional Swing Points

Understanding Order Flow Using ICT Concepts

PO3 + MMXM + SMT + STDV | ICT Concepts | DexterLab

How To Trade Order Blocks | Trading Strategy

5.0 / 5 (0 votes)