Investing Statistics

Summary

TLDRIn this informative video, Richard Matthews from Matthews Wealth Management delves into essential investing statistics, focusing on the mean and standard deviation to assess portfolio performance. He illustrates how these statistics inform expectations and volatility using bell curve examples. The discussion further explores secondary statistics like beta, which compares portfolio volatility to benchmarks, and alpha, indicating excess returns. By emphasizing the importance of these metrics, Matthews equips investors with the tools to analyze their portfolios effectively, enabling better comparisons and informed decision-making in the investment landscape.

Takeaways

- 😀 Understanding investment statistics is crucial for analyzing portfolio performance.

- 📊 The mean (average rate of return) is a key metric to assess investment returns; a commonly used example is 7.2%, which doubles an investment in ten years.

- 📈 Standard deviation measures the volatility of returns; a higher standard deviation indicates greater risk and uncertainty in potential outcomes.

- 📉 Different standard deviations can significantly alter the shape of the return distribution curve, impacting investment strategies.

- 🔄 A narrow standard deviation indicates more consistent returns, making for a more predictable investment experience.

- 📋 Secondary statistics like beta, alpha, and R-squared help compare portfolio performance against benchmarks.

- 🔍 Beta compares a portfolio's volatility to a benchmark, indicating the risk level; a beta between 0.80 and 1.20 is typically considered acceptable.

- ✨ Alpha represents the excess return of a portfolio above its benchmark; a positive alpha indicates effective management and outperformance.

- 📊 Investors should regularly review reports that include standard deviation, mean, beta, and alpha to assess investment performance.

- 🔄 A positive alpha is a strong indicator of a manager's effectiveness, while a negative alpha suggests inefficiency, warranting a review of management strategies.

Q & A

What is the significance of understanding statistics in investing?

-Understanding statistics is crucial for deciphering portfolio performance, comparing portfolios to benchmarks, and making informed investment decisions.

What does the term 'mean' refer to in the context of investment performance?

-The 'mean' refers to the average rate of return of a portfolio, which, in the example given, is set at 7.2%.

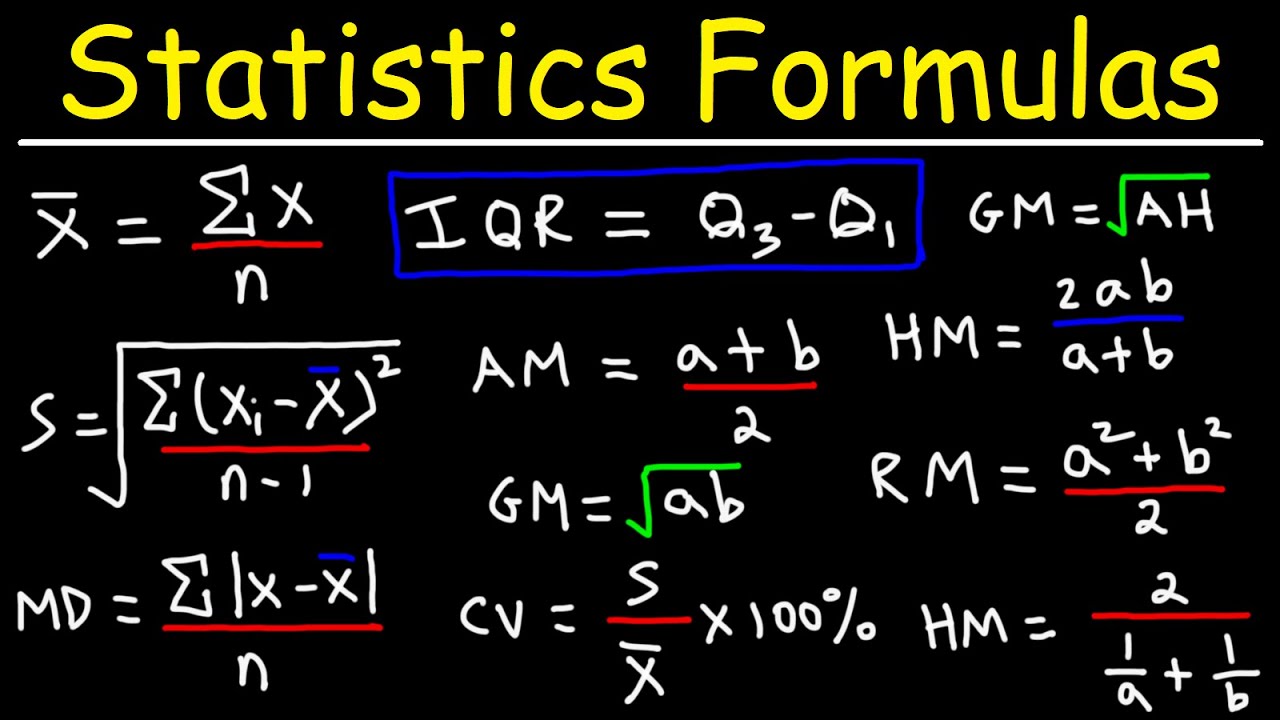

What is standard deviation and why is it important?

-Standard deviation measures the amount of variation or dispersion in a set of values. It is important because it helps investors understand the volatility of a portfolio's returns.

How does standard deviation affect the expected range of portfolio returns?

-A higher standard deviation indicates a wider range of potential returns, meaning greater uncertainty. For example, a standard deviation of 20% means the returns could vary significantly from the mean.

What do the terms 'one standard deviation' and 'two standard deviations' indicate?

-One standard deviation captures about 67% of the performance data, while two standard deviations encompass approximately 97%, providing insight into the likelihood of returns falling within certain ranges.

How does a narrower standard deviation impact investor experience?

-A narrower standard deviation suggests more predictable and stable returns, leading to a more pleasant investing experience as it reduces the emotional volatility associated with market fluctuations.

What is the purpose of using secondary statistics like beta and alpha?

-Beta measures a portfolio's volatility compared to a benchmark, while alpha assesses the excess return of a portfolio over that benchmark, helping to evaluate performance efficiency.

How is beta calculated, and what does it signify?

-Beta is calculated by dividing the standard deviation of a portfolio by the standard deviation of a benchmark. A beta less than 1 indicates lower volatility compared to the benchmark.

What does a positive alpha indicate about a portfolio's performance?

-A positive alpha signifies that the portfolio has outperformed its benchmark, demonstrating effective management and efficiency in generating returns.

Why is it important to compare portfolios against relevant benchmarks?

-Comparing portfolios to relevant benchmarks ensures that the performance evaluation accounts for appropriate levels of risk and volatility, allowing for a fair assessment of investment strategies.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)